LIBRA Memecoin Scandal: Argentina ‚Ā§approves Official Inquiry

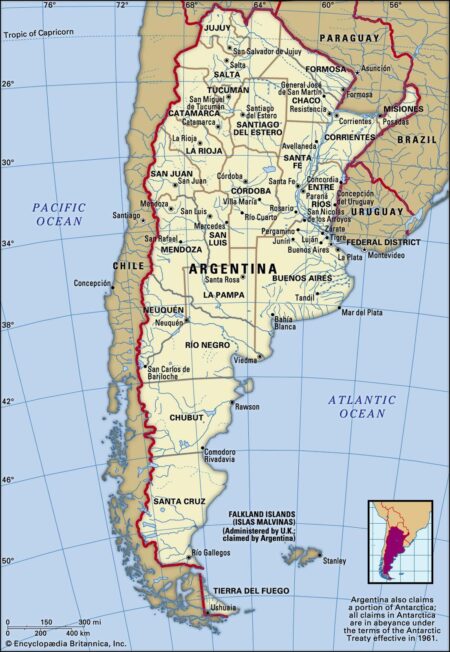

In‚Äč a significant advancement in the‚Ā§ world ‚Ā£of cryptocurrency,‚ÄĆ the Argentine‚ÄĆ government has ‚ĀĘofficially launched an inquiry into the controversial‚Ā§ LIBRA memecoin scandal,‚ÄĆ a matter‚Äć that has‚Äć ignited‚Ā§ debates over regulatory practices‚Äć and consumer protection‚ĀĘ within the digital ‚ĀĘcurrency sphere. As the value of ‚Ā£LIBRA spiraled amidst allegations‚Ā§ of fraud and mismanagement, authorities have ‚Äćexpressed concerns about the‚Äć potential ‚Äčimpact on investors and the ‚Äćbroader crypto ‚Ā§ecosystem.This announcement comes as ‚Ā£Argentina grapples wiht its‚Ā§ own‚Äć economic challenges, raising questions about the role of emerging digital assets in a ‚Ā£nation struggling with‚ÄĆ inflation ‚Äćand financial instability. The inquiry‚Ā§ aims to shed light ‚Ā§on‚ÄĆ the ‚Äčinner workings ‚Ā§of‚ĀĘ the‚Äć LIBRA token, its ‚ÄĆcreators, ‚Äčand the implications of its meteoric rise and fall, as investors ‚ÄĆand analysts alike‚Ā§ await the ‚ÄĆfindings that could reshape the future of cryptocurrency regulation in the‚Ā§ country.

LIBRA Memecoin‚Äč Scandal Triggers Official Inquiry in Argentina

the recent scandal involving the LIBRA ‚ĀĘmemecoin has escalated to new heights, prompting the ‚Ā£Argentine government ‚ÄĆto launch an official inquiry into the matter. This decision stems from allegations of fraud, ‚Äćmarket manipulation,‚Ā§ and the ‚Ā§potential impact on investors who may have suffered‚Äć significant losses.The inquiry ‚Ā§aims to investigate the activities surrounding the‚ÄĆ token’s launch and‚Äč its subsequent rise in ‚Äčpopularity, raising‚Ā§ concerns about regulatory compliance and consumer protection in the rapidly‚Ā§ evolving world of cryptocurrencies.

Authorities are also looking ‚Ā§into the role of‚ĀĘ various stakeholders, including developers, exchanges, ‚Äćand marketing teams involved in the ‚ĀĘLIBRA‚ĀĘ project. Key points of focus in this investigation include:

- Token Distribution: Analyzing how LIBRA tokens were distributed and marketed to potential investors.

- Price Volatility: Examining price spikes and crashes‚ĀĘ that may indicate manipulation or insider trading.

- Investor Protection: Assessing the measures taken to ‚Ā§safeguard ‚ÄĆinvestors against ‚Äćfraudulent activities.

Considering‚Äć the‚Äć inquiry, the Argentine government is expected to‚Äć establish a task force comprising financial experts and legal advisors to ensure a thorough investigation.‚ÄĆ This initiative may set a precedent for‚Äć how similar cases are handled‚Ā§ not only in argentina but across the cryptocurrency globe‚Äć as regulatory bodies grapple with the growing influence of digital currencies.

Regulatory Scrutiny of Cryptocurrency:‚Ā£ implications for Investors

The recent approval‚Äć of ‚ĀĘan‚Ā§ official inquiry into the LIBRA memecoin‚ĀĘ scandal by the Argentine government has intensified the regulatory scrutiny surrounding ‚Ā§the cryptocurrency market. This escalating‚Äč investigation is primarily focused on the potential impacts of such‚Äć digital currencies on consumer protection and market integrity. As authorities ‚ÄĆdelve deeper, investors ‚Äčmay face new challenges as ‚Äćregulatory frameworks evolve to‚Äč address these risks. Key implications for investors include:

- Increased ‚ÄćCompliance Costs: Companies may ‚ĀĘneed to allocate significant resources to meet new compliance‚Ā£ requirements, affecting their ‚ÄĆoperational efficiency.

- Market Volatility: Periodic regulatory announcements can‚Ā£ lead to unpredictable market movements, impacting investment decisions.

- Investor Protection: Stricter‚Ā£ regulations could enhance security protocols, potentially ‚Ā£safeguarding investors ‚ĀĘfrom fraud.

Moreover, ‚Äćas argentina’s inquiry‚ĀĘ unfolds, it sets a‚ÄĆ precedent for other nations grappling with the‚ÄĆ challenges posed by cryptocurrencies. Investors ‚Ā§must stay‚ÄĆ informed about‚Äć the shifting‚ĀĘ landscape and consider the following factors before making decisions:

| Factor | Impact on ‚ÄćInvestors |

|---|---|

| Regulatory ‚ÄčClarity | Could ‚Äčimprove long-term‚ÄĆ stability. |

| Legal Risks | Potential legal‚Äč ramifications for non-compliance. |

| Innovation and Adaptability | encourages ‚Äćadaptation to new ‚Ā§technologies and practices. |

Recommendations for Safeguarding ‚Ā£Against Future Crypto Scandals

As‚Äć the ‚ÄčLIBRA memecoin scandal unravels, it‚Ā§ is crucial ‚ĀĘfor both regulators and‚Ā§ investors to adopt a proactive‚Äč approach ‚ÄĆto mitigate ‚ĀĘthe risk ‚Äćof ‚Äčsimilar‚ĀĘ incidents in the future. First and foremost, enhancing regulatory frameworks is essential. Authorities should consider implementing‚ÄĆ stricter compliance measures for crypto projects,including extensive background checks‚Äč for founders and key team members. ‚ÄćThis can definitely help ensure that‚ĀĘ those‚Äč behind‚ÄĆ the digital assets are held accountable and are operating within the law. Furthermore, ‚Äčincreased transparency‚Äć is vital; platforms ‚Ā§should ‚ÄĆpublish ‚Ā£regular audits and‚Ā£ financial ‚ÄĆreports to provide clearer insights into‚Äč their ‚Äćoperations.

Along with regulatory measures, education plays a key role in‚Äć safeguarding the public. Investors‚Äć need ‚Äčto‚ÄĆ be empowered with the ‚Ā§knowledge to make informed‚ĀĘ decisions regarding cryptocurrencies.‚ĀĘ Initiatives ‚ĀĘsuch as community workshops, online webinars, ‚Ā£and comprehensive guides can definitely help‚ĀĘ demystify the complexities of the crypto ‚Ā§world. Moreover, fostering a culture‚Äć of skepticism and ‚ĀĘcritical thinking towards ‚Ā£potential investment opportunities can reduce the susceptibility to scams. By prioritizing these strategies, the industry can work towards a safer and more reliable‚Ā£ crypto environment.

To Conclude

the‚Äč LIBRA Memecoin scandal has not only‚Äč raised serious questions regarding regulatory oversight in the rapidly evolving cryptocurrency landscape but‚Ā£ also highlighted the ‚Äćneed for greater transparency in digital ‚Äčasset transactions.‚Äč With Argentina’s decision to launch an official inquiry, the implications‚ĀĘ of this scandal could‚ÄĆ extend far beyond its‚ÄĆ borders, influencing global perceptions of memecoins and their role ‚Äćin the financial system. as authorities delve deeper ‚Äćinto the allegations, both investors‚Äč and ‚ÄĆindustry stakeholders will ‚Ā£be ‚ĀĘwatching closely, eager to‚ĀĘ see how this situation unfolds and what measures may be implemented to safeguard the integrity of ‚Ā£the crypto market. As the story develops, The crypto Times‚ĀĘ remains committed ‚Äćto‚ÄĆ providing ‚ÄĆtimely updates‚Äč and in-depth analysis on this significant event, which is sure to have ‚Äćlasting effects‚Ā§ on the world of ‚Ā§digital currencies.