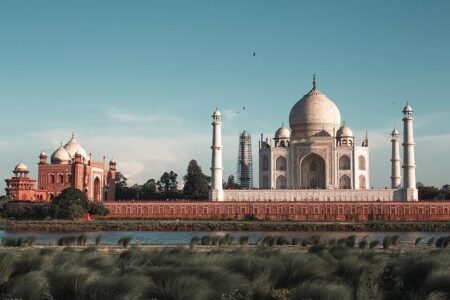

In recent months, teh spotlight on Indian consumption stocks has intensified amid speculation regarding potential tax cuts that could invigorate the market. CNBC’s Inside India newsletter explores this emerging narrative, providing insights into how anticipated fiscal policies could bolster consumer spending and drive stock performance within the sector. As the Indian economy navigates a complex landscape of inflationary pressures and changing consumer behavior, investors are keenly watching the actions of policymakers. This article delves into the implications of tax cuts for Indian consumption stocks, analyzing market trends and expert opinions to paint a thorough picture of what lies ahead for investors in this dynamic economic habitat.

Understanding the Impact of Tax Cuts on Indian Consumption Stocks

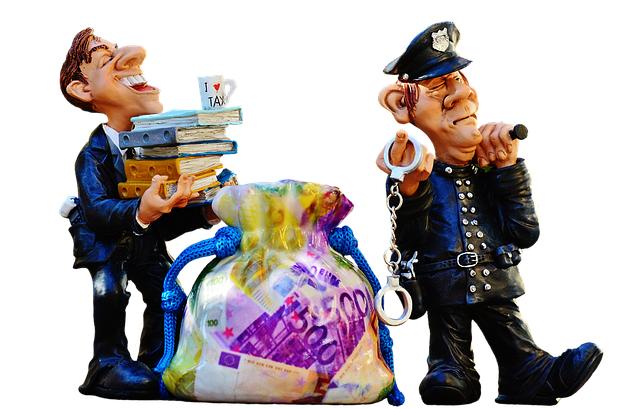

Tax cuts have long been recognized as a mechanism to stimulate economic growth, especially within a burgeoning market like India. as the goverment considers reductions in personal income tax, the implications for consumption stocks could be significant. A reduction in taxes typically increases disposable income for consumers, leading to enhanced spending capacity. This is notably crucial for sectors reliant on consumer discretionary spending—such as retail, automobiles, and hospitality—where increased demand can directly impact sales growth and profitability. Analysts are projecting that consumption-based companies may experiance a surge as more cash in hand allows for greater consumer engagement with both essential and luxury goods.

Moreover, the reverberations of tax cuts can be felt across various layers of the economy. Companies may find themselves recalibrating their strategies to cater to a more affluent consumer base. Key benefits could include:

- Increased Revenue: With more disposable income, consumers are likely to spend more, boosting sales for companies in the consumer goods sector.

- Investment Opportunities: Enhanced profitability may enable companies to reinvest in growth initiatives, potentially expanding their product lines.

- Market Sentiment: Positive investor sentiment could lead to higher valuations for consumption stocks, attracting more capital.

Companies positioned favorably to leverage these changes are likely to show robust stock performance. To illustrate potential outcomes, consider the forecasted impact on various sectors following a tax cut, as detailed in the table below:

| Sector | Projected Growth (%) | Key Drivers |

|---|---|---|

| Retail | 15% | Increased consumer spending |

| Automotive | 10% | Higher demand for personal vehicles |

| FMCG | 12% | Increased purchasing of everyday goods |

Key Drivers Behind the Projected Upsurge in Consumer sector Valuations

The projected surge in valuations within the consumer sector can be attributed to several interrelated factors that have created a conducive environment for growth. Consumer confidence has been on the rise,bolstered by improving economic indicators and a stable political backdrop. This has led to an increase in discretionary spending, as households feel more secure about their financial futures.Moreover, innovations in e-commerce and digital payments have streamlined shopping experiences, enabling consumers to access products more conveniently and affordably, which amplifies demand across various segments.

Additionally, the anticipated tax cuts are expected to provide a significant boost to disposable incomes, further fueling consumer spending. This fiscal stimulus will empower consumers to make larger purchases and invest in higher-quality goods, enhancing brand loyalty and market penetration for companies.In turn,strategic partnerships among retailers and manufacturers are facilitating more targeted and adaptive supply chains,optimizing inventory management,and ensuring that consumer preferences are met promptly. As these dynamics unfold, companies that adapt effectively to the changing landscape are likely to experience remarkable valuation expansions, solidifying their positions in the market.

Strategic Investment Recommendations for Navigating the Indian Market

As the Indian economy continues to demonstrate resilience, investors should closely consider specific sectors poised to benefit from anticipated tax cuts. Key consumer sectors, particularly those displaying robust demand elasticity, stand to gain substantially as disposable incomes rise. FMCG (Fast-Moving Consumer Goods) and retail stocks are among the leaders in this space, reflecting strong fundamentals and favorable growth trajectories. Investing now could potentially yield promising returns as consumer sentiment shifts positively in response to fiscal policies aimed at stimulating economic growth.

Furthermore, sectors like automobile and durables should not be overlooked, given their correlation with increased spending following tax reductions.Companies with innovative product offerings and strong distribution networks will likely thrive. To navigate this landscape effectively, investors might consider diversifying their portfolios by focusing on:

- High-growth FMCG companies with strong market positioning.

- Leading automobile brands that are embracing electrification trends.

- Retailers that have adeptly transitioned to e-commerce platforms.

| Sector | Potential Growth Opportunities |

|---|---|

| FMCG | Increased demand for essential and discretionary goods. |

| Automobile | Shift towards electric vehicles and enduring options. |

| Retail | Expansion of online sales channels. |

Analyzing the Broader Economic Implications of Consumption Trends in India

In the wake of evolving consumption trends, the economic landscape in India is undergoing significant shifts that could have lasting implications.The anticipated tax cuts are expected to serve as a catalyst for increased consumer spending, particularly in sectors such as retail, automobile, and technology.This uptick in consumption is projected to not only bolster corporate earnings but also enhance overall GDP growth. Analysts suggest that with disposable incomes on the rise, driven by favorable fiscal policies, certain segments of the market may experience a rebirth, leading to heightened investment interest from both domestic and international stakeholders.

Furthermore, the ripple effects of these consumption patterns could lead to a more robust supply chain, thereby fostering local manufacturing and job creation. For instance, as demand for consumer goods escalates, businesses may need to scale up production capacities, which in turn can catalyze an increase in imports of raw materials. This relationship highlights how consumption trends ultimately intertwine with industrial growth and employment rates. The following table illustrates the projected growth rates for various consumption-driven sectors following potential tax reforms:

| sector | Projected Growth Rate (%) |

|---|---|

| Retail | 12 |

| Automobile | 10 |

| Technology | 15 |

| Consumer Durables | 8 |

as these industries flourish, the convergence of innovation and consumer demand will likely lead to a more vibrant entrepreneurial ecosystem. Companies might focus on enhancing their digital platforms, improving customer engagement strategies, and tailoring their product offerings to meet the evolving preferences of Indian consumers. This transformational period presents a unique opportunity for stakeholders to align themselves with the burgeoning consumption narrative, ultimately contributing to a more resilient and dynamic economic framework.

Closing Remarks

CNBC’s Inside India newsletter highlights the promising outlook for Indian consumption stocks as investors anticipate the potential impact of tax cuts on this sector. With the Government’s proactive measures to stimulate economic growth and consumer spending, market analysts suggest that businesses in retail, FMCG, and consumer durables could experience a significant boost. As the economy continues to evolve, tracking these developments will be crucial for stakeholders navigating the complex landscape of Indian equity markets.For investors seeking opportunities in this dynamic environment, staying informed through resources like the Inside India newsletter will prove essential in making data-driven decisions. The emerging trends in consumer behavior, coupled with supportive fiscal policies, set the stage for a transformative phase in India’s consumption market.