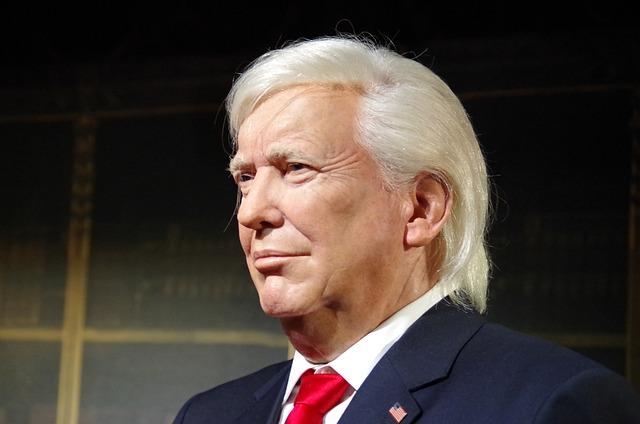

In a bold move that could escalate trade tensions, former President Donald Trump has announced plans to impose tariffs starting March 4 on imports from Mexico and Canada, and also an additional 10% duty on goods from China. This decision, motivated by ongoing concerns over the trafficking of fentanyl and related substances, signals a notable shift in U.S. trade policy.Trump’s proposal has reignited debates around the effectiveness of tariffs as a tool for achieving national security and public health objectives. As stakeholders brace for potential impacts on cross-border trade relationships and the broader economy, this development raises questions about the future of U.S.-Canada-Mexico trade agreements and the global supply chain.

Trumps Tariff Proposal: A Closer Look at the Impact on Trade Relations with canada and Mexico

The recent tariff proposal announced by the Trump administration is poised to have significant ramifications for trade relations with Canada and Mexico. While the overt objective is to curb the flow of fentanyl and other opioids into the United States, the broader implications are likely to reverberate throughout North America. The introduction of tariffs on goods from these key trading partners—scheduled to begin on March 4—can strain long-standing economic partnerships. Stakeholders in various sectors, including automotive, agriculture, and manufacturing, may face increased costs and disruptions as businesses adjust to the new trade landscape.

As a direct consequence of the proposed tariffs, the following factors will need to be considered:

- Increased Prices: Tariffs may lead to higher consumer prices, especially in industries heavily reliant on imports from Canada and Mexico.

- Supply Chain Disruptions: Companies could face delays and increased costs, prompting them to reevaluate their supply chains and sourcing strategies.

- Retaliatory Measures: Both Canada and Mexico could respond with their own tariffs, escalating tensions and further complicating trade negotiations.

- Economic Uncertainty: Businesses may adopt a more cautious approach to investment and expansion, hampered by the unpredictability of trade policies.

| Country | Proposed tariff Rate | Industry Impact |

|---|---|---|

| Canada | march 4 (specific rate pending) | Automotive, agriculture |

| mexico | March 4 (specific rate pending) | Manufacturing, Retail |

| China | Extra 10% | Electronics, Textiles |

Assessing the Additional 10% Tariff on China: Implications for the Global Supply Chain

The decision to impose an additional 10% tariff on imports from China, particularly amidst ongoing trade tensions, carries significant implications for the global supply chain. With China’s pivotal role as a manufacturing hub, any tariffs can reshape the landscape of international trade, leading to increased production costs for companies reliant on Chinese goods. Manufacturers in sectors ranging from electronics to textiles may face heightened expenses,which could result in a ripple effect impacting pricing strategies for consumers worldwide.companies may need to absorb these costs or pass them on to customers, leading to inflationary pressures in various markets.

Moreover,the tariff could accelerate a shift in global sourcing strategies as businesses seek to mitigate risks associated with increased tariffs. Potential responses from companies may include:

- Diversifying suppliers by relocating manufacturing to countries with lower tariffs

- Investing in automation to reduce dependency on labor-intensive processes in China

- Increasing inventory levels to buffer against supply chain disruptions

This realignment may foster new trade relationships and alter competitive dynamics across industries. In this evolving landscape, it’s crucial for companies to stay agile, reassess their supply chains, and embrace innovative solutions to remain competitive in a world where tariffs can swiftly alter the rules of engagement.

fentanyl Crisis as a Catalyst: How Drug Policy is Intertwined with International Trade

The fentanyl crisis has unveiled the complex relationship between drug policy and international trade, propelling discussions surrounding tariffs and trade agreements to the forefront of national dialog. With the escalation of fentanyl-related overdose deaths in the United States, former President Trump’s proposed tariffs on Mexico, Canada, and a diminished agreement with China emphasize the urgency in tackling the epidemic. These tariffs serve multiple purposes, from urging neighboring countries to fortify their regulations against the trafficking of synthetic opioids to positioning the U.S. as a gatekeeper in global drug policy reform. By holding countries accountable through financial measures, the administration aims to mitigate the flow of fentanyl entering the U.S. while simultaneously attempting to leverage these tariffs to reshape trade dynamics.

In order to grasp the full scope of this intertwining relationship, it’s essential to assess how specific countries are responding to this crisis and the implications of proposed measures:

- Mexico: Critically viewed as a conduit for fentanyl shipments, measures are increasing to bolster border security and enhance surveillance.

- Canada: As a close trade partner, Canada’s cooperation on drug legislation and details sharing has become pivotal in addressing cross-border trafficking.

- China: Historically a key supplier of precursor chemicals, the push for tougher tariffs seeks to compel China to take stronger action against illegal exports.

| Country | Tariff Rate | Action Taken |

|---|---|---|

| Mexico | March 4,2024 – 25% | Increased border enforcement |

| Canada | March 4,2024 – 15% | Strengthened regulations |

| China | Extra 10% | Negotiations for better cooperation |

As the fentanyl crisis continues to unfold,the tangible impact of these tariffs on international trade policy will be closely scrutinized. The call for a more thorough solution—one that addresses supply chain vulnerabilities and promotes collaboration among nations—will likely gain momentum in the ongoing debate over drug control measures. The intersection of drug enforcement and trade policy not only challenges established norms but also signals a pivotal shift in how countries prioritize public health in the context of global commerce.

Recommendations for Navigating the New Tariff Landscape: Strategies for Businesses and Policymakers

As businesses and policymakers grapple with the newly imposed tariffs on imports from Mexico, Canada, and China, it’s critical to adopt proactive strategies to mitigate potential repercussions. Companies should first conduct a thorough supply chain analysis to identify how increased costs might effect their operations.By closely examining their suppliers and sourcing options, businesses can explore opportunities for local sourcing or seek partnerships with suppliers who can provide more favorable terms under the new tariff regime. Additionally, companies are encouraged to engage in forward contracting for materials and resources to lock in current prices and hedge against future tariff increases.

On the policy-making front, it’s vital for governments to communicate transparently about the intentions behind the tariffs and their anticipated effects. Collaborative forums between policymakers and business leaders can foster dialogue aimed at highlighting challenges faced by industries heavily impacted by the tariffs. Furthermore,implementing incentives for affected sectors,such as tax breaks for businesses that invest domestically or funding for innovation in choice sourcing strategies,could alleviate negative impacts. Effective lobbying for tariff reviews or exemptions based on industry-specific needs may also offer relief and support economic resilience amidst these fiscal changes.

To Wrap It Up

President trump’s commitment to impose tariffs on Mexico and Canada,alongside an additional 10% levy on Chinese imports,underscores the administration’s ongoing focus on trade relationships while addressing the fentanyl crisis. These measures are positioned not only as economic strategies but also as part of a broader effort to combat the opioid epidemic that has claimed countless lives across the United States. As the situation develops, it will be essential to monitor the reactions from both domestic industries and foreign governments, as well as the potential implications for trade agreements.The effectiveness of these tariffs in curbing drug trafficking and their impact on the economy will be closely scrutinized in the days to come. as always, the interplay between policy, trade, and public health remains a critical area of observation in the continually evolving landscape of U.S. foreign relations.