In a recent statement that underscores his long-term confidence in the Japanese market, Warren Buffett revealed that Berkshire Hathaway plans to further boost its investments in Japan’s trading houses. The renowned investor, known for his strategic decision-making and emphasis on value investing, highlighted the resilience and potential of these firms within the diverse landscape of the Japanese economy.This move aligns with Berkshire’s broader strategy of diversifying its global portfolio and capitalizing on emerging opportunities. As Japan’s trading houses navigate a complex economic environment marked by both challenges and growth prospects, Buffett’s commitment signals a belief in their essential strengths and the enduring value they bring to investors. In this article, we explore the implications of Buffett’s statement and what it means for Berkshire Hathaway’s investment strategy moving forward.

Buffetts Strategic commitment to Japanese Trading Houses

Warren Buffett’s ongoing strategy to deepen Berkshire Hathaway’s investments in Japan’s trading houses reflects a robust confidence in the resilience and potential of the Japanese economy. With a history steeped in diversified businesses, these trading houses serve as pivotal players in various sectors, ranging from energy and food to technology and finance.Buffett has expressed his belief that these companies possess unique assets and capabilities that align well with Berkshire’s operational philosophy, emphasizing long-term value creation and prudent management.

As part of this strategic commitment, Buffett has outlined several key reasons for increasing investments in the trading houses:

- Economic stability: Japan’s economy continues to show robust fundamentals, making it an attractive market for investment.

- Diverse Portfolios: Trading houses diversify risk through their extensive portfolio spanning multiple industries.

- Strong Management: Buffett has consistently highlighted the talented management teams leading these firms, which enhances operational efficiencies.

- Future Growth: The emphasis on emerging technologies and overseas expansions positions these companies for notable growth opportunities.

| Trading House | Sector Focus | Recent Investment Highlights |

|---|---|---|

| Mitsui & Co. | Energy, Chemicals | Investing in renewables and technology innovations. |

| Sumitomo Corporation | Manufacturing,Mining | Expanding into sustainable sourcing solutions. |

| Marubeni Corporation | Agriculture, Infrastructure | Focusing on global agricultural investments. |

Analyzing the growth Potential of Japans Trading sector

The recent affirmation from Warren Buffett regarding Berkshire Hathaway’s sustained investment strategy in Japan’s trading houses underscores a robust optimism about the sector’s growth trajectory. The trading houses, often regarded as the backbone of Japan’s economy, have shown remarkable resilience in navigating global market fluctuations. Factors contributing to their potential include:

- Diversified Business Models: These conglomerates engage in various sectors,including energy,metals,chemicals,and food,providing a cushion against market volatility.

- Global Expansion: Many trading houses are strategically placing themselves in emerging markets, capitalizing on the demand surge in Asia and beyond.

- Technological Adaptation: Investment in technology and digital transformation is streamlining operations and improving efficiency.

Additionally, an examination of their financial health reveals promising signs.Recent data trends indicate a rebound in profitability,driven by smart acquisitions and resource investments. Below is a snapshot of key financial indicators for major Japanese trading houses:

| Trading House | Q2 2023 Revenue (in Billion JPY) | Year-on-Year Growth (%) |

|---|---|---|

| Sumitomo corporation | 2,500 | 12% |

| Mitsubishi Corporation | 3,200 | 10% |

| Marubeni Corporation | 1,800 | 8% |

As indicated, these figures demonstrate the sector’s capability to adapt and thrive, positioning Japanese trading houses as pivotal players in the evolving global economy.

Implications for Berkshire Hathaways Investment Portfolio

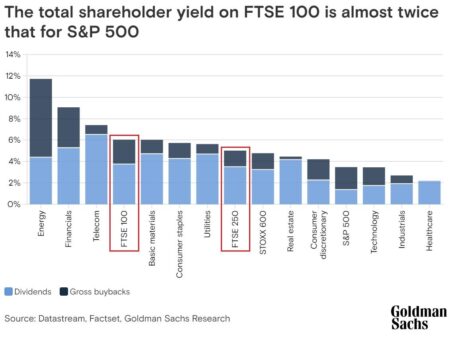

The recent announcement by Warren Buffett regarding Berkshire Hathaway’s commitment to increasing its investments in Japanese trading houses unveils a significant strategic direction for the conglomerate’s portfolio. This move may reflect a broader confidence in the Japanese market, which coudl be perceived as undervalued compared to global counterparts. Notably, the trading houses that Berkshire is focusing on are deeply integrated into essential industries, ranging from commodities to technology, thus offering diverse exposure. The implications for Berkshire’s investment strategy include:

- Diversification: expanding into different sectors enhances risk management.

- Growth Potential: Investing in Japan may yield robust returns as the country’s economy resurges post-pandemic.

- Market Stability: Japanese companies often provide a stable dividend yield, contributing to Berkshire’s income stream.

Furthermore,the increased investment could signify a strategic bet on global supply chains rejuvenating,as Japan plays a pivotal role in manufacturing and exporting key goods. Berkshire’s engagement with these trading houses not only positions it advantageously within Asian markets but also emphasizes its long-standing philosophy of nurturing long-term value. The implications for stakeholders could include:

| Aspect | Implication |

|---|---|

| Financial Performance | Potential for enhanced returns on investments |

| Strategic Partnerships | Strengthened ties with Japanese firms |

| Market Insights | Access to emerging industry trends in Asia |

Insights for Investors on Following Buffetts Lead in Japan

Warren Buffett’s endorsement of Japan’s trading houses has sparked considerable interest among investors looking for potential opportunities in the Asian market. these trading houses, known for their diverse portfolios and global reach, have become increasingly appealing as they partake in the recovery story of Japan’s economy. With the forecasted rise in consumer spending and infrastructure investments, these companies are well-positioned for growth. Investors should consider the following key aspects when evaluating these trading houses:

- Diversification: trading houses have investments across various sectors, reducing risk.

- Global Presence: Their international operations mitigate local economic fluctuations.

- Cyclicality: Many trading houses are poised to benefit from global economic cycles, enabling potential profit growth.

To further illustrate the attractive valuation of these firms, a comparative analysis table provides insights into some of the leading trading houses in Japan. As these companies continue to adapt and innovate in a dynamic economic environment, investors may find them increasingly appealing.

| Trading House | Market Cap (Billion ¥) | Recent Performance |

|---|---|---|

| Mitsubishi Corp | 3,000 | +5.3% YTD |

| Sumitomo Corp | 2,500 | +4.8% YTD |

| Marubeni Corp | 1,800 | +6.1% YTD |

The Conclusion

Warren Buffett’s commitment to increasing investments in Japanese trading houses underscores his long-term vision for Berkshire Hathaway’s portfolio diversification and growth. By capitalizing on the robust economic opportunities presented by these companies, Buffett not only signifies confidence in the Japanese market but also strategically positions Berkshire to benefit from global economic trends. As the world continues to evolve, it remains to be seen how this investment strategy will unfold and what implications it may hold for both Berkshire and the broader investment landscape.Investors and analysts alike will be watching closely as Buffett navigates this promising territory, reinforcing his status as a shrewd and forward-thinking leader in the world of finance.