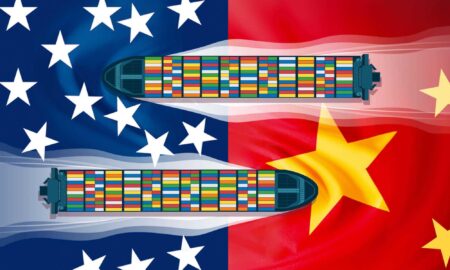

In a‚Äč landscape ‚ÄĆwhere cross-border ‚Ā§investments are‚Äć a‚ĀĘ cornerstone of economic partnerships, Canada has emerged as a significant player in‚ÄĆ the U.S. real estate ‚ĀĘmarket, holding billions in‚ĀĘ properties across various states. However, recent political tensions and ‚Ā£inflammatory rhetoric from former President Donald Trump have ‚Ā§raised alarms about‚Äč the vulnerability of these Canadian investments. As Trump intensifies his criticisms‚Äć of foreign ownership in America, concerns mount over the potential‚Äč ramifications for Canadian stakeholders ‚ĀĘand the broader implications ‚Ā£for U.S.-Canada‚Äć economic relations. This article delves into the intricate web of‚Ā§ Canadian investments in American real estate and the precarious position they now‚Äč find themselves in amidst a shifting political climate.

Canada’s ‚ĀĘMassive ‚Ā§Investment in ‚ÄĆUS Real Estate Faces Uncertain Future Amid Political Tensions

In‚Äć recent years, Canadian investors have made substantial strides ‚Äčin the U.S. real‚Äč estate market,‚Ā£ channeling billions into‚Ā§ properties across various sectors, ‚Ā§including ‚ÄĆcommercial,‚ÄĆ residential, ‚Ā§and industrial. This ‚Äčinflux‚Ā§ reflects Canada’s desire to‚Äć diversify its investment ‚Ā£portfolio and‚Ā§ capitalize on perceived‚ÄĆ opportunities in a robust market. However, ‚ÄĆthe geopolitical ‚Äčlandscape ‚ÄĆhas shifted dramatically‚Äč with rising ‚Ā§political tensions, notably amid election rhetoric ‚ÄĆfrom U.S. political figures. The‚Ā§ threat of protectionist ‚Äćpolicies ‚ÄĆand potential tariffs looms large, raising alarm bells for Canadian ‚ÄĆstakeholders. Key‚Äć concerns ‚ĀĘinclude:

- Changes in Trade Policies: ‚ĀĘ Proposed tariffs could increase costs for Canadian ‚Äćreal ‚ÄĆestate investors.

- Political Uncertainty: campaigns laden‚ĀĘ with anti-foreign sentiments might result in backlash against‚Ā§ foreign ‚Ā£ownership.

- Market Volatility: Unrest‚Ā£ tied to political ‚Äćdevelopments could undermine ‚ĀĘproperty ‚Ā§values‚Äč significantly.

As the market reacts to these‚Ā§ shifting dynamics, Canadian investors are reevaluating‚ĀĘ their ‚Ā§strategies. The apprehension‚Äč is particularly palpable in major markets such as New York, Los Angeles, ‚ÄĆand‚Äč Miami, ‚ĀĘwhere competition is‚ĀĘ fierce and ‚Äčstakes are‚Ā§ high. Investors ‚Äćare engaging ‚ÄĆin contingency planning to mitigate potential fallout. A recent study highlighted the following investment sentiments‚ÄĆ among Canadian stakeholders:

| Investor ‚ÄčConcerns | Percentage ‚ÄćExpressing Concern |

|---|---|

| Policy‚ÄĆ Changes Impacting investments | 72% |

| Market Instability | 68% |

| Regulatory Changes | 65% |

Implications of Trump‚Äôs Policy Shifts on ‚ĀĘCross-Border‚Ā£ Real Estate Investments

The recent ‚Ā§shifts in policies under ‚ÄćTrump have cast‚Äć a shadow over ‚Äčcross-border‚Äč real ‚Ā£estate investments, particularly ‚Ā£concerning Canadian assets in ‚Ā£the U.S. As the ‚Ā§former‚ĀĘ President‚Ā£ reiterates‚Ā£ protectionist‚Ā£ stances and immigration‚ÄĆ restrictions, the investment landscape becomes increasingly ‚Äčprecarious. Key‚ÄĆ considerations ‚ÄĆfor investors include:

- increased‚Äć Tariffs and Costs: New tariffs ‚ĀĘon construction ‚ÄĆmaterials may escalate project costs‚ĀĘ for Canadian investors involved ‚ÄĆin U.S. real estate.

- Uncertainty in Immigration Policies: Stricter‚Ā§ immigration rules could deter ‚Äćskilled ‚Äčlabor‚Ā£ from entering the U.S., impacting the timely progress ‚Äćof progress projects.

- Regulatory changes: Trump’s administration may‚ĀĘ push for significant regulatory alterations, possibly ‚Äćaffecting property ‚Ā£rights and enforcement.

Moreover, shifting‚Ā§ market sentiments could lead to volatility in property valuations.Investors may ‚ÄĆface higher risks‚ÄĆ associated with ‚ĀĘfluctuating demand driven by policy ‚Ā§changes or economic indicators influenced by political rhetoric. A snapshot‚Äč of potential impacts can be observed in the following table:

| Impact Factor | Potential Effect |

|---|---|

| Market Confidence | Reduced foreign investment ‚ĀĘwillingness |

| Regulatory Changes | Increased ‚ĀĘcompliance costs |

| Economic Policies | Shifts in property demand and‚Äć pricing |

Strategies for Canadian Investors to safeguard Assets in a ‚Ā§Volatile Market

As tensions rise and ‚ĀĘuncertainty looms, Canadian investors‚Ā§ must stay ‚Ā£vigilant in protecting their assets,‚Äč especially in the realm ‚Äćof U.S.real estate.‚Ā§ A diversified investment strategy‚ĀĘ can act‚ÄĆ as a buffer against ‚Ā£market fluctuations.Investors are encouraged to consider the‚ÄĆ following‚Äč approaches ‚ĀĘto‚Ā§ mitigate risks:

- Geographic Diversification: Expanding investments beyond the U.S. into other international markets ‚Ā£can reduce‚Ā£ exposure to american ‚Ā§political volatility.

- Asset‚Äč Allocation: Emphasize a balanced portfolio‚Äč that includes stocks, bonds, and‚Äč option investments, allowing for greater movement during market changes.

- Regular Portfolio Review: Assessing and adjusting ‚ÄĆinvestments periodically can help align ‚ĀĘthem with‚ĀĘ emerging market conditions and personal financial goals.

- Consider REITs: Real Estate investment Trusts can provide ‚Äćexposure to real estate without the ‚Ā£direct risks associated‚ĀĘ with physical properties, ‚Ā§helping‚ĀĘ to‚ÄĆ stabilize returns.

Moreover,understanding the regulatory landscape ‚Ā§is essential,especially if cross-border investments ‚Ā§become more complex. Investors should stay‚Ā§ informed about potential changes‚ĀĘ in U.S. policies that could ‚ÄĆimpact their holdings. Engaging with financial advisors ‚ÄĆwho specialize ‚Äćin international‚ĀĘ real estate can provide ‚Ā£insights necessary for informed decision-making. to facilitate this, a‚ĀĘ simplified table of key considerations can enhance clarity:

| strategy | Description |

|---|---|

| Geographic ‚ÄĆDiversification | Invest in various global markets to‚ĀĘ reduce exposure. |

| Asset Allocation | balance investments‚ÄĆ across‚ĀĘ different asset classes. |

| Regular Review | Adjust portfolio according to market shifts. |

| Invest in ‚ÄćREITs | Gain real estate exposure through ‚Ā£shares, mitigating ‚Ā§risks of direct ownership. |

Insights and Conclusions

Canada‚Äôs ‚Äćsignificant ‚ĀĘinvestments in‚ÄĆ U.S.‚Äč real estate represent not‚ĀĘ only‚Äć a strategic financial interest but also a testament to the ‚Ā£complex interdependence of the two economies. Though, the potential ramifications of political tensions, ‚Ā£particularly threats from former President Trump regarding ‚ĀĘtrade ‚Äčand economic policies, pose considerable risks to ‚ĀĘthese holdings. ‚ÄĆAs ‚Ā§both countries navigate ‚Äća landscape ‚Äćmarked by uncertainty and potential conflict, stakeholders on both sides of the border will need to‚ÄĆ carefully consider the ‚Ā§implications ‚ĀĘof these developments.The outcome‚Äč of ‚Ā§this political volley could have lasting‚Ā£ effects, not just ‚Ā§for the ‚ÄĆCanadian investors involved, ‚ĀĘbut ‚ÄĆfor the broader real estate market and economic relations between the two nations. As‚Äć always, investors should remain vigilant and informed, as shifts in the political climate could dictate the future of transnational investments.