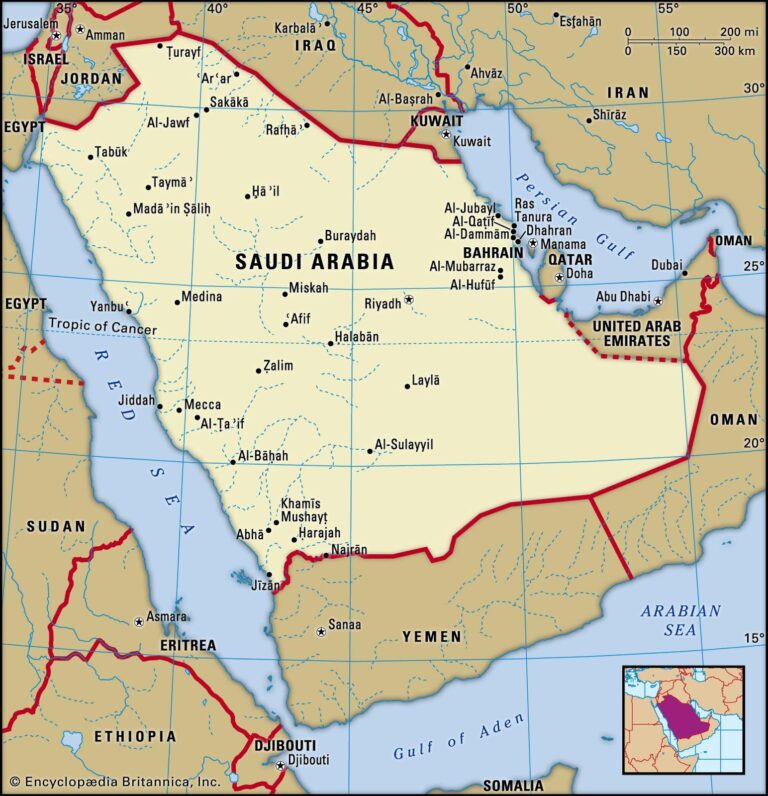

In a decisive move aimed at bolstering global oil market stability, key oil-producing nations, including Saudi Arabia, Russia, Iraq, the United Arab Emirates, Kuwait, Kazakhstan, Algeria, and Oman, have reaffirmed their commitment to maintaining a balanced market amid shifting economic conditions. As the world faces unprecedented challenges—ranging from fluctuating demand patterns to geopolitical tensions—these countries,collectively representing a meaningful portion of global oil production,have united under the banner of the Association of the Petroleum Exporting Countries (OPEC) to outline strategies that promote healthier oil market dynamics. This collaborative effort underscores their recognition of the need for coordinated action to ensure lasting price levels and secure long-term energy stability in a rapidly evolving landscape. As they set the stage for constructive dialog and policy alignment, the implications of this commitment are poised to resonate far beyond the oil industry, influencing economies, consumers, and energy markets worldwide.

Commitment to oil Market Stability in a Shifting Global Landscape

The commitment of key oil-producing nations, including Saudi Arabia, Russia, Iraq, the United arab Emirates, kuwait, Kazakhstan, Algeria, and Oman, underscores a unified approach toward achieving market stability in a rapidly changing global economic surroundings. The recent discussions have highlighted the importance of collaboration among these nations to balance supply and demand effectively. As global economies begin to recover, their strategies are designed not only to ensure sustainable production levels but also to safeguard against potential price volatility. This commitment is crucial for long-term investment in the oil sector and the overall health of the world economy.

Among the measures being considered are voluntary production adjustments and enhanced coordination in terms of output levels. The nations recognize that a stable and predictable oil market is imperative for consumers and producers alike. Key priorities include:

- Enhancing clarity: regular updates and communication among member states to prevent speculation and market manipulation.

- Investing in renewable energy: acknowledging the need for diversification in the energy portfolio to address future demands.

- Monitoring market dynamics: Keeping a close eye on geopolitical developments and global economic trends that could impact oil supply chains.

This proactive stance not only reassures investors but also contributes to global economic stability during uncertain times.

opecs Strategic Collaboration: Key players Unite for Future Sustainability

In a significant move towards ensuring a balanced and sustainable oil market, key members of the Organization of the Petroleum Exporting Countries (OPEC) have come together to reaffirm their commitment to market stability. Saudi Arabia, Russia, Iraq, the United Arab Emirates, Kuwait, Kazakhstan, Algeria, and Oman are collaborating closely to navigate the complex dynamics of global oil supply and demand. This strategic alliance not only aims to stabilize oil prices but also focuses on long-term sustainability, emphasizing the importance of cooperation between producers and developing a unified approach to market fluctuations.

The participants laid out their immediate objectives during a recent meeting, highlighting several core strategies that will guide their collaboration. These strategies include:

- Enhancing communication: Regular dialogues among key players to promptly address any emerging challenges.

- Adaptive production strategies: Flexibly adjusting production levels in response to market signals.

- Investment in sustainable practices: Committing to environmental sustainability and technological innovation in oil extraction and processing.

Additionally, the collective efforts are expected to yield a healthier oil market outlook as these nations implement policies that promote long-term growth and stability in the energy sector.As a testament to their unyielding dedication, the collaboration signifies a pivotal moment for OPEC, positioning it as a proactive force in the evolving landscape of global energy consumption and production.

Analyzing the Impacts of Oil Production Adjustments on Global Prices

The recent affirmation by OPEC member countries,including Saudi Arabia,Russia,Iraq,the United Arab Emirates,Kuwait,Kazakhstan,Algeria,and Oman,to commit to market stability highlights the complex interplay between oil production levels and global market prices. Adjustments in production can trigger ripples across international markets, influencing everything from fuel prices to inflation rates. These nations,recognizing the pressing need for a balanced approach,seek to mitigate the volatility that has characterized the oil markets in recent years. their collective strategy includes aligning production cuts or increases with anticipated global demand, thereby fostering a healthier economic environment for both producers and consumers.

Key factors contributing to the impacts of these production adjustments include:

- Supply-Demand Dynamics: A careful calibration of supply to meet the shifting demands, especially in the post-pandemic recovery phase.

- Geopolitical Factors: Tensions in oil-producing regions can influence production capabilities and, later, global prices.

- Influence of Non-OPEC Producers: Countries outside of OPEC also play a pivotal role in shaping the overall oil supply landscape, necessitating collaborative strategies.

To provide a clearer picture of recent production adjustments and their effects on oil prices, the following table summarizes key statistics:

| Country | Recent production Adjustment (barrels/day) | Impact on Global Prices ($/barrel) |

|---|---|---|

| Saudi Arabia | -1,000,000 | +5 |

| Russia | -500,000 | +4 |

| UAE | -300,000 | +3 |

| Iraq | -200,000 | +2 |

As production levels are strategically managed, the resulting price stability has the potential to engender long-term investments in energy infrastructures and foster more sustainable economic growth trajectories.

Recommendations for Enhancing Resilience in Oil Markets Amid Volatile Trends

To strengthen the resilience of oil markets amidst fluctuating trends, stakeholders must adopt a multi-faceted approach that incorporates both short-term and long-term strategies. This applies notably to producers who are part of the OPEC+ coalition. Key recommendations include:

- Increased Transparency: Enhanced communication channels among OPEC members and external stakeholders can foster trust and facilitate more predictable market responses.

- Diverse Supply Strategies: Diversifying production sources can mitigate the impact of geopolitical disruptions and natural disasters.

- Investment in Technology: Leveraging technological advancements can improve efficiency in oil extraction and processing, ultimately leading to cost savings and enhanced supply stability.

- Data-Driven Decision Making: Utilizing market analytics and forecasting tools to aid in production adjustments can enable members to respond proactively to demand shifts.

Moreover,cooperative efforts that focus on economic diversification within member countries can reduce dependency on oil revenues,fostering greater overall stability. A concerted push towards renewable energy investments will also prepare nations for a future with possibly lower fossil fuel consumption.For instance, a collaborative initiative might include:

| Country | Renewable Investment Strategy |

|---|---|

| Saudi Arabia | Massive solar projects to meet domestic energy needs. |

| UAE | Investing in solar and nuclear power infrastructure. |

| Kuwait | Enhancing wind energy to complement existing resources. |

| Oman | Exploration of high-potential solar and geothermal sites. |

To Conclude

the collaborative efforts of Saudi Arabia, Russia, Iraq, the United Arab Emirates, Kuwait, Kazakhstan, Algeria, and Oman, as outlined by OPEC’s recent statements, signal a renewed commitment to ensuring market stability amid a shifting global economic landscape. Their collective focus on a healthier oil market reflects an understanding of the intricate balance required to support both producers and consumers alike. As these nations reinforce their roles in shaping oil supply dynamics, the world will be watching closely for the impact of their strategies on prices, production levels, and broader economic stability. The ongoing dialogue within OPEC and among its partners underscores the importance of unity and adaptability in navigating future challenges in the energy sector.