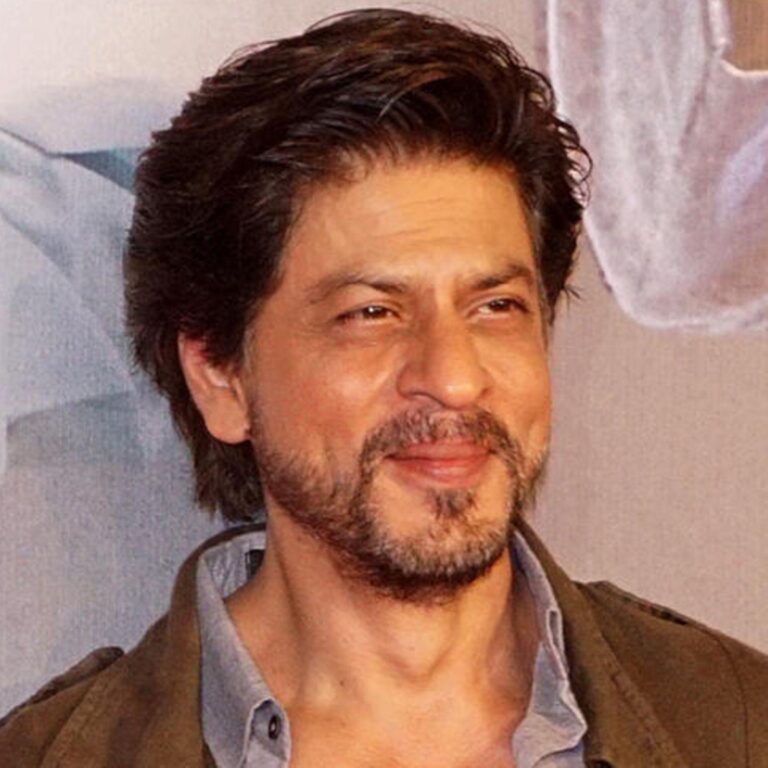

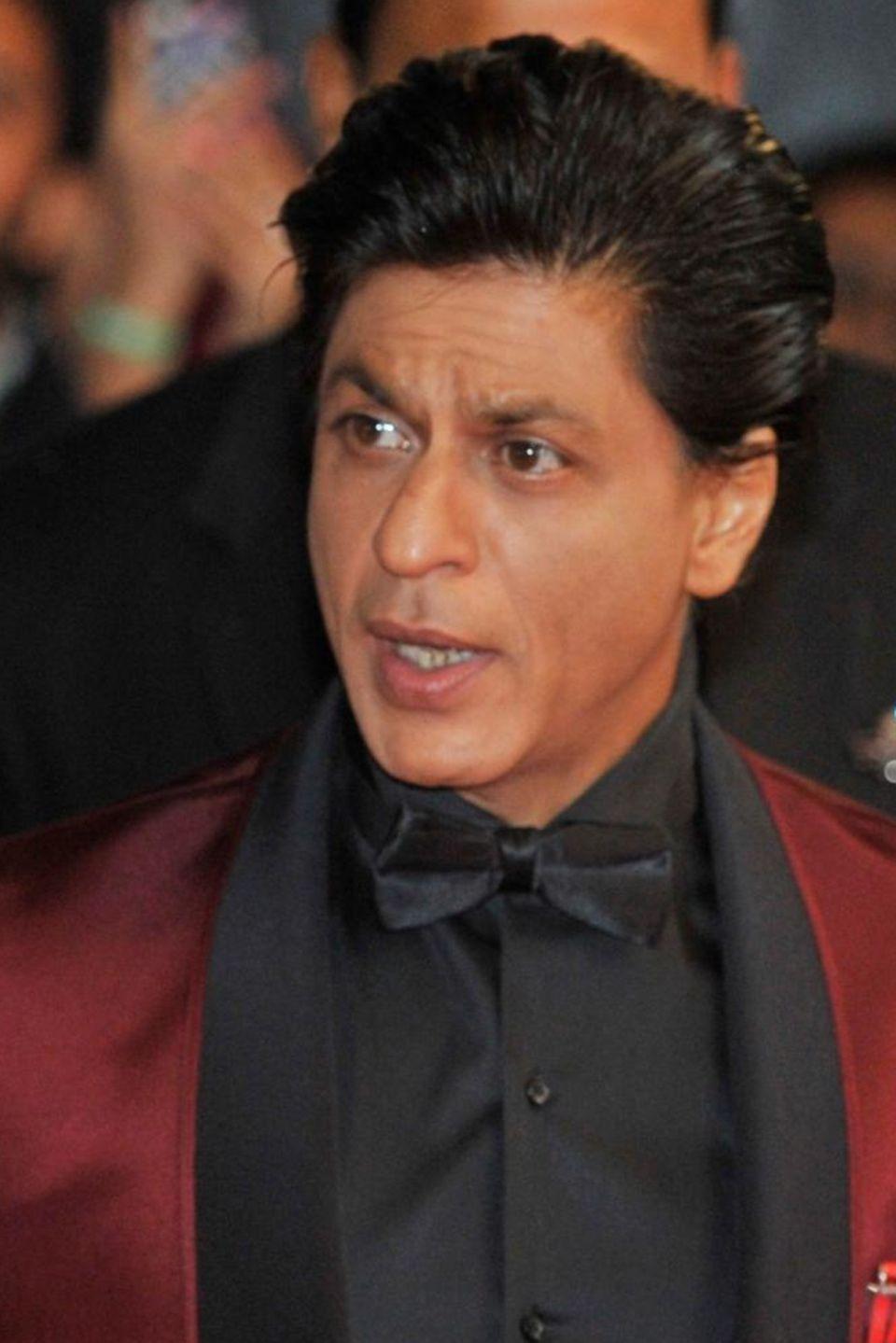

In a landmark ruling that underscores the complexities of tax legislation in India, Bollywood superstar Shah rukh Khan has emerged victorious in a tax dispute with the Income Tax Department. The tribunal has sided with Khan, affirming that the actor did not owe the contested taxes, a decision which not only highlights the intricacies of financial regulations but also the scrutiny faced by high-profile individuals in the entertainment industry. This ruling, reported by NDTV, arrives at a time when public figures are increasingly navigating the challenges posed by an evolving tax landscape, and it adds another chapter to the ongoing dialog surrounding celebrity, finance, and accountability in India. As Khan celebrates this legal triumph, the implications of the tribunal’s decision extend beyond the actor himself, reflecting broader themes of justice and compliance within the nation’s tax framework.

Shah Rukh Khans Legal Victory: Implications for celebrity Taxation in India

Shah Rukh Khan’s recent legal victory over the tax authorities marks a notable moment in India’s evolving landscape of celebrity taxation. The tribunal’s ruling, which favors the Bollywood icon, underscores the potential for a more balanced approach to taxation among high-profile individuals.This case serves as a critical reminder that tax policies must align with the complexities and contributions of celebrity figures in the Indian economy. As Khan successfully demonstrated, factors such as international income and the nuances of how earnings are classified can greatly influence tax obligations.

Following this landmark decision, several implications arise for the framework of celebrity taxation in India. Key takeaways from this case include:

- Precedent for Future Cases: This ruling could set a precedent for other celebrities facing similar tax disputes,perhaps leading to more favorable outcomes.

- Reevaluation of Tax Regulations: It may prompt the government to reevaluate current tax regulations pertaining to high-income earners and their international financial activities.

- Increasing Financial Openness: The case could encourage increased transparency among celebrities concerning their income sources and tax obligations.

As the landscape shifts, stakeholders will be watching closely to see how this case influences both public sentiment and tax policy reforms going forward.

Understanding the Tribunals Ruling: Key Takeaways from the Case

The recent tribunal ruling in favor of Shah Rukh Khan has significant implications for the interpretation of tax laws in India. The tribunal found that the tax authorities had overstepped their bounds, leading to key insights regarding taxpayer rights and procedural fairness. Notably, the case underscores the importance of comprehending the difference between personal income and professional income, which can often influence tax liabilities. The decision illustrates that clear documentation and proper classification of income sources can play a crucial role in similar disputes.

Among the important lessons from this ruling are:

- Documentation is Essential: Taxpayers must maintain accurate and comprehensive records of income and expenses.

- Legal Precedence: The tribunal’s emphasis on adhering to established legal precedents can serve as a guide for future cases.

- Understanding Tax Obligations: A clearer grasp of the obligations and rights can assist taxpayers in navigating complex tax situations.

Furthermore, the tribunal outlined the criteria used to evaluate the validity of claims made by the tax authorities. These criteria are pivotal for ensuring transparency and accountability within the tax system.Below is a simplified breakdown of the key evaluative criteria:

| Criteria | Description |

|---|---|

| Clarity of income Source | Determining the origin of income to classify it accurately. |

| Legal Framework | Assessment based on applicable laws and regulations. |

| Previous Rulings | Consideration of past tribunal decisions on similar matters. |

Tax Compliance Strategies for High-Profile Individuals: Lessons from shah Rukh Khans experience

Shah Rukh Khan’s recent legal victory emphasizes the importance of robust tax compliance strategies for high-profile individuals. Given the intricate and evolving landscape of tax regulations, it is crucial for celebrities and high-net-worth individuals to stay informed and proactive. some effective strategies that emerged from his experience include:

- Engagement of Expert Advisors: Collaborating with top-tier tax advisors ensures that individuals navigate the complexities of tax laws efficiently.

- Thorough Documentation: Maintaining meticulous records of income, expenses, and deductions serves as a foundation for any successful tax case.

- Transparency: Being open about financial dealings with tax authorities can build trust and mitigate disputes.

In addition to these strategies, conducting regular audits of financial statements can help anticipate potential tax liabilities. Moreover, understanding the nuances of international tax laws is essential for those with global earnings, as demonstrated by Shah Rukh Khan. Below is a simplified comparison of key compliance practices:

| Strategy | Description |

|---|---|

| Tax planning | Evaluating and forecasting tax liabilities through informed financial decisions. |

| Regular Reviews | Assessing financial practices periodically to adapt to new tax regulations. |

| Legal Counsel | Consulting with legal experts on compliance matters to safeguard interests. |

The Future of Taxation Disputes in the Entertainment Industry: What This Case Means for Stakeholders

The recent tribunal ruling in favor of Shah Rukh Khan not only marks a significant victory for the superstar but also sets a precedent for taxation disputes within the entertainment industry. As stakeholders navigate the complexities of tax regulations and discrepancies, this case serves as a landmark example of how legal interpretations in high-profile instances can influence broader practices.This decision underscores the necessity for clarity in tax legislation affecting artists, producers, and other industry personnel, highlighting the importance of due diligence in compliance and the potential for costly disputes arising from ambiguous tax laws.

Moreover, stakeholders in the entertainment sector shoudl take note of the implications this ruling holds for their future dealings with tax authorities. By addressing key aspects of tax obligations, including revenue reporting and the classification of income sources, creative enterprises can better prepare themselves to avoid pitfalls that could lead to disputes. As the landscape continues to evolve,a collaborative approach between industry players and tax regulators will be essential to foster transparency and reduce the frequency of disputes. To illustrate the key takeaways from this case, consider the table below:

| Key Takeaways | Implications for Stakeholders |

|---|---|

| Increased Scrutiny | Expect heightened review of tax filings by authorities. |

| Clarification of Regulations | Need for clear guidelines on income classification. |

| Precedent Setting | Influence on future rulings and compliance practices. |

| Encouragement of Industry Collaboration | Foster dialogue between artists and tax regulators. |

in Summary

Shah Rukh Khan’s recent victory in the tax case marks a significant milestone not only for the actor but also for the broader entertainment industry in India. The tribunal’s ruling in his favor underscores the importance of clarity and fairness in tax assessments, especially for high-profile individuals. As Khan continues to be a prominent figure in Bollywood, this verdict is highly likely to bolster his standing and may set a precedent for similar cases in the future. As the landscape of celebrity taxation evolves,the implications of this ruling will be closely monitored by both industry insiders and the public alike.With this matter resolved, fans and observers alike can look forward to witnessing Khan’s next cinematic ventures with renewed enthusiasm.