In the fast-paced world of cryptocurrency, where fortunes can be made and lost in the blink of an eye, one name has emerged as both a beacon of entrepreneurial spirit and a symbol of a major scandal: Hayden Davis. Recently thrust into the limelight amid a staggering $250 million crypto debacle in Argentina, Davis, frequently enough referred to as the ‘Hustling expert,’ has captivated the public’s attention not just for his alleged role in the controversy, but also for his rapid ascent in the crypto landscape. This article delves into the journey of Davis,exploring the intricacies of the scandal,the mechanisms of the crypto platform at its center,and the broader implications of trust in an industry rife with both innovation and uncertainty. As investigations unfold and the fallout reverberates through the financial sector,understanding Davis’s impact is essential for grasping the complexities of a market that continues to evolve at a breakneck pace.

Investigation of Hayden Davis and the Mechanics of the Crypto Scandal

hayden davis has emerged as a pivotal figure at the center of Argentina’s staggering $250 million cryptocurrency scandal. Through a network of complex transactions and dubious marketing tactics, Davis has showcased the intricacies of digital currency manipulation. Key components of his approach included:

- Pseudonymous Investments: Davis initially attracted investors with promises of high returns, utilizing a series of shell companies to obscure his identity.

- False Clarity: Through slick marketing and strategic social media campaigns, he created an illusion of credibility, enticing unsuspecting individuals to participate.

- Market Manipulation: Reports suggest that Davis played a notable role in artificially inflating cryptocurrency values, ensuring profitable exits for himself and key accomplices.

As investigations delve deeper, authorities have begun to unearth a web of collaborators that facilitated Davis’s operations. A preliminary analysis of his known associates highlights several red flags:

| Name | Role | involvement |

|---|---|---|

| Oliver Martinez | Marketing Strategist | Developed promotional content to draw in investors. |

| Ariana Lopez | Financial Advisor | Provided dubious financial guidance to potential investors. |

| Raj Patel | Crypto Developer | Created software tools for managing digital assets. |

Unraveling the financial Strategies that Led to a $250 Million Fallout

In the murky waters of cryptocurrency, Hayden Davis emerged as a pivotal figure whose dealings unraveled a staggering financial fiasco. His strategies, a jumble of aggressive trading and high-stakes investments, led to a series of decisions that not only misled investors but also amplified the risks associated with the crypto boom. Among the tactics employed were:

- Overleveraging Assets: Davis amplified his exposure in a volatile market, creating an illusion of stability that attracted unwary investors.

- Lack of Transparency: Key financial details were obscured, leaving investors in the dark about the true health of their investments.

- Hasty Partnerships: Collaborations with questionable entities further clouded the legitimacy of his operations.

As the fallout began to unfold, the consequences of these strategies became increasingly clear. A tailored approach to risk management was conspicuously absent, which exacerbated the chaos. Investors were left holding empty bags, leading to widespread disenchantment and significant financial losses. The following table outlines the key financial missteps associated with Dawn Davis’s endeavors:

| Financial Misstep | Impact |

|---|---|

| Overleveraging | Increased risk and exposure to market volatility |

| Opaque Communication | Investor mistrust and confusion |

| ill-advised Alliances | Questionable credibility and legitimacy |

Lessons from the Argentina Case: Preventative Measures for Future Crypto Endeavors

The fallout from the Argentina case serves as a crucial reminder for anyone navigating the complex world of cryptocurrency investments. First and foremost,potential investors should conduct thorough due diligence by scrutinizing the backgrounds of those behind crypto initiatives. This entails verifying their qualifications, past ventures, and any legal entanglements. A culture of transparency can be fostered by promoting an environment where investors demand accountability from project leaders. This will not only empower investors but also mitigate risks associated with deceptive practices.

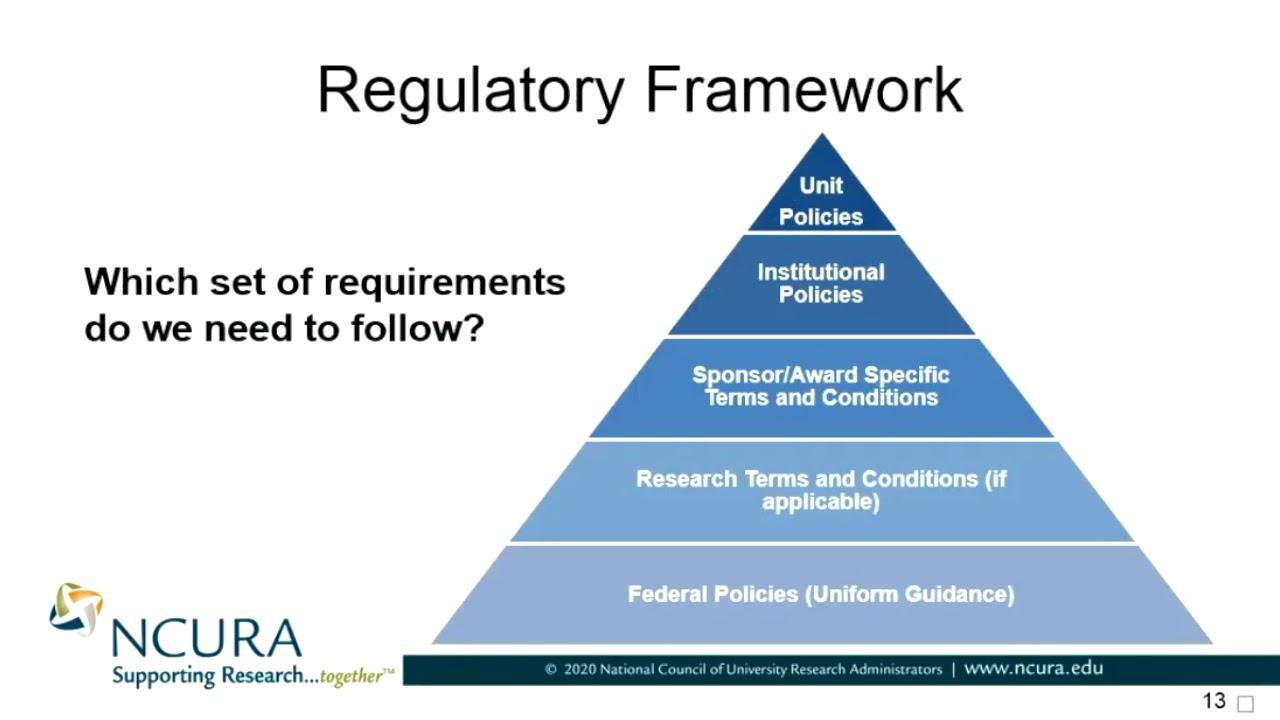

Moreover, regulatory bodies must step up their efforts to establish clear frameworks that govern cryptocurrency operations. This could include the implementation of mandatory licensing for crypto enterprises and the creation of robust reporting protocols. By enforcing these preventative measures, regulators can help ensure the credibility of crypto projects and protect investors.A summary of effective strategies for future endeavors could include:

| Strategy | Description |

|---|---|

| Investor Education | Workshops and resources on crypto fundamentals. |

| regulatory Compliance | Adherence to established financial regulations. |

| Clear Reporting | Regular updates on project status and financials. |

The Role of regulatory Frameworks in Mitigating Crypto Fraud Risks

The increasing prevalence of cryptocurrency fraud has prompted a significant reevaluation of regulatory frameworks across the globe. in the aftermath of high-profile scandals like the one involving Hayden Davis, it has become paramount for regulatory bodies to implement robust measures aimed at mitigating risks associated with digital assets. This involves establishing clear guidelines that govern the operation of cryptocurrency exchanges,Initial Coin Offerings (ICOs),and other blockchain-based services. A well-defined regulatory landscape not only enhances investor protection but also promotes transparency and accountability within the sector.

To effectively combat fraud in the crypto space,regulatory frameworks should emphasize the following key components: licensing requirements,anti-money laundering (AML) protocols,consumer protection standards, and enforcement mechanisms. According to industry experts, the establishment of a cohesive international regulatory approach is critical. Such a strategy could involve:

| Key Component | Description |

|---|---|

| Licensing Requirements | Ensuring that all cryptocurrency exchanges must meet specific criteria to operate legally. |

| AML Protocols | Implementing strict measures to prevent illegal activities such as money laundering. |

| Consumer Protection | Enforcing regulations that safeguard investors against fraud and misinformation. |

| Enforcement mechanisms | Establishing clear penalties for non-compliance to deter fraudulent behavior. |

closing Remarks

the saga of Hayden Davis and the $250 million crypto scandal that has rocked Argentina serves as a cautionary tale in the burgeoning landscape of digital finance. As investigations continue to unfold, the complexities surrounding the case underscore the urgent need for regulatory frameworks that can adequately address the challenges posed by cryptocurrencies.With Davis at the center of this controversy,the implications extend far beyond Argentina,raising critical questions about trust,accountability,and the future of decentralized finance. as stakeholders from investors to policymakers grapple with the fallout, this incident may very well shape the discourse around crypto governance and investor protection in the years to come. The lessons learned from this scandal will be pivotal in guiding the industry’s development, ensuring that innovation does not come at the cost of integrity.