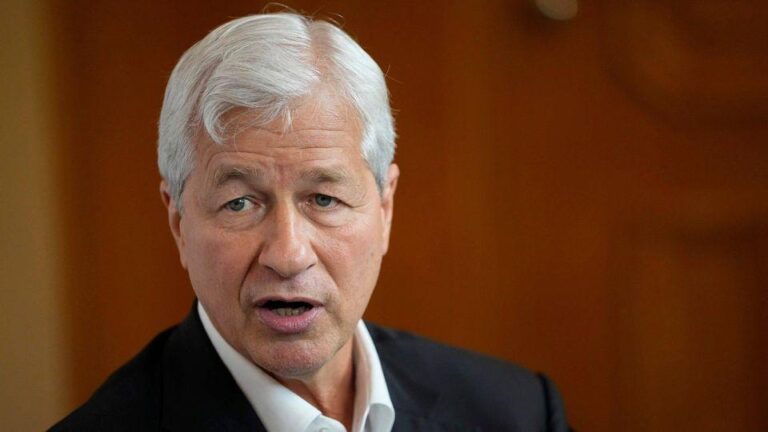

In a striking endorsementŌüż of the Ōüżglobal economic Ōüżlandscape, JPMorgan Chase CEO Jamie Dimon has provided former President Donald Trump with strategic insights amid growing concerns overŌĆī aŌĆŗ potential recession in the united States. HighlightingŌüŻ the resilience and opportunities in emerging markets, including countries like India, DimonŌüŻ emphasized theŌüŻ importance of diversifying economicŌüż engagement beyondŌĆŗ conventional partners. His comments come Ōüóat ŌüŻa crucial time when many economists are soundingŌĆī alarms about signs ofŌĆŹ economic slowdown in Ōüóthe U.S., urging policymakers to consider the dynamic growth ŌüŻpotentialŌüŻ in other regions. This article delves ŌĆīintoŌüż DimonŌĆÖs viewpoint, the implications for ŌüóU.S. economic policy, and the burgeoning role of countries such as India in shaping ŌĆīa more interconnected global economy.

JPMorgan CEOŌüó Emphasizes Diversification ŌĆŹin Global Economic StrategiesŌĆŗ for the US

The CEO of JPMorgan has recently underscored theŌüż significance of diversification in formulating global economic strategies, particularly in the context of potential challenges the US economy may face. Speaking to a wider audience, the executive pointed to emerging markets such as India as critical partners in new economicŌĆŗ ventures.By encouragingŌüó collaboration across borders, organizations can mitigate risks Ōüżassociated with market fluctuations ŌĆŗandŌĆī geopolitical uncertainties. Diversification not only facilitates ŌĆŹaccess to a broader consumer base but also enhances resilience ŌüŻagainst economic downturns.

During discussions,the CEO recommended a multi-faceted approach that includes investing in innovative sectors and formingŌüó strategic alliances. Some key areas highlightedŌĆŗ were:

- Technology and Digital Transformation: Embracing cutting-edge advancements to stay competitive.

- Renewable ŌĆīEnergy: Focusing on lasting practices and partnerships for long-term growth.

- Healthcare Initiatives: Investing in health-related sectors to address ŌüŻglobal needs.

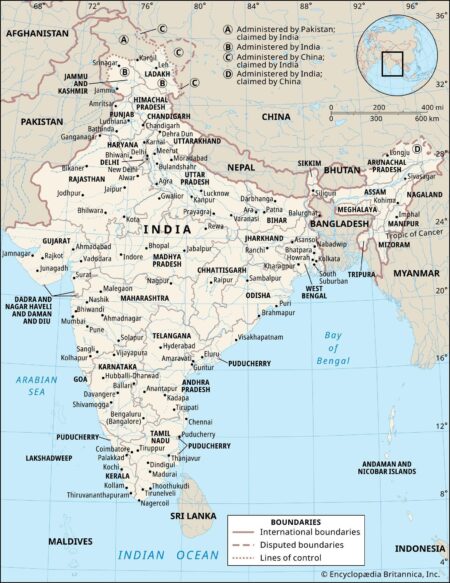

TheseŌĆŹ strategies reflect a Ōüócommitment toŌĆŹ not just navigate through potential recessions, butŌĆī to thrive amidst uncertainty. ByŌüó looking eastward and fostering Ōüżrelationships ŌĆŹwith nations likeŌĆī India,US businesses can leverageŌüó untapped markets and ŌĆŗinnovative capabilitiesŌüż that ŌĆīdriveŌĆŗ economic growth.

Implications of a potentialŌĆī US Recession on Emerging Markets like ŌüŻIndia

The potential for aŌüó recession in the ŌĆŹUnited ŌĆīStates raises meaningful concerns for emerging markets, particularlyŌüż for economies like India. ŌĆŹas the worldŌĆÖs largest economy enters a potential downturn, developing nations could face increased volatility in capital flows, ŌĆŹprimarily driven Ōüóby ŌĆŗshifts in investor ŌĆŗsentiment. With investors gravitating towards safer assets, countries ŌĆŗlike India may experience a reduction in foreign directŌĆī investment (FDI) and portfolio inflows, leading to currency depreciation and higher external debt servicing costs. The implications couldŌüż further strain domestic consumption and investment, ŌĆŹhampering growth prospects in theŌĆŹ short term.

Moreover,the interconnectednessŌüż ofŌĆŗ global trade means that a slowdown in the U.S.ŌüŻ could Ōüóadversely impact Indian exports, particularly ŌĆŗin sectors like textiles, data technology, and pharmaceuticals. Reduced ŌüżdemandŌüŻ from American consumers would not only affect revenue for Indian exporters but could alsoŌĆŹ lead Ōüżto job losses in key industries. In facing this potential challenge,Ōüż Indian policymakers may ŌĆīneed to implement strategic measures, such as:

- Boosting domestic consumption: Encouraging local spending to hedgeŌüó against falling exports.

- Diversifying trade partners: Strengthening ties with other emerging markets to reduce reliance on ŌüŻthe U.S.

- Enhancing ŌĆŗinfrastructure: Investing in infrastructure to attract investment even in a slow global economy.

Building Resilience: RecommendationsŌüŻ for Strengthening Economic Ties with Global Partners

In aŌĆŹ rapidly evolving global landscape, ŌüŻfostering robust economic relationships with international partners is pivotalŌüŻ for nations seeking to enhance their resilience against ŌĆŹuncertainties.A strategic approach involves leveraging ŌĆŹthe strengths of emerging ŌĆīmarkets, such as India, to establish mutually beneficial connections. By focusing on sectors that ŌüóofferŌĆī significant growth potential, countries can mitigate risks associated with economic ŌüŻdownturns. Key ŌĆŗareas of collaboration should include:

- Technology Transfer: Encouraging innovation throughŌĆī shared knowledge and resources.

- Trade Agreements: NegotiatingŌüż favorable terms that open up new markets.

- Investment in Infrastructure: ŌĆŹCollaborating in ŌĆŹprojects thatŌüż enhance connectivity and Ōüżefficiency.

Additionally, nationsŌĆī can benefit Ōüżfrom ŌĆŹestablishing diverse supply chains that are less susceptible to Ōüóglobal disruptions. By diversifying imports and ŌĆŹexports acrossŌüŻ various regions, countries may minimize the impact of geopolitical tensions and economic Ōüóshocks.A focused approach on key trading partners can Ōüóyield significant benefits.Ōüż The following table outlines essential trading partners and their significance:

| Country | SectorŌüó of Importance | Potential Growth Areas |

|---|---|---|

| india | Information Technology | Artificial Intelligence, Cybersecurity |

| Germany | Manufacturing | Automation, RenewableŌĆī Energy |

| Brazil | Agriculture | Sustainable Farming, Biofuels |

Wrapping Up

JPMorgan ŌĆŹCEO Jamie Dimon’s insights serve as a critical reminderŌüŻ ofŌĆŹ the complex interplay betweenŌüŻ global markets and local Ōüżeconomies.His advice to former President Donald Trump highlights the need for U.S. ŌüżpolicymakersŌüż to focus on fostering relationships with emerging economies like India, particularly in the face of potential recessionary pressures. As dim economicŌüŻ forecasts loom, ŌĆŹthe emphasis on ŌĆīcollaboration and mutual growth becomes increasingly vital. ŌüóWithŌüż global interdependence at an all-time high, DimonŌĆÖs perspective Ōüżnot only underscores theŌĆŹ potential for economic resilience but also the importance of forward-thinking strategies in navigating uncertain times.As the financial landscape evolves, ŌüŻthe world ŌĆīwill ŌüŻbeŌüó watching how U.S.leaders respond to these challenges andŌĆŗ opportunities on the international stage.