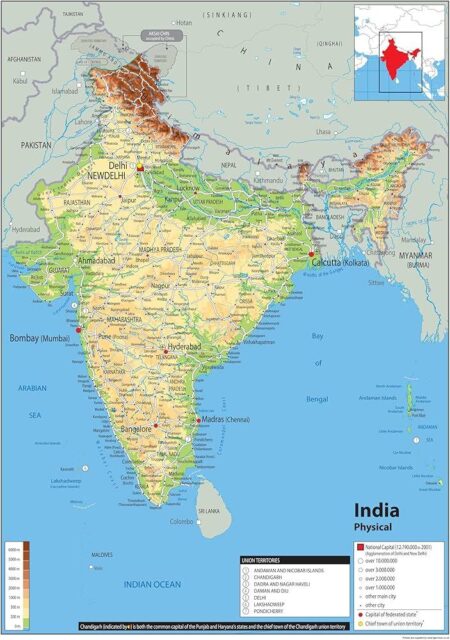

InŌüó a significant stride towards enhancingŌüŻ financial accessibility in Ōüórural India, Telangana’s ŌĆīITŌĆī Minister recently inaugurated Viyona Fintech’s innovativeŌüŻ platform, GraamPay.This initiative aims to empower local communities by bridging the digital Ōüżdivide and providing seamless ŌĆīaccessŌüó to banking and financial services. ŌüżWith a ŌĆīfocus on uplifting underserved populations, GraamPay leverages cutting-edge technology Ōüżto ŌĆīoffer tailored solutions ŌĆŗfor everyday transactions, thereby fostering economic growth and ŌĆīfinancial inclusion. The launch ŌĆŹevent, covered by ŌĆŗYahoo Finance, highlights theŌĆŹ government’s commitment to harnessing technology forŌĆī equitable progress and underscores the critical role fintech plays in reshaping the landscape of rural finance. As India continues to push towards Ōüóa more digital economy,ŌüŻ GraamPay stands out as a promising solution poisedŌĆī to transform the Ōüżlives of millions across the nation.

Telanganas Commitment to ŌĆīRural ŌĆŗEmpowermentŌüż Through Innovative fintechŌüŻ Solutions

The recent launch of GraamPay by Viyona Fintech marksŌüó a pivotal step ŌĆŗin enhancingŌĆŗ financial inclusion in rural India, particularly in ŌĆīTelangana. With a vision to empower underserved Ōüżcommunities,the initiative ŌĆīleveragesŌüó technology to provide accessible and affordableŌüż financial solutions. This aligns seamlessly with theŌĆī state’s broader strategy ŌĆŹto revolutionizeŌüż rural economies by integrating innovative fintech services that cater Ōüżto ŌĆīthe unique needs of the agrarian population. Through GraamPay,residents can access ŌĆīa rangeŌüż of services,enabling them to manage their finances more effectively thanŌüó everŌĆī before.

KeyŌĆŗ featuresŌüŻ of GraamPay include:

- Seamless Transactions: users Ōüócan ŌĆīsend and receiveŌüż money instantly, reducing ŌĆīthe relianceŌüż on cash and Ōüżtraditional ŌĆībanking.

- Microloans: ŌüŻ EasilyŌĆŗ accessible small loan options tailored for farmers and small business owners, promoting ŌĆŹentrepreneurship.

- financialŌüó Literacy Programs: InitiativesŌĆŗ aimed at Ōüóeducating users Ōüżabout financial management andŌüŻ digital literacy.

Additionally,the platform is designed to be user-friendly,accommodating the technological capabilities of all rural residents,nonetheless ŌĆīof ŌĆŹage orŌĆī education level. ThisŌüŻ effortŌĆī is anticipated toŌüż bridge the gap that has traditionally existedŌüŻ between urban andŌüó rural sectors, ŌüŻfacilitatingŌĆŗ better ŌüŻeconomicŌĆŹ opportunitiesŌĆŹ and improving ŌĆīthe quality of lifeŌüŻ for countless individuals.

Exploring the Features and ŌĆŗBenefitsŌüŻ ofŌĆŹ Viyona fintechŌĆÖs graampay for ŌĆŹRural Enterprises

Viyona FintechŌĆÖs GraamPay is a game-changer for rural enterprises, ŌüódesignedŌĆī with features that cater to the unique needs of these businesses. this digital payment platform facilitates seamless transactions, enablingŌĆŹ small-scale farmers and rural entrepreneurs to receive payments swiftly and securely. ŌĆīBy integrating mobile wallets, UPI Ōüżtransactions, and QR code payments, GraamPay simplifies the financial tools ŌĆīavailableŌüó for these ŌüŻenterprises, ultimately driving economic growth in regions where banking infrastructure mayŌüŻ be limited.usersŌüŻ can also benefit fromŌüŻ real-time transaction Ōüżtracking, ensuring openness and enhancing trustŌüó inŌĆŹ their financial dealings.

in ŌüŻaddition ŌĆŗto its ŌüŻuser-friendlyŌĆŹ interface and diverse payment options, GraamPay offers several benefits that empower Ōüżrural businesses to thrive. Among ŌĆŹthese advantages are:

- Financial ŌĆīInclusion: Bridging the ŌĆŹgap ŌĆīfor unbanked populations.

- Cost-Effectiveness: Lower transaction fees compared to Ōüótraditional Ōüóbanking services.

- Access to Credit: Users can buildŌüŻ credit scores through their transactions.

- Education and Training: ŌĆŗResources provided to ŌüóimproveŌĆŗ financial literacy among users.

By ŌĆīleveraging technology,GraamPay not only streamlinesŌüż financial operations but also aids in fostering community development andŌüŻ resilience in ruralŌüó sectors.

The Role of Government Support in Advancing FinancialŌĆŗ Inclusion in ŌĆŹRural India

Government intervention plays a pivotal role in bridging Ōüóthe financial Ōüódivide between urban and rural areas, particularly Ōüżin ŌüŻa ŌĆŹcountry like India where a significantŌĆī portion of theŌüó populationŌüó residesŌĆŗ in rural regions. ŌĆŗThe recent inauguration of Viyona FintechŌĆÖsŌüó GraamPay by the Telangana IT Minister ŌĆīunderscores theŌĆī importance of such ŌĆŗinitiatives backed Ōüżby ŌĆŗgovernmentalŌüŻ support. By fostering an environment conducive to fintech Ōüżgrowth, the governmentŌĆŹ can help ŌĆŗcreate platforms that offerŌĆī a range of financialŌĆŹ services, including digital ŌĆīpayments, savingsŌüó accounts, and microloans directly to rural communities. ThisŌĆŹ can lead to increased financial literacy Ōüó and ŌĆŗenhanced economic empowerment among underserved populations.

to advance financialŌüż inclusion in rural India, government support ŌüŻcan take various Ōüżforms, Ōüżincluding:

- PolicyŌüó Frameworks: ŌĆŹEstablishing clear and supportive ŌüŻregulations for ŌĆŹfintech companies.

- Financial Incentives: ŌĆŹ Offering subsidies ŌĆŗor taxŌüż breaksŌüó for companies that invest Ōüóin rural infrastructure.

- Public AwarenessŌüŻ Campaigns: Educating rural populations about available financialŌĆŗ products andŌüż services.

Moreover, partnerships between theŌĆī governmentŌĆī and Ōüóprivate sector can lead ŌĆŗto innovative solutions tailored to ŌĆŹspecific regional needs.Collaborating with local organizations ensures that the services providedŌüó are culturally relevant andŌĆŗ accessible.Consequently, this confluence of support not only ŌĆŹstrengthens the ŌüŻoverallŌĆī financial ecosystemŌĆī but ŌĆŗalso empowers rural communitiesŌüŻ to take charge of their economic ŌĆŹfutures.

Future ŌĆŹDirections: Recommendations Ōüżfor Scaling Fintech ŌĆīInitiatives Ōüóin Emerging Markets

To effectively scale Ōüżfintech initiatives in emerging markets, Ōüóstakeholders must prioritize a range ŌüŻof strategiesŌüŻ that ŌĆŹcater to the unique challenges of these regions. Collaborative Ōüópartnerships between government ŌĆīentities, localŌĆŹ businesses, andŌüŻ fintech startups are essential for creating a robust ŌĆīecosystem. By leveraging local expertise and ŌüŻresources, initiatives Ōüżlike GraamPay can enhance ŌĆīaccessibility and trust among Ōüórural populations. Additionally, investing in digital literacy programs will empowerŌüż more individuals to engage withŌüŻ fintech solutions, ensuring widespreadŌüŻ adoption and effective utilizationŌüż of Ōüżfinancial services.

Furthermore, addressing the infrastructure gaps remainsŌüó critical ŌüżforŌĆŹ the success of fintech ŌüŻin rural areas. initiatives Ōüżshould ŌĆŗconsider ŌĆīrobust networking solutions, enhancing internet connectivity, and improving powerŌüó availability to supportŌüó digital ŌĆŹtransactions. As part of a comprehensive ŌĆīgrowth strategy,ŌĆŗ emerging marketsŌüŻ can ŌĆŗbenefit from deployingŌüż mobile technology as a ŌĆŗprimary platform for ŌĆŗfinancial services, given ŌĆŗthe high mobile ŌĆŗpenetration rates. the creation of Ōüż localized ŌĆŗsolutions tailored toŌĆŹ individual community needs will foster ŌüóinclusivityŌüŻ and resilience, allowing fintech ŌĆŗto ŌĆīthrive inŌüŻ diverse socio-economicŌüż landscapes.

The Conclusion

As Telangana’s IT ŌĆīMinister inaugurates Viyona Fintech’s GraamPay,the initiativeŌüŻ marks a ŌüŻsignificant ŌĆŹstep towards bridging the ŌĆŹdigital divide in rural india. By providingŌüż accessible financialŌĆŗ servicesŌüŻ and empowering local communities, GraamPay aims to enhance economic opportunities for underserved populations. With the backingŌüż ofŌüŻ governmental support andŌüó innovative fintech ŌĆīsolutions,this initiative notŌüż only reflects the growing importance of technology in everyday life but ŌüŻalsoŌüó underscores the commitment to fostering inclusive growth across ŌĆŗthe nation. As Viyona Fintech rolls ŌĆŗout itsŌĆŹ services, all eyes will be on ŌüŻits impact in transforming theŌĆī financial landscapeŌüŻ of rural India ŌĆīand paving ŌüŻthe way for a more equitable future. The success of ŌĆŗGraamPay could ŌüŻserve Ōüóas a blueprint for similar initiatives, reinforcing the roleŌĆŹ of technology inŌĆŗ promoting financial literacy and ŌĆŹeconomic ŌüŻresilience inŌĆī rural communities.