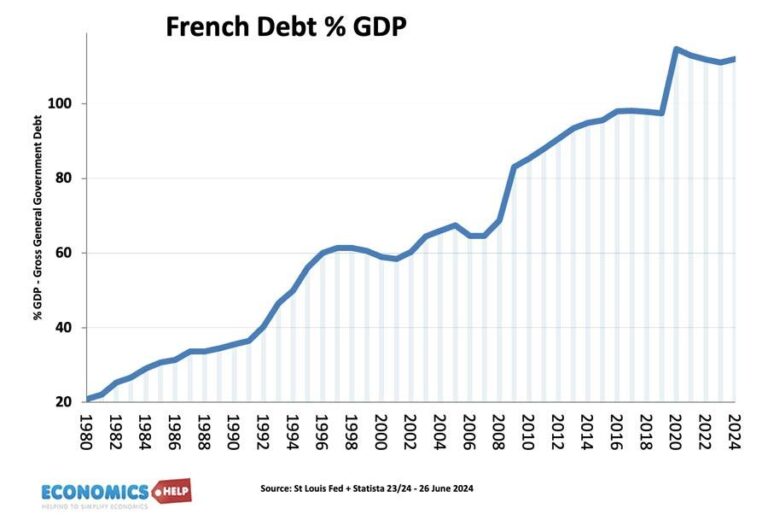

In a move that has sparked considerable debate within both political and economic circles,France’s economy minister has proposed a controversial new initiative aimed at bolstering the country’s military capabilities through a targeted tax on the wealthy. This strategy, outlined in recent discussions, seeks to address increasing security demands amid rising geopolitical tensions in Europe. As nations reevaluate their defense postures in light of ongoing global conflicts, the idea of reallocating financial resources from affluent citizens toward military enhancement raises questions about equity, fiscal duty, and the broader implications for France’s socio-economic landscape. This article delves into the details of the proposal, its potential impact on the French economy, and the reactions it has ignited among stakeholders.

French Economy Minister Proposes Wealth Tax to Support Military Expansion

The French government is contemplating a novel approach to bolster its military financing amidst rising geopolitical tensions. In a recent proposal, the Economy Minister suggested implementing a wealth tax targeting the nation’s affluent citizens. This controversial measure aims to gather funds that would facilitate a significant expansion of military capabilities. by focusing on the wealthiest segments of society, the plan seeks to redistribute resources and ensure that the financial burden of national defense is shared more equitably.

Key components of the minister’s proposal include:

- A progressive tax structure: Higher rates for those wiht substantial incomes and assets.

- Openness in fund allocation: Clear guidelines on how the raised capital will specifically benefit military spending.

- Public engagement measures: Opportunities for citizen input to discuss the potential impacts of such a tax.

| Income Bracket | Proposed Tax Rate |

|---|---|

| €1 million – €2 million | 1% |

| €2 million – €5 million | 3% |

| Above €5 million | 5% |

This wealth tax proposal has ignited debates across the political spectrum, provoking responses from various economic experts and citizens alike. Proponents argue that a structured contribution from the wealthiest would level the playing field, while opponents raise concerns about the potential impact on investment and economic growth. As the discourse evolves, the government’s commitment to national security funding will undoubtedly remain a pivotal issue in France’s economic landscape.

Economic Implications of Taxing the Rich for Defense Funding

The proposal to impose higher taxes on the wealthy to bolster defense funding raises crucial questions about its potential effects on the broader economy. Proponents argue that such a tax could generate substantial revenue, alleviating the strain on public budgets while ensuring national security. However, critics caution that increasing taxes on high earners might lead to several unintended consequences, such as capital flight, where wealthy individuals relocate their assets or move to jurisdictions with friendlier tax policies. This could ultimately result in diminished investment within the country, stunting economic growth and job creation.

Additionally, the impact on consumer spending should not be underestimated. Wealthy individuals play a significant role in stimulating economic activity through their consumption patterns. If a large portion of their income is redirected toward taxes, their affordability to invest in luxury goods and services could decline. This could have a cascading effect on sectors reliant on high-net-worth consumers. A careful analysis of the potential *trade-offs* between enhanced military funding and the overall economic health of the nation will be vital in shaping sustainable fiscal policies.The table below summarizes key considerations in this debate:

| Factor | Potential Effect |

|---|---|

| Revenue Generation | Increased funding for defense projects |

| Capital Flight | Reduction in domestic investment |

| Consumer Spending | Possible decline in luxury market |

| Public Support | Potential backlash from wealthy taxpayers |

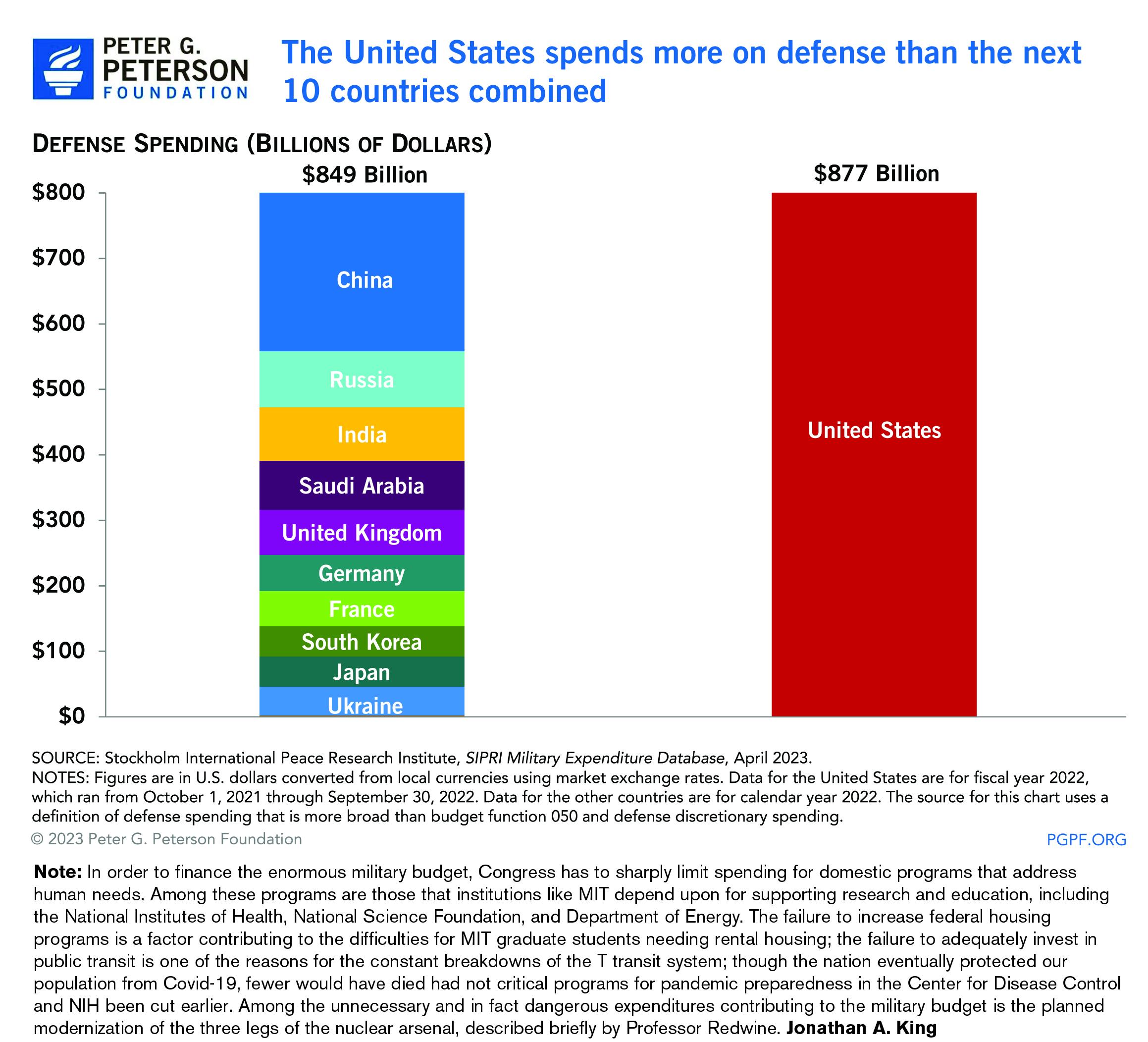

Analyzing Public Response to Military Spending and Wealth Redistribution

As discussions around enhancing military capabilities increasingly dominate the public discourse in france, the proposal to tax the wealthy has ignited a passionate debate among citizens. Supporters of the initiative argue that it could address pressing security needs while simultaneously addressing the growing wealth inequality. They emphasize that higher military spending is essential in an unstable global surroundings, and funding it through wealth redistribution may foster a stronger national identity. Conversely, critics fear that the emphasis on taxing the rich diverts attention from more systemic issues, such as improving public services or investing in sustainable economic growth. Key talking points influencing public sentiment include:

- Concerns about national security and the perceived threats from geopolitical adversaries.

- The belief in creating a fairer society by mitigating wealth disparities through taxation.

- Apprehension about prioritizing military spending over vital social programs.

Additionally, the effectiveness of such policies hinges on public perception and trust in government. A recent poll revealed that 55% of respondents believe taxing the wealthy could provide a viable solution for military funding, whereas a smaller faction, 25%, expressed skepticism regarding the government’s ability to utilize funds efficiently. The response to this fiscal strategy underscores the delicate balancing act between bolstering military readiness and addressing the socio-economic challenges facing the nation.The following table highlights the contrasting viewpoints:

| Viewpoint | Arguments For | Arguments Against |

|---|---|---|

| Supporters | Enhance security, fair wealth distribution | Potential misuse of funds, service neglect |

| Critics | N/A | Tax burden on the wealthy, inequality concerns |

recommendations for Balancing National security and economic Equity

To effectively balance national security and economic equity, governments should explore a multifaceted approach that prioritizes sustainable funding models. One of these models could involve increasing taxes on the wealthiest individuals and corporations, ensuring that those who benefit the most from a stable and secure society contribute fairly to its defense. Such funding could be redirected towards military enhancements without neglecting economic improvement initiatives.The additional resources could support crucial sectors such as education, healthcare, and infrastructure, creating a ripple effect that not only strengthens national security but also promotes wealth distribution.

Further, engaging a variety of stakeholders in discussions about fiscal policy can yield innovative solutions to ensure equitable resource allocation. Policymakers should consider implementing the following strategies to achieve this goal:

- Progressive Taxation: Increase tax rates gradually based on income levels to ensure the wealthiest contribute their fair share.

- Public-Private Partnerships: Foster collaborations between the government and private sectors to fund military and economic initiatives efficiently.

- investment in Technology: Allocate funds for technology upgrades in defense, which could lead to job creation and economic growth.

- Social Safety Nets: Ensure that military funds do not undermine social welfare programs that support the most vulnerable populations.

| Strategy | Potential Benefits |

|---|---|

| Progressive Taxation | Reduces income inequality while boosting military funding. |

| Public-Private Partnerships | Increased efficiency and shared risk in funding initiatives. |

| investment in Technology | Enhances defense capabilities and creates job opportunities. |

| Social Safety Nets | Protects vulnerable populations while maintaining defense readiness. |

to sum up

the proposal by France’s economy minister to impose higher taxes on the wealthy to bolster the nation’s military funding represents a significant shift in fiscal policy and reflects broader concerns about national security and defense capabilities. As the geopolitical landscape continues to evolve, this suggested approach has sparked a robust debate about the balance between wealth distribution and the necessity of a well-equipped military. Whether this initiative gains traction remains to be seen, but it undeniably raises crucial questions about fiscal responsibility, public support, and the long-term implications for both the French economy and its global standing. As policymakers weigh the importance of a fortified defense against the backdrop of current economic challenges, the discussion surrounding taxing the rich as a solution serves as a potent reminder of the complexities inherent in modern governance.