In a staggering advancement that poses a notable threat to the stability of Russia’s already beleaguered economy, oil prices have plummeted by 31%, delivering yet another blow to President Vladimir Putin’s administration. The crash in prices, a crucial revenue source for the Kremlin, comes amidst a backdrop of geopolitical tensions and ongoing sanctions that have already strained Russia’s financial landscape. As the global market grapples with oversupply and decreasing demand, the ramifications of this sudden decline extend beyond economic metrics, possibly undermining the political fabric of Putin’s regime. This article delves into the implications of the oil price crash, examining how it exacerbates Russia’s economic vulnerabilities and what it could mean for the country’s future.

russia’s Economic Strain Intensifies Amid Plummeting Oil Prices

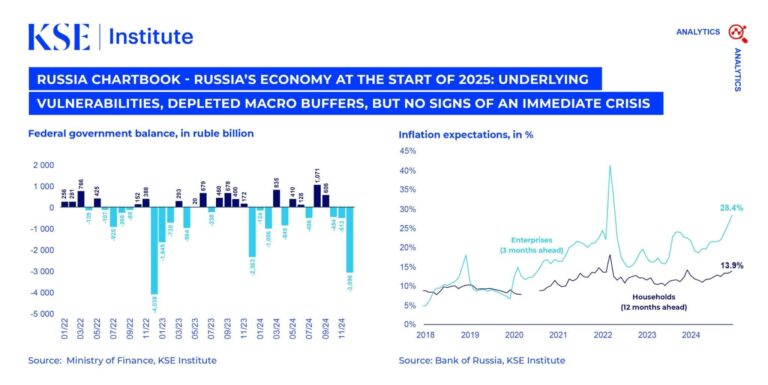

In a significant turn of events that has sent shockwaves through the global market, Russia’s economy faces an unprecedented challenge as oil prices have plummeted by 31%. This dramatic decline not only threatens the Kremlin’s fiscal stability but also poses a serious challenge to President Putin’s grip on power. With oil and gas exports accounting for a large portion of the nation’s revenue, the repercussions are expected to ripple through sectors reliant on government funds. Analysts warn that if these price trends continue, Russia could see a surge in inflation and a deterioration of public services, compounding existing economic woes.

The collapse in oil prices can be attributed to a myriad of factors comprising increasing supply from international producers and reduced demand driven by global economic uncertainties. This downturn could lead to various enhancements in the economic landscape, such as:

- Currency Devaluation: The Russian ruble may weaken further, leading to more expensive imports.

- Investment Decline: Foreign investors might withdraw or delay investments in the Russian market due to uncertainty.

- Social Unrest: A rise in unemployment and decreased public spending could lead to protests and social discontent.

Furthermore, government revenues are set to fall sharply, increasing the likelihood of budget cuts in essential social programs. A table below highlights the percentage of government revenue derived from oil and gas:

| Year | % of Revenue from Oil and Gas |

|---|---|

| 2020 | 37% |

| 2021 | 41% |

| 2022 | 36% |

| 2023 | Estimated 34% |

the impact of Oil Price Volatility on Russia’s Financial Stability

The recent plunge in oil prices by 31% presents a significant threat to the financial stability of Russia, a nation heavily reliant on its energy exports. as global demand fluctuates and geopolitical tensions reshape market dynamics, Russia finds itself in a precarious position. The volatility impacts not only government revenues but also the overall economy, influencing critical sectors such as infrastructure, social services, and private investment. Key indicators revealing the strain include:

- Declining Ruble Value: A direct consequence of falling oil prices, leading to increased inflation.

- Shrinking GDP: Economic forecasts suggest a contraction in growth, pushing Russia towards recession.

- Increased Economic Isolation: Sanctions complicate the situation, limiting access to foreign investment and technology.

To illustrate the severity of the situation, the following table summarizes recent oil price trends and thier anticipated effects on Russia’s economy:

| Time Frame | Oil Price (USD) | Impact on GDP (%) |

|---|---|---|

| Previous Quarter | $70 | +1.5 |

| Current Quarter | $48.5 | -2.3 |

| projected Next Quarter | $50 | -1.0 |

This systemic vulnerability underscores the need for Russia to diversify its economy beyond oil and gas. However,the path to resilience remains strewn with challenges,requiring swift and strategic policy responses to both stabilize the immediate fallout and lay a foundation for sustainable growth.

Strategies for Russia to Mitigate the Economic Fallout from Oil Declines

Considering the recent plunge in oil prices, Russia must adopt multifaceted strategies to cushion its economy from the impending fallout. First and foremost, diversifying the economic portfolio is crucial. By investing in alternative sectors such as technology, agriculture, and renewable energy, Russia can reduce its dependence on oil revenues. This can be facilitated through government incentives that promote innovation and foreign investment, creating a more resilient economic framework. Moreover, fostering partnerships with neighboring countries can definately help bolster trade relations and open new markets, mitigating the risks associated with global oil volatility.

Additionally, enhancing fiscal policies will be vital in stabilizing the economy during this downturn. Implementing measures to cut non-essential government spending while increasing social safety nets for vulnerable populations could alleviate some pressure. strengthening the national currency’s stability through effective monetary policy can also provide a buffer against the economic shocks. Further, leveraging existing resources to create a sovereign wealth fund could equip Russia with the financial tools necessary to weather future oil price fluctuations. The collective request of these strategies will be essential for Russia to navigate this turbulent period effectively.

Closing Remarks

the dramatic 31% plunge in oil prices poses a significant threat to an already struggling Russian economy. As global markets react to shifting dynamics and the ongoing geopolitical tensions, the implications for President Vladimir Putin’s administration are profound.With oil revenues constituting a substantial portion of Russia’s national income, this latest downturn could exacerbate existing economic challenges, leading to increased domestic pressure and further isolation on the international stage. As the world watches closely,the consequences of this latest financial blow will likely resonate far beyond Russia’s borders,shaping geopolitical strategies and economic policies in the months to come.For now, the Kremlin faces a critical juncture, balancing immediate economic instability with long-term strategic interests amidst an uncertain global landscape.