In a notable development for the Australian economy, the nation’s gross domestic product (GDP) experienced a robust expansion of 0.6% in the fourth quarter, as reported by fxstreet. This growth not only indicates a resilient economic landscape but also highlights the ongoing recovery efforts following the disruptions caused by the pandemic and global economic fluctuations. as sectors across the board contribute to this upward momentum, analysts and stakeholders are keenly observing the implications of this growth on future economic policies and consumer confidence. In this article, we delve into the factors driving this expansion, the sectors that have shown significant improvement, and what this means for Australia’s economic outlook in the coming months.

Australian economic Growth Drivers Behind Q4 Expansion

Australia’s economic landscape demonstrated resilience with a notable expansion in the fourth quarter, driven by several key factors. The strengthening of the services sector, notably in hospitality and tourism, has been pivotal as consumer confidence rebounded, prompting increased spending. Alongside this, significant investment in infrastructure projects has not only enhanced public utilities but also stimulated job creation, further buoying economic activity.

Additionally, the robust performance in the agricultural sector contributed substantially to growth, as favorable weather conditions boosted crop yields. Innovations in technology have also played a crucial role, enabling businesses to operate more efficiently. To illustrate the contributions of thes sectors to GDP growth in Q4, consider the following table:

| Sector | Contribution to GDP Growth |

|---|---|

| services | 0.3% |

| Agriculture | 0.1% |

| infrastructure | 0.2% |

These diverse drivers, alongside supportive goverment policies and a favorable global economic environment, have collectively propelled Australia’s GDP growth, reflecting a robust recovery trajectory in the face of ongoing challenges.

Sector Analysis: Key Contributors to GDP Growth in Australia

Australia’s recent GDP growth of 0.6% quarter-on-quarter in Q4 can largely be attributed to several key sectors that have demonstrated resilience and adaptability amidst global economic challenges. Services remain a cornerstone of the economy, particularly with strong performances in sectors such as education and healthcare. the resurgence of domestic consumption has also played a pivotal role, thanks in part to increased consumer confidence and spending, which have boosted retail sales considerably. furthermore, the housing sector continues to show stability, supported by ongoing demand and tight supply conditions, thereby contributing positively to overall economic activity.

On the other hand, the mining sector has faced some headwinds, but it still represents a critical component of Australia’s GDP. Despite fluctuations in commodity prices, it remains a significant contributor due to robust demand from Asian markets, particularly for iron ore and lithium. Additionally, the agriculture sector has shown resilience, with favorable weather conditions leading to improved crop yields. Key contributors can be summarized as follows:

| Sector | Contribution to GDP Growth |

|---|---|

| Services | +0.3% |

| Real Estate | +0.1% |

| Mining | +0.1% |

| Agriculture | +0.05% |

Implications for Investors: Strategies in response to Economic trends

The recent 0.6% quarter-on-quarter expansion in Australia’s GDP signals a favorable economic environment attracting investors. Market participants should assess the sectors poised for growth as the economy demonstrates resilience in the face of global challenges.investors may consider reallocating their portfolios by focusing on key sectors that frequently enough thrive in expanding economies. These sectors include:

- Consumer Discretionary: Increased consumer spending can lead to greater profits.

- Financial Services: A robust economic environment may support lending and investment services.

- Technology: Continued innovation and demand for tech solutions remain strong candidates for investment.

Moreover, understanding the broader economic trends allows investors to employ more nuanced strategies. It might potentially be beneficial to diversify investments geographically, tapping into international markets that may benefit from australia’s flourishing economy. As a notable example, considering assets in emerging markets can yield high returns as these economies also look to capitalize on stronger global trade relationships. Assessing interest rates and monetary policies is also crucial, as shifts in these areas may indicate favorable conditions for borrowing or investment. Investors should keep an eye on:

| Economic Indicator | current Status | Investor Implication |

|---|---|---|

| Interest Rates | Stable | Encourages borrowing; consider leveraged investments. |

| Inflation Rate | Moderate | Potential stocks in sectors resilient to inflation. |

| Unemployment Rate | Low | Potential for increased consumer spending; focus on retail. |

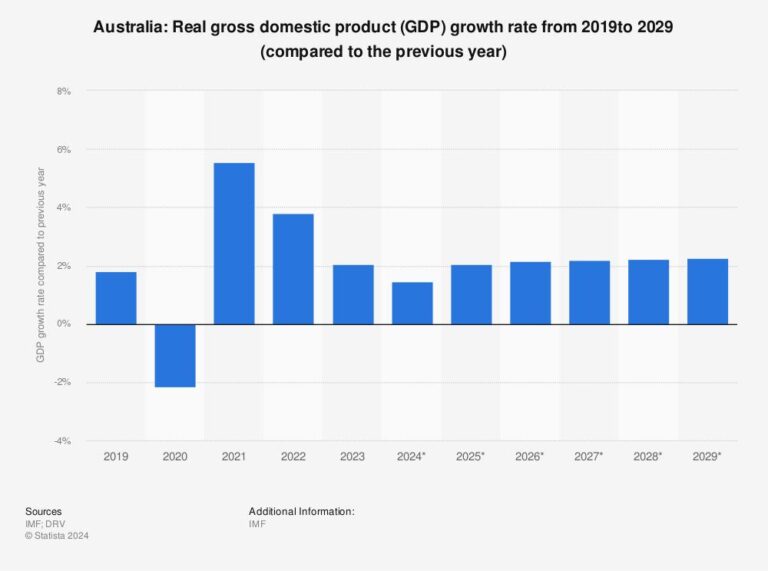

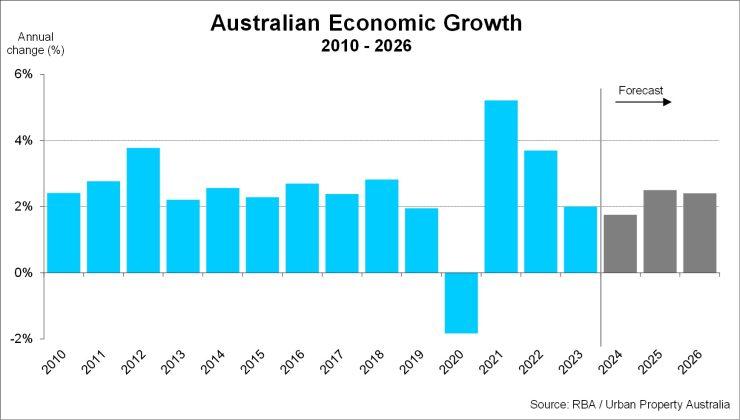

Future Outlook: Predicting the Trajectory of Australian Economic Performance

As we assess the latest data revealing a 0.6% quarter-on-quarter expansion in Q4, attention turns to what lies ahead for the Australian economy. The modest growth rate indicates resilience amidst global economic turbulence, but it also poses questions about sustainability. Key factors influencing future performance include:

- Consumer Confidence: Increasing household spending and confidence are critical in driving economic momentum.

- Commodity Prices: Fluctuations in global demand for Australian commodities can significantly impact trade balances.

- Interest Rates: The RBA’s monetary policy will play a pivotal role in stabilizing inflation while supporting growth.

Furthermore, emerging sectors, such as renewable energy and technology, present opportunities that could redefine economic performance trajectories. Government initiatives aimed at fostering innovation and infrastructure development may lead to increased job creation and investment. It’s essential to monitor:

- Government Policy Changes: Evaluating policies that support or hinder growth might affect both business sentiment and investment.

- Global Economic Trends: Geopolitical stability and international trade partnerships will greatly influence Australia’s economic landscape.

- Labour Market Developments: Changes in employment rates can lead to shifts in consumer spending and overall economic health.

Concluding Remarks

the 0.6% quarter-on-quarter expansion of Australia’s GDP in the fourth quarter signals a resilient economic recovery amid ongoing global challenges.This growth reflects strong consumer spending, robust export figures, and an increase in business investments, positioning Australia favorably as it navigates through a complex international landscape. As analysts and policymakers monitor these developments, the data underscores the importance of sustaining growth momentum while addressing potential risks such as inflation and labor shortages. with a cautiously optimistic outlook, Australia appears poised to build on this positive trajectory in the coming months, making it essential for stakeholders to remain vigilant in adapting to shifting economic dynamics.