Introduction

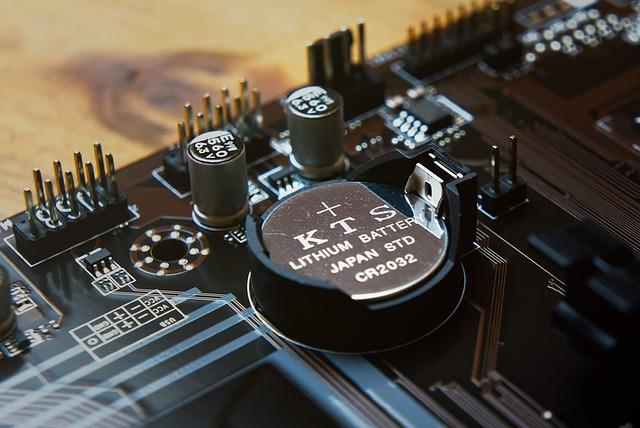

in the rapidly evolving landscape of ‚ĀĘrenewable energy and electric‚Äć vehicle production, lithium has ‚Äčemerged ‚ÄĆas ‚ÄĆa‚ĀĘ critical component, pivotal for the batteries ‚ĀĘthat power this green revolution. As global demand surges, companies like Lithium Argentina are vying for‚ĀĘ prominence in this burgeoning market. ‚Ā§seeking Alpha recently delved into the potential and viability of Lithium Argentina, drawing attention to its strategic positioning and promising prospects. This article evaluates the‚ĀĘ findings,‚ÄĆ examining what makes Lithium Argentina a compelling choice for‚Ā§ investors and stakeholders navigating the complexities of the lithium sector.‚Ā£ Thru‚ĀĘ a detailed analysis of ‚Äćits‚ÄĆ operational framework, market conditions, and growth potential,‚Äč we aim to provide ‚ÄĆa nuanced understanding of‚ÄĆ why Lithium Argentina might potentially be a safe and attractive‚ĀĘ investment chance in today’s dynamic economic ‚Äčclimate.

Market Potential and Demand Dynamics in ‚ÄčLithium Production

The surge in demand for lithium, primarily driven by the rapid growth of electric vehicle (EV) production and renewable energy storage ‚ĀĘsolutions, has‚Ā£ positioned nations with rich lithium ‚Ā§reserves, such as Argentina, at the forefront of a transformative‚Äč industry. Currently, lithium-ion batteries constitute a important portion ‚Ā§of the global battery market, with analysts estimating the demand to exceed 2 ‚Äčmillion metric tons by 2025. Key factors ‚ÄĆfueling this expansion include:

- Increased EV Adoption: Governments worldwide are promoting electric mobility to curb carbon emissions.

- Energy Storage Solutions: With a growing emphasis on renewable energy, lithium ‚ĀĘbatteries serve as essential components for energy‚ĀĘ storage systems.

- Technological Advancements: Innovations in ‚Äčbattery technology enhance the efficiency and performance of lithium-based solutions.

As‚Äć a major player in the lithium‚Äć market, Argentina boasts the world’s second-largest lithium reserves. This presents a lucrative opportunity for investments and partnerships in lithium extraction and ‚Äćprocessing. However, the market is not ‚ĀĘwithout its complexities.Factors such as regulatory frameworks, environmental concerns, and geopolitical dynamics can influence production capabilities and supply chain stability. The ‚ĀĘfollowing table ‚ÄĆoutlines key‚Ā£ players in Argentina’s ‚Ā§lithium sector, along with their respective projects:

| Company | Project Name | Status |

|---|---|---|

| Albemarle Corporation | Silver Peak | Operational |

| Orocobre Ltd. | olaroz | Operational |

| Lithium Americas | Thacker Pass | In Development |

Investment valuation and Price forecasts‚ĀĘ for Lithium Argentina

‚ÄĆ The valuation of ‚Ā£Lithium ‚Ā£Argentina is anchored in robust fundamentals and a buoyant market outlook. With the global push towards renewable energy ‚ÄĆand electric vehicles, lithium has become a crucial commodity. Analysts have pointed ‚Äčto several key factors influencing the company’s market‚ĀĘ positioning:

- Demand Growth: ‚ÄčAs EV production ramps up, lithium battery demand is expected to surge.

- Strategic Partnerships: Collaborations with major automakers bolster supply chain reliability.

- Geographic ‚ĀĘAdvantage: Argentina’s lithium-rich resources provide competitive ‚Ā£extraction costs.

‚Ā£ Price forecasts for Lithium Argentina remain optimistic, underpinned by market dynamics and evolving ‚Ā§industry standards. The company‚Äôs recent initiatives to enhance production capacity could translate into significant revenue growth over the next few years. Projections suggest a potential increase in share price as follows:

| Year | projected Share Price | Key Drivers |

|---|---|---|

| 2024 | $18 | Increased ‚ĀĘdemand from ‚ÄčEV markets |

| 2025 | $24 | New strategic partnerships |

| 2026 | $30 | Expansion of production capabilities |

Risk Assessment: Navigating Challenges in the Lithium Sector

In the dynamic landscape of the lithium sector, several challenges emerge that investors must navigate to assess the viability of their investments. market‚Äč volatility remains a significant hurdle, influenced ‚Ā§by fluctuations in demand driven by the‚Ā§ electric vehicle (EV) ‚Ā£market and broader technological advancements. Moreover, geopolitical risks ofen surface‚Äč as‚Ā£ lithium deposits are concentrated in politically sensitive regions. Countries‚Äć like‚ÄĆ Argentina,‚ĀĘ Bolivia, and Chile, known for their‚Ā£ “Lithium triangle,” face unique challenges ranging from regulatory hurdles to social unrest, ‚ÄĆwhich can impact production timelines and costs.

To better illustrate these risks, consider the following factors‚Äć that investors should monitor closely:

- Supply Chain Disruptions: The proliferation of EVs ‚ÄĆnecessitates a ‚Ā§robust supply chain; disruptions can lead to bottlenecks.

- Regulatory Changes: Sudden shifts in governmental policies ‚Ā§can affect mining permits and environmental regulations,‚Äč changing the landscape‚ÄĆ overnight.

- technological ‚ÄćInnovations: Advances in lithium extraction methods could ‚Ā§reshape cost structures and sustainability considerations.

Analyzing the potential rewards alongside these risks can shed light on the long-term prospects of lithium investments. The following table summarizes‚ÄĆ key players in the Argentinian ‚ÄĆlithium market alongside their anticipated production capacities:

| Company | Location | Projected Capacity (tonnes/year) |

|---|---|---|

| Company‚ÄĆ A | Salinas Grandes | 20,000 |

| Company B | Olaroz | 14,000 |

| Company C | Hombre Muerto | 40,000 |

Staying informed on these variables will enable stakeholders to make educated decisions ‚ĀĘin an ever-evolving ‚ĀĘsector,‚Ā§ possibly turning challenges into opportunities for growth and innovation.

Strategic Recommendations for Investors in Lithium Argentina

Investors‚Äć looking to capitalize‚Ā£ on the burgeoning‚Äč lithium market ‚Äčin Argentina should consider diversifying their portfolios to‚ĀĘ include a mix of exploration companies and ‚Ā§established producers. ‚Äć Key players such as Albemarle and Livent offer relative stability and proven operational capabilities, while smaller companies may present higher risk but also potential for greater rewards. It would be prudent to watch the progress of these firms as they navigate local regulations and partnerships. Additionally, keeping an eye on the political landscape is essential, as changes in government policy can considerably impact production timelines and ‚ĀĘcosts.

furthermore,forming strategic alliances ‚Äčwith local ‚ÄĆfirms can provide vital advantages in terms of resource access and market‚Ā£ intelligence. Investors should also pay close attention to global demand trends for electric vehicles and renewable energy technologies, which are driving lithium consumption.‚Ā£ A heightened focus‚ĀĘ on enduring mining‚ÄĆ practices will ‚Ā§likely influence investor sentiment, making it essential‚ÄĆ to support companies ‚Äćthat prioritize environmental, social, and governance‚Äć (ESG) criteria. ‚ĀĘThe following table highlights potential investment categories and their associated risks and rewards:

| Investment Category | Risk Level | Potential Reward |

|---|---|---|

| Established Producers | Low | Steady ‚ĀĘReturns |

| Emerging Explorers | High | High Returns |

| Sustainable Ventures | Medium | Aligned with ESG ‚Ā£trends |

The Way Forward

Lithium Argentina demonstrates‚ĀĘ a robust portfolio and a strategic approach‚Äć that suggests a promising trajectory in‚Äć the rapidly evolving lithium market. ‚ÄćWith its strong resource base,favorable regulatory surroundings,and commitment to ‚Äčsustainable practices,the company is well-positioned to capitalize on the ‚Ā§increasing ‚Ā§demand for lithium,fueled by the global shift towards electric vehicles and renewable energy solutions. As investors look to navigate the‚Äč complexities of this burgeoning sector, Lithium Argentina’s proactive measures and sound financial management make it a compelling candidate for those seeking exposure in the lithium space.As always,potential investors should conduct ‚ĀĘthorough due diligence and consider market‚ÄĆ fluctuations,but the outlook for Lithium ‚ĀĘArgentina remains optimistic.