Argentina’sŌĆŹ state-owned energyŌĆŹ company, YPF, is poisedŌĆŗ too make a significant leap in the global energyŌüŻ sector ŌüówithŌüó plans for a ŌĆīfinal investment decision ŌĆŹ(FID)ŌĆī on its liquefied natural gas (LNG) export terminal slated for the second ŌüŻquarter of this year.This ŌĆīstrategic ŌüŻmove comesŌüŻ amid a backdrop of Ōüórising ŌĆīglobal demand forŌĆī cleaner energyŌĆī alternatives and ArgentinaŌĆÖs ambition ŌĆīto enhance its position as a keyŌĆī playerŌüó in the LNG market. As the country seeks toŌĆī capitalize on its vast natural gas reserves, notably fromŌĆŗ theŌĆī prolificŌüż Vaca Muerta ŌĆŹformation, YPFŌĆÖs commitmentŌĆŹ to advancing its LNG exportsŌüó could notŌüŻ only reshape the national energy landscape but also bolster Argentina’s economy. This article ŌüŻdelves intoŌüż the implicationsŌĆī of YPF’s upcoming decision, Ōüóthe Ōüżsurrounding market dynamics,ŌĆŹ and the potential impact on both domestic and international energyŌüó markets.

Argentinas YPF Advances LNGŌüŻ Export ŌĆŗTerminal Plans with Upcoming FID

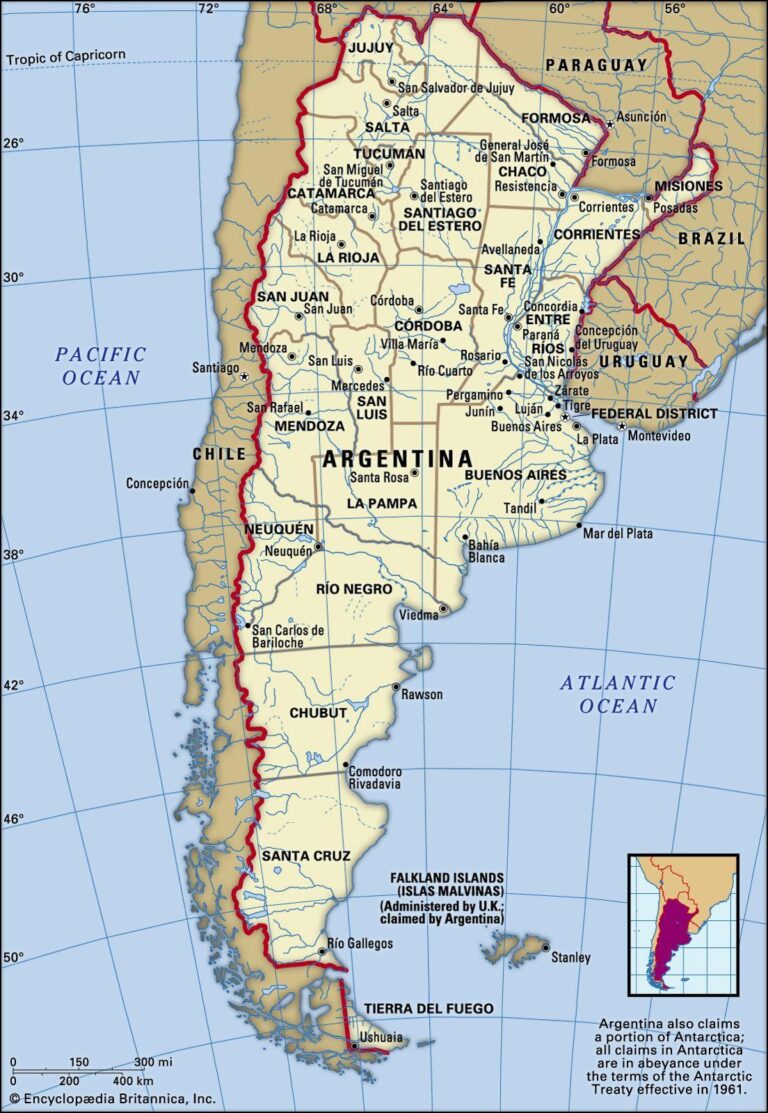

YPF, Argentina’s state-owned energy ŌĆŗcompany, is positioning itself to become a key player in the ŌĆŹglobal ŌĆīliquefied natural gas (LNG) market withŌüż plans to finalize its Final Investment Decision (FID) ŌĆŗ in Ōüóthe ŌüżsecondŌüŻ quarter of this year. thisŌĆŗ strategic initiative Ōüóaims to enhance the country’s natural gas exports and strengthen energy security, ŌĆŹboth domesticallyŌĆŗ and internationally. The decision to proceed with the export terminalŌĆŗ underscores YPF’s commitmentŌĆŗ to tapping into Argentina’sŌĆī vast shale ŌüógasŌĆī reserves,particularly those in the VacaŌüż Muerta formation,which ŌüóholdsŌüż some of theŌüó largestŌüŻ untapped natural gas ŌĆŹresources ŌüŻin Ōüóthe world.

As part of the project, YPF Ōüżis expected to collaborate with variousŌĆŹ partners ŌĆŗto establish a terminal capable of ŌĆŹprocessingŌüó and exporting considerable volumes of LNG. Key components of the plan include:

- InfrastructureŌĆī Progress: ŌĆī Construction ŌüżofŌüó facilitiesŌüż to liquefy and storeŌĆŗ natural ŌĆīgas.

- Partnerships: ŌĆŹ Building alliances Ōüżwith global investors and technology providers.

- environmental Considerations: ŌüżImplementing measures to minimize ŌĆīecological impact.

- MarketŌüŻ Strategy: Identifying competitive markets for ŌĆŗLNGŌĆŹ exports, especially in EuropeŌüż and Asia.

This project not only aims to alleviate Ōüóenergy supply challenges in Argentina but also opens doorsŌĆŗ for foreignŌĆŹ investment, fostering economicŌĆī growth inŌüŻ the energy sector.

Strategic ImportanceŌĆī of the LNG Project for ŌĆŹArgentinas EnergyŌüż Landscape

The anticipated liquefied ŌĆīnatural gas (LNG) project spearheadedŌüó by ŌüóYPFŌĆŹ is set toŌĆī redefine Argentina’s energy paradigm, offering multiple benefits thatŌüż couldŌĆŹ bolster both economic growth ŌĆŗand energy ŌĆŹsecurity.This Ōüżinitiative isŌüż vital for ŌüŻenhancing the countryŌĆÖs position as a ŌüŻsignificant player ŌüóinŌĆŗ theŌĆŹ global ŌĆŗenergy market. ByŌüó tapping into its vast ŌĆŹshale gas reserves,Argentina Ōüóaims to transform its energy profile through the export of ŌĆīLNG,which can diversify income streamsŌüŻ and ŌĆŗattract foreign investment. The potentialŌĆŹ for job creation in both rural and Ōüżurban ŌĆīareasŌüż further emphasizesŌĆŹ theŌĆŹ project’s significance to ŌĆīlocal economies.

Moreover, ŌüŻthe LNG projectŌĆŗ addresses the pressing need to integrateŌĆī renewable energy sources intoŌüż Argentina’s energy grid. The shift towards ŌĆŹcleaner fuels is an essential part ofŌĆŗ the ŌüŻnationŌĆÖs commitment to environmental sustainability. By facilitating the transition fromŌĆī customary fossil fuels to natural gas, the project can help reduce greenhouse gasŌĆŗ emissions. The strategic location of the terminal will not only enable ŌĆīquickerŌüż accessŌüó to international markets but ŌüŻalso ensure that Argentina can respond effectivelyŌüŻ to energy demand fluctuations. The multi-faceted benefitsŌüż encompass:

- Energy Security: Reducing dependence onŌĆŹ energy imports.

- Economic Growth: Generating employment opportunities Ōüżand stimulating local businesses.

- EnvironmentalŌĆŹ Impact: ŌĆŹ Supporting the shift ŌĆīto greener energy sources.

- Geopolitical Positioning: Establishing Argentina as a key Ōüżplayer in the Ōüżglobal LNG market.

Investment Opportunities and ŌüŻChallenges in the LNGŌĆŗ Sector

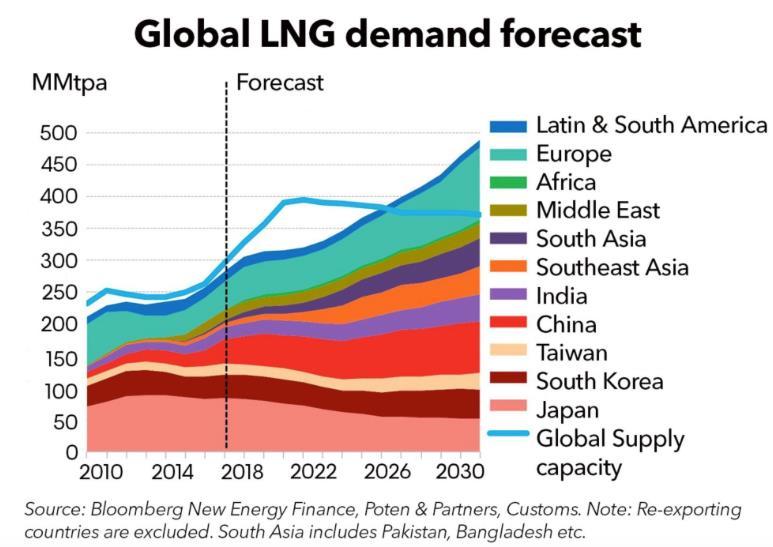

The ŌüżLNGŌĆŹ sectorŌüż presents a myriad of ŌĆŗ investment opportunities as global energy Ōüódemands surge, withŌĆŗ nations pivoting towardsŌüó cleaner energy sources.argentinaŌĆÖs strategic move ŌĆīwith the FID on the LNGŌĆŹ export terminal in the second quarter is emblematic of the broader trendsŌüż reshaping the market. Key factors enticing investorsŌüż include:

- Growing Demand: The ŌüżshiftŌüŻ towards natural gas as a transitional fuel bolsters market prospects.

- Infrastructure ŌĆŹDevelopment: Increased investments in infrastructure can enhance export capacities and efficiency.

- Government Support: Favorable regulatoryŌĆŹ frameworks Ōüżencourage growth and attract foreign direct investment.

However, theŌüó sector is not without itsŌüż challenges. Potential investors must navigate aŌĆŹ landscape shaped by volatilityŌĆī and geopoliticalŌĆī dynamics. Noteworthy challenges include:

- Market Volatility: Fluctuating ŌüŻgas prices can impact profitability ŌĆŹand Ōüżinvestment returns.

- Technological Hurdles: Developing ŌĆŹefficient extractionŌĆŹ and liquefaction technologies requires significantŌüż capital.

- Environmental Concerns: Ōüó Increasing focus onŌüŻ carbon emissionsŌĆī could influence public perception and regulatoryŌĆī policies.

| Opportunities | Challenges |

|---|---|

| Expanding global LNG market | PriceŌĆŹ fluctuations impacting ŌĆŹprofit margins |

| Enhanced ŌüótradeŌĆī partnerships | Technological advancements needed |

| Supportive government policies | Regulatory and environmental pressures |

Recommendations for ŌüóStakeholders in the growing ŌĆŗLNG market

As stakeholders navigate the burgeoning LNG market, it ŌĆŹis indeed essential toŌĆī adopt strategicŌüŻ approachesŌĆī to enhance competitiveness and sustainability. Key considerations include:

- Investment inŌĆī Infrastructure: ŌüŻEmphasize ŌüŻthe need for robust infrastructure to support LNG production and transportation, ensuring that facilities are capable of accommodating future demand.

- Diversity inŌüó Supply ŌĆīChains: ŌüżFosterŌüż diverse and ŌüŻflexibleŌĆŗ supply chains to ŌüŻmitigate risks associated ŌĆīwith geopoliticalŌĆŗ tensions ŌĆīand fluctuating market conditions.

- FocusŌüŻ on Sustainability: Prioritize investments that align withŌüż global sustainability goals, integrating technologies that reduce the carbon footprint of ŌĆŗLNG production.

Additionally, collaborationŌüŻ among stakeholders is ŌĆŹvital for ŌĆŗmaximizing opportunities in the LNG Ōüżarena. This could involve:

- Public-Private Partnerships: Leverage partnerships between governments and private entities to streamline the Ōüżregulatory process and attract investment.

- Research and Development: Invest in R&D to innovate and improve extraction and ŌĆīprocessing technologies,Ōüż ultimately Ōüżenhancing efficiency.

- Market Education: Develop educational initiatives aimed at informing potential consumers and investors about the benefits and applications ŌüŻof LNG.

| Focus Area | Advice |

|---|---|

| Infrastructure | Invest ŌĆŗin modernizationŌĆī andŌĆī expansion |

| Supply Chains | diversify sources and logistics |

| Sustainability | Adopt green ŌĆŗtechnologies |

| Collaboration | Encourage partnerships across sectors |

In Retrospect

Argentina’s YPF is on theŌüŻ cusp ofŌüó significant advancements in itsŌüż liquefied Ōüżnatural gas ŌüŻ(LNG) exportŌĆŗ capabilities, with a final investment decision anticipatedŌüó in the second quarter. This strategic moveŌĆŹ not onlyŌüó underscores Argentina’s ŌĆŹcommitment ŌĆŹto enhancing its energy infrastructure but also positions the country as a burgeoningŌüŻ player in the globalŌüŻ LNG market. As YPF navigates ŌĆīthe complexities ofŌĆŗ this project,stakeholders will beŌüó closely watching the implicationsŌüŻ forŌüż domestic energy supply,internationalŌüż trade relationships,and the broader economicŌüó landscape. With a positive outlook ŌüóforŌĆŹ the future,this development could ŌüŻpave ŌĆīthe ŌüŻway for ŌĆŗincreased investment and ŌüŻinnovation within Ōüóthe sector,ultimately contributing to ŌüŻArgentina’s energy ŌĆŹindependence and growthŌĆī trajectory. As ŌĆŗthe situation ŌĆŹunfolds, ŌĆīthe energy community will ŌüŻbe ŌĆīeager to see how YPF’s ambitious plans materializeŌĆī and ŌĆŹwhat ŌĆŹthey meanŌüó for the ŌĆŹregion and beyond.