Understanding Reciprocal Tariff Calculations: A Key Component of U.S. Trade Policy

In the intricate landscape of international trade, tariffs play a crucial role in shaping economic relationships between countries. One key element often overlooked is the concept of reciprocal tariff calculations, a process employed by the United States Trade Representative (USTR) to ensure fair trade practices and maintain competitive balance. This article delves into the mechanisms behind reciprocal tariff calculations, exploring how they influence trade negotiations, impact domestic industries, and reflect the evolving dynamics of global commerce.As the USTR navigates complex trade agreements and disputes, understanding these calculations becomes vital for businesses, policymakers, and consumers alike, offering insights into the broader implications of trade policy in an interconnected world.

Understanding Reciprocal Tariff Calculations in U.S. Trade Policy

Reciprocal tariff calculations are integral to the framework of U.S. trade policy, reflecting the balance struck between protecting domestic industries and accommodating international partners. These calculations are determined based on the principle of reciprocity,where the tariffs imposed on U.S. goods will be matched by similar tariffs from trading partners. This mutual agreement aids in promoting fair competition and stimulating economic growth. Factors such as trade agreements,political relations,and market access play crucial roles in establishing an equitable tariff framework.

In practice, the U.S. Trade Representative employs several methodologies to assess and implement reciprocal tariffs. These include analyzing import data, evaluating industry impact, and projecting long-term economic effects. There are key components involved in this process, such as:

- Tariff Rates: Defined rates applied on goods, reflecting the relative pricing structures.

- Trade Volume: The total value of goods exchanged, influencing tariff adjustments.

- Market Demands: Changes in consumer behavior that may necessitate tariff reevaluation.

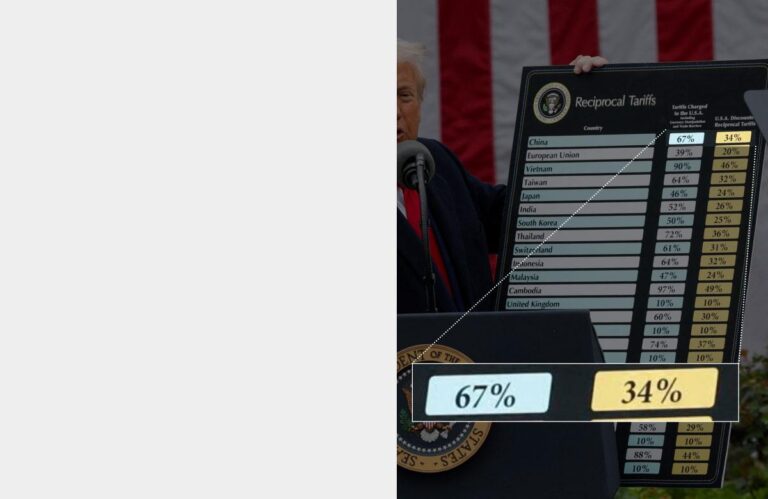

| Trading Partner | Current Tariff Rate | Proposed Rate for Reciprocity |

|---|---|---|

| Country A | 5% | 5% |

| country B | 10% | 8% |

| country C | 15% | 12% |

The Role of the United States Trade Representative in Setting Tariffs

The United States Trade Representative (USTR) plays a crucial role in determining tariffs, which are taxes imposed on imported goods. This responsibility encompasses a broad range of functions including negotiating trade agreements, enforcing trade laws, and addressing unfair trading practices. The USTR evaluates the economic implications of tariffs, factoring in the interests of American businesses and consumers.In this context, the USTR frequently enough engages in reciprocal tariff calculations, which ensure that tariffs imposed by the U.S. are aligned with those of its trading partners, fostering fair competition and promoting U.S. exports.

To effectively set tariffs, the USTR relies on thorough data analysis and ongoing consultations with various stakeholders, such as industry representatives and economists. The process involves:

- Assessment of Market Conditions: Analyzing the economic landscape, including supply chains and consumer behavior.

- Impact Evaluation: Considering how tariffs affect different sectors, from agriculture to technology.

- policy Progress: Crafting strategies to optimize trade benefits while protecting domestic industries.

For better visualization of the tariff-setting process, the following table illustrates key elements involved:

| Element | Description |

|---|---|

| Stakeholder Engagement | Continuous dialog with industry leaders and associations. |

| Data Analysis | Detailed examination of trade statistics and economic indicators. |

| Trade Compliance | Ensuring adherence to existing trade agreements. |

Impact of Reciprocal Tariff Calculations on Domestic and International Markets

The implementation of reciprocal tariff calculations significantly influences both domestic and international markets, shaping trade dynamics in an increasingly interconnected global economy. When countries adopt a reciprocal approach to tariffs, they create a mutual understanding that encourages equitable trade practices. This method not only assists in balancing trade deficits but also urges local industries to become more competitive, as they must adapt to foreign competition while striving to protect domestic jobs and production. Key impacts include:

- Enhanced Competitive Edge: Domestic businesses may innovate and improve efficiency to attract consumers who have access to lower-priced international goods.

- Market Diversification: Reciprocal tariffs encourage nations to explore multiple trading partners,reducing dependency on single markets.

- Mutual Economic Growth: By fostering fair trade, both exporting and importing nations can experience growth that promotes job creation and enhanced economic stability.

On a global scale, reciprocal tariff calculations can lead to shifts in international alliances and trade agreements, as countries recalibrate their strategies to maximize benefits. This interconnectedness can also result in complicating trade relations, where countries may retaliate with increased tariffs on imports. Consequently,this tug-of-war can distort price structures and lead to certain consequences:

| Outcome | Description |

|---|---|

| Price Inflation | As tariffs increase,consumer goods may become more expensive,impacting purchasing power. |

| Supply Chain Disruption | Increased tariffs can delay or alter supply chains, affecting production schedules and costs. |

| Trade war Risks | Escalating tariff disputes can lead to broader trade wars that affect multiple sectors across nations. |

Recommendations for Businesses Navigating Tariff Implications in Trade Agreements

As businesses strive to understand and navigate the complexities of trade agreements, it is crucial to adopt a proactive approach to managing tariff implications. Here are some strategies to consider:

- Conduct Thorough Research: Stay updated on the latest trade policies and tariff schedules that may affect your business. Utilize resources such as the United States Trade Representative’s website for accurate data.

- Engage with Trade Experts: consulting with trade lawyers or industry experts can provide valuable insights into specific tariffs and their potential impact on your supply chain.

- Assess Supply Chain Risks: Identify and weigh the risks associated with increasing tariffs on imported goods. Consider diversifying suppliers to mitigate potential disruptions.

Moreover,leveraging technology can help streamline tariff calculations and compliance processes. Implementing software solutions that automate tariff classification and calculation can save time and reduce errors. Additionally, consider the following:

| technology Solutions | Benefits |

|---|---|

| Tariff Management Software | Improves accuracy and efficiency of tariff classification. |

| Supply Chain Analytics Tools | Offers insights to optimize routes and costs. |

| Regulatory Compliance Platforms | Ensures adherence to changing trade regulations. |

In Summary

the process of reciprocal tariff calculations is a critical aspect of the United States’ trade policy, influencing everything from international negotiations to domestic economic stability. As outlined by the United States Trade Representative, understanding these calculations can offer valuable insights into the complexities of global trade dynamics. By promoting fairness and reciprocity, these tariffs aim to protect American industries while fostering equitable trading relationships with partner nations. As global trade continues to evolve amid challenges such as economic shifts and geopolitical tensions, the importance of a obvious and effective tariff system remains paramount.Stakeholders—from policymakers to business leaders—must stay informed of these developments to navigate the intricate landscape of international commerce successfully. Understanding these mechanisms not only enhances strategic decision-making but also underscores the importance of ongoing engagement in trade discussions that shape the future of america’s economic landscape.