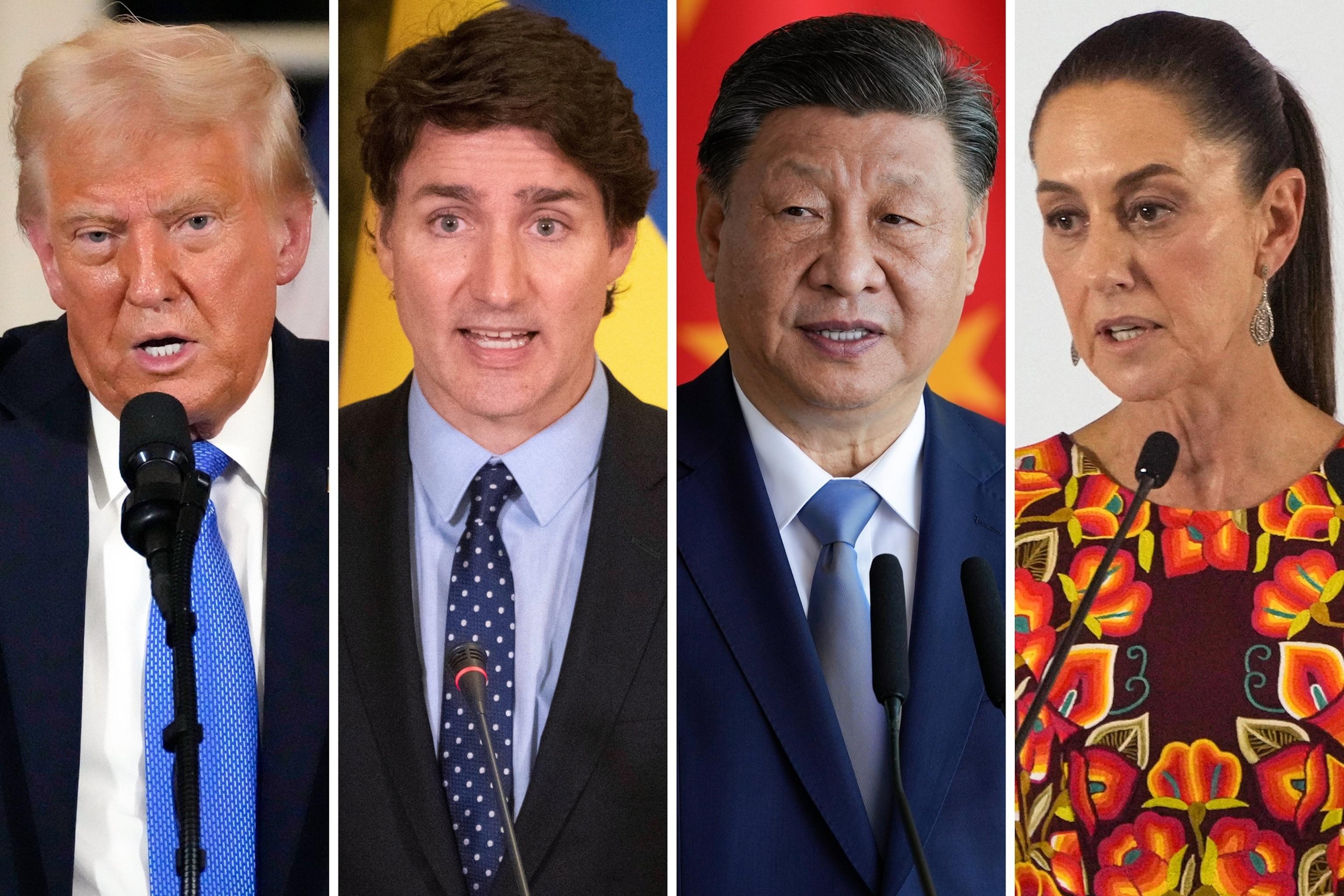

In a potential shift in trade policy, former President donald Trump is poised to announce a reduction of tariffs on goods imported from Canada and Mexico, according to CEO Howard Lutnick in a recent CNBC report. This move, which could materialize as early as Wednesday, comes amid ongoing discussions about the economic impact of these tariffs on North American supply chains and inflation. As global markets react, analysts are closely monitoring the implications for both U.S. consumers and businesses, as well as the broader North american Free Trade Agreement (NAFTA) landscape. With fears of escalating trade tensions subsiding, Trump’s anticipated decision may signify a recalibration of his administration’s approach to trade relations within the continent.

Analysis of Potential Tariff Reductions on Canada and Mexico

The discussion surrounding potential tariff reductions on Canada and Mexico has amplified amidst changing economic landscapes and trade relations. Analysts suggest several key factors that may influence the upcoming decisions, including the ongoing negotiations in the United States-Mexico-Canada Agreement (USMCA) framework. A recalibration of tariffs could foster enhanced trade relationships and stimulate economic growth in the region. Some of the primary considerations include:

- Impact on Consumers: Lower tariffs could lead to reduced prices on imported goods, benefiting consumers and increasing purchasing power.

- Business Operations: Companies relying on cross-border supply chains may see an advancement in operational efficiencies, allowing for better resource allocation.

- Political Climate: The reduction strategy may aim to alleviate tensions and improve diplomatic relations with neighboring countries.

Furthermore, the implications of such tariff shifts extend beyond immediate economic benefits. A potential reduction might influence market sentiments,stock valuations,and investor confidence. To illustrate the possible economic impact, the table below outlines a comparison of projected GDP growth influenced by different tariff levels:

| Tariff Level | Estimated GDP Growth (%) |

|---|---|

| Current Tariffs | 2.0 |

| Reduced tariffs | 2.5 |

| No Tariffs | 3.0 |

This analysis underscores the multifaceted implications of tariff adjustments on cross-border commerce and the broader economic environment. Stakeholders across various sectors are keeping a close watch as the situation unfolds, anticipating changes that could reshape trade dynamics within North America.

Implications for Trade Relations and Economic stability

The potential scaling back of tariffs on Canada and Mexico could lead to critically important shifts in trade dynamics within North America. By reducing these tariffs, ther is a strong likelihood of enhanced bilateral trade flows, which would benefit industries on both sides of the border. This move could pave the way for increased investment opportunities and foster a more collaborative economic environment. The prospect of lower costs for consumers and businesses alike may stimulate economic growth, creating a win-win scenario that enhances interdependence among the three nations. The ripple effects on supply chains, especially in manufacturing and agriculture, are expected to provide a boost to economic stability throughout the region.

Moreover, this shift has broader implications for the geopolitical landscape, as it signals a possible thaw in relations following years of trade tensions. Countries that rely on the U.S., Canada, and Mexico for trade may also observe these changes and adjust their strategies accordingly. In the table below, we outline key industries that could benefit from reduced tariffs:

| Industry | potential Benefits |

|---|---|

| Automotive | Lower production costs and increased exports |

| Agriculture | access to larger markets and reduced pricing |

| Technology | Enhanced innovation through shared resources |

| Textiles | Improved competitiveness and collaboration |

Expert Insights on Market Reactions and Investor Confidence

The potential scaling back of tariffs imposed by the Trump administration on Canada and Mexico is causing a ripple effect in the financial markets.Analysts suggest that easing these trade barriers could enhance investor confidence considerably. A reduction in tariffs may lead to improved trade relations and boost economic activity across North America, which can have a positive impact on various sectors, particularly in manufacturing and agriculture. The anticipated move has investors keenly watching financial indicators, with a keen interest in how it might affect stock prices and currency values.

Considering these developments, experts pinpoint several factors that will determine market reactions and overall investor sentiment, including:

- Economic Indicators: key metrics such as GDP growth rates and employment figures that signal economic health.

- Earnings Reports: The performance of publicly traded companies, which may see improved earnings due to reduced costs.

- Consumer Confidence: Perspectives on how tariffs influence consumer spending and behaviors.

This complex interplay of influences highlights the interconnected nature of global trade policies and investor behavior. Market analysts argue that while these tariffs are a pivotal element, broader economic conditions will also play a significant role in shaping investor confidence in the coming weeks.

Strategic Recommendations for Businesses Amid Tariff Changes

As tariff adjustments loom, businesses must pivot strategically to navigate potential changes in trade regulations.One crucial approach is to diversify supply chains to mitigate risks associated with tariff increases or decreases. Firms can explore new suppliers in different countries, which may present more favorable pricing and reduced exposure to tariffs.Additionally, forming strong relationships with local suppliers can enhance resilience and responsiveness to market fluctuations.

Another essential recommendation is to invest in technology that enhances operational efficiency. Automation and data analytics can streamline procurement processes, helping businesses better forecast and manage costs associated with tariffs. Companies should also consider conducting regular assessments of their pricing strategies and supply chain logistics to adapt swiftly in response to any tariff changes. By proactively reevaluating their business models, organizations can maintain competitive advantages and safeguard their profit margins.

The way Forward

the potential scaling back of tariffs on Canada and Mexico by former President Trump could have significant implications for North American trade relations and the broader economic landscape. Such a move, as highlighted by industry experts like Howard Lutnick, may signal a shift toward more cooperative trade policies, potentially easing tensions that have lingered since the implementation of these tariffs.As stakeholders await the forthcoming proclamation,the impact on industries dependent on cross-border trade will be closely monitored. As developments unfold, the focus remains on how these changes might reshape the economic dynamics within the region and foster a more favorable environment for businesses and consumers alike.