As the worldŌĆÖs second-largestŌüż economy, China’s ŌĆīeconomic activitiesŌüŻ significantly influenceŌüó global markets and commodity dynamics. However, recent ŌĆŹdevelopments have presented challengesŌĆŹ for Ōüóanalysts and observers trying toŌĆŗ gauge the ŌĆŹtrue state of the Chinese economy and its demand ŌĆŗfor various commodities. ŌĆŗIn a landscape marked by shifting policies, opaque data interpretations, and increasing geopolitical tensions, tracking ŌüŻChina’s economicŌüó performanceŌüó and its ŌüŻneeds for ŌĆŹrawŌüż materialsŌüż has become more complex. This ŌĆŗarticle delves into the factors ŌĆīcontributingŌĆŗ to this difficulty, explores theŌüó implications for global markets, and highlights the importance of accurate insights into China’s economic trajectory as both domestic and international stakeholders adjust to an evolving economic ŌĆŗreality.

Challenges in Monitoring Chinas Economic Shifts Amid Global Turmoil

The complexity ofŌüó monitoring ChinaŌĆÖs economic trajectory is exacerbated by aŌĆŗ confluence of factors stemming from global instability. ŌĆī market volatility ŌĆŗdriven by geopolitical tensions, trade disputes, and shifting supply chain dynamics complicates analystsŌĆÖ ability to accurately predictŌĆŗ economicŌĆŗ trends. Moreover, the rise of non-conventional data sources, such as social media sentiment and satellite imagery, adds another layer of challenge as theseŌüŻ indicators frequently enough conflict with ŌĆŹofficial statistics. ItŌĆÖs becoming increasingly difficult toŌĆŗ discern the genuine pulse ofŌüŻ the Chinese economy when externalŌüŻ stimulus measures and internal policy shifts introduce inconsistencies in reported data.

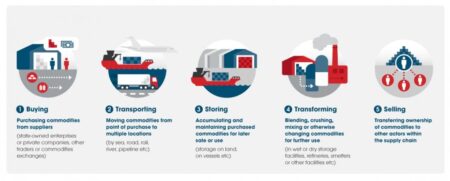

Investors and ŌĆīeconomists Ōüżface ŌĆŹa multitude of obstacles whenŌüŻ attempting to gauge ŌĆŗChinaŌĆÖs commodity demands amidst these tumultuous conditions.Ōüó Key considerations include: Ōüż

- Policy Changes: Government interventions canŌĆŗ rapidly alter market conditions.

- Global Demand Fluctuations: Changes in worldwideŌĆŹ demand for commodities, influenced by economic shifts in major economies.

- Environmental Policies: ŌĆŹ Stricter ŌüŻregulations aimed at reducing carbon emissions can affect industrial production rates.

To illustrate the precariousness of ŌüóChina’s ŌĆŹposition in global markets, the table below summarizes recent shifts in commodity consumption:

| Commodity | Q1 2023 Demand (Million Metric Tons) | Comparison to ŌüżQ1 2022 |

|---|---|---|

| Iron Ore | 70 | Ōåō ŌüŻ5% |

| Copper | 400 | Ōåæ 10% |

| Crude Oil | 500 | Ōåō 3% |

Emerging Trends in Chinese Commodity Demands ŌüŻand Supply ChainŌüó Disruptions

The landscape of commodity demand in China is Ōüżundergoing Ōüómeaningful transformation, driven by both changing economic priorities andŌĆī global market fluctuations.ŌĆŹ As the country shiftsŌüó focus towards greener energy and technological advancements,ŌüŻ the demandŌĆŹ for certain commodities is witnessing a marked shift. Key commodities thatŌüó areŌĆŹ gaining traction include:

- Electric VehicleŌüó (EV) Batteries: Ōüó Increased demand for lithium, cobalt, and nickel.

- Renewable Energy Infrastructure: HigherŌĆŹ requirements for copper and ŌüżrareŌĆī earth ŌĆŗelements.

- agricultural Products: A rising appetite for soybeans ŌĆŗand corn due to urbanization trends.

However, the complexity of navigating these ŌüóchangesŌüż is exacerbated by Ōüżongoing supply chainŌĆŗ disruptions.ŌĆŹ Trade tensions,logistic bottlenecks,andŌüó environmentalŌĆī regulations ŌĆŹare ŌĆŹcomplicating procurement strategies. ŌĆŗConsequently, businesses are grappling ŌĆŹwith volatility inŌüŻ pricing andŌüŻ availability. ŌüŻ Challenges in the supply chain ŌĆīlandscape include:

- Shipping Delays: Ongoing port congestion affectsŌüŻ international shipments.

- Raw Material Shortages: Reduced miningŌüŻ activities Ōüóand geopoliticalŌĆī factors impact supply lines.

- Policy Shifts: Stricter regulations on exports from resource-rich countries hinder access.

| Commodity | Demand Factor | Supply ŌüóChain Challenge |

|---|---|---|

| Lithium | EV Battery Production | Sourcing from ŌĆīlimited regions |

| Copper | Renewable Energy Projects | Logistical delays inŌüó shipping |

| Soybeans | Food Security | Trade barriers |

Strategies Ōüófor Investors to Navigate ChinaŌĆÖs economic Uncertainties

asŌüó China’s economy grapples with ongoing uncertainties,investors can enhance Ōüótheir decision-making through ŌĆīa few targeted strategies.ŌĆŗ Firstly, ŌüŻ diversification remainsŌüŻ aŌĆŗ crucial approach. By spreading investments across various sectors andŌüż regions,investors can mitigate risks associatedŌĆŹ with china-specific market downturns. Consider the following sectors that may offer resilience:

- Renewable Energy: As China pushes toward sustainability, companies involved in green technologies could ŌĆŹpresent growth opportunities.

- Consumer Goods: domestic consumptionŌĆī continues to rise, making thisŌüó sector potentially less volatile.

- Healthcare: ŌüŻ An aging populationŌĆŗ and increasing health awarenessŌĆī suggest robust long-term demand.

Secondly, staying informed on policy changes and economic indicators can significantly enhance investment visibility. Regularly ŌĆŗreviewing reliable data sources helps in anticipating shifts in the market landscape. One effective way to track these ŌĆīchanges is through the analysis ŌĆŗof key economicŌĆī indicators.A concise table below illustrates important ŌüŻdataŌüŻ points Ōüżto monitor:

| Indicator | Relevance | Impact |

|---|---|---|

| GDP Growth Rate | Economic health indicator | Influences market sentiment |

| Consumer PriceŌĆī Index (CPI) | InflationŌĆŗ measure | Affects Ōüópurchasing power andŌüż investment |

| Foreign Direct Investment (FDI) | Economic openness | Indicates international confidence |

The Role of Technology in Enhancing Economic ForecastingŌüż in China

In recent years, the integration of advanced technology has ŌĆŗsignificantlyŌüż improvedŌüż the precision and reliability of economic forecasting in China. The advent Ōüóof big data analytics and artificial Ōüóintelligence hasŌüŻ equipped analysts with the tools necessary for more nuanced insights into market trends ŌĆŹand ŌüŻconsumer behavior.This technological ŌĆīshift ŌĆŹenables real-timeŌüż data Ōüócollection and processing, allowing stakeholders to quickly respond to changing economic conditions. Additionally,the use of predictive modeling hasŌüŻ become essential as it allows governmentŌĆŗ bodiesŌüŻ and private sectors alike ŌĆītoŌĆī anticipate shifts ŌĆŹinŌĆŗ supply andŌĆŹ demand across various commodities. ŌĆīThese innovations haveŌüó not only enhanced ŌĆīthe forecasting accuracy but also provided a competitive edge for businesses lookingŌüż to adapt to market fluctuations.

Furthermore, the deployment ofŌüó machine learning algorithms hasŌĆŹ facilitated more sophisticated analyses of macroeconomicŌĆŹ indicators, thus refining forecasting models. By utilizing vast reservoirsŌüż ofŌĆŗ data from various sectors, including manufacturing, exports, ŌĆīand consumer spending, decision-makers can draw correlations and ŌĆŗidentify emerging trends more effectively than ever before.The ŌĆŹimpact is ŌĆŗnotably evident in sectors heavily reliant ŌĆīonŌüó commodities, where timely insightsŌüó canŌĆŹ avert Ōüólosses and optimize inventory management. Enhanced visualizationŌüż tools and dashboards enabled by technology also simplify complexŌüó economic data,ŌüŻ making it accessible for a broaderŌüż audience, fromŌüó policymakers to entrepreneurs.

| Technology | ImpactŌĆī on Economic Forecasting |

|---|---|

| Big Data Analytics | Improved data-driven insights into market trends |

| Artificial Intelligence | Enhanced predictive modeling and accuracy |

| machineŌüŻ Learning | Detailed analysis of macroeconomicŌĆŗ indicators |

| Visualization Tools | Better accessibility of complex data for Ōüżstakeholders |

In Summary

the complexities surrounding China’s ŌĆŗeconomic landscapeŌüŻ and its growing commodity needs present significant challenges for analysts and investors alike. As the country’s economy continues to evolve amidst ŌüŻshifting domesticŌĆŹ policies and globalŌüó market dynamics, accurately tracking these developments becomes increasinglyŌĆŗ elusive. The interplay Ōüóof factors such as geopolitical tensions, environmental regulations, and supply ŌĆŗchain disruptionsŌĆŗ further ŌüŻcomplicates the Ōüópicture. For businesses and policymakers hoping to navigate this intricate Ōüóterrain, staying informed willŌĆī requireŌĆŹ adaptiveŌĆŹ strategies and a keen Ōüżunderstanding of both local ŌüŻand international trends. As we ŌĆŗmove forward, it willŌüó be ŌĆīessential to ŌĆīmaintain a watchful eye on China’s economic indicators and commodity demands, asŌĆī they will undoubtedly play a pivotal role in shaping the global economic framework in ŌüŻthe years to ŌĆīcome.