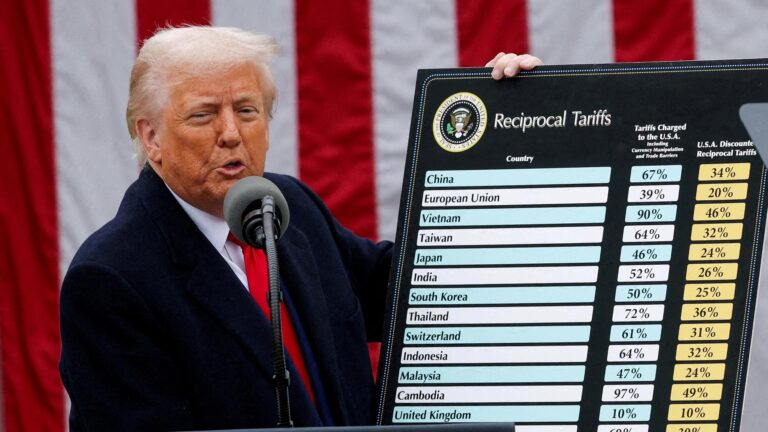

In a notable escalation ‚Äčof trade tensions,‚Ā§ the Trump ‚Ā§administration’s ‚Ā§reciprocal tariffs alongside additional ‚Äčlevies ‚ÄĆon China officially took effect this‚Ā§ week, reshaping the landscape of international commerce. ‚Ā§As both nations grapple with the implications of thes ‚Ā£financial measures, businesses and consumers alike face‚ĀĘ uncertainty in an already volatile ‚ÄĆeconomic‚Ā£ environment.The tariffs, ‚ÄĆaimed primarily at counteracting what the‚Äć U.S. deems unfair trade ‚Äćpractices, have sparked widespread concern over potential retaliation‚Äč from China and ‚Ā§the broader ramifications ‚Äćfor global‚Ā£ supply chains. ‚ÄčThis article will delve into the ‚Äćdetails of‚Äč the newly‚Ā£ imposed tariffs, their anticipated impact on the U.S. economy, and‚Ā§ the‚Ā§ potential consequences for the ongoing ‚Ā§trade relationship between‚Äč the two ‚Ā£economic powerhouses.

Impact of Trump’s Reciprocal ‚ÄćTariffs on U.S. Economy and‚ÄĆ Trade‚Äč Relations

The implementation of ‚Ā£reciprocal ‚Ā£tariffs under the Trump ‚Äčadministration has provoked a ‚Äćsignificant‚Ā£ shift in trade‚Ā§ dynamics that reverberates ‚Ā£through the U.S. economy. As ‚Ā£various goods face increased duties, ‚ÄćAmerican industries are grappling with both ‚Ā£opportunities and challenges.Organizations ‚Ā£that rely on imported materials are ‚ÄĆexperiencing heightened‚ĀĘ costs, which often lead to‚Ā§ increased prices for consumers. The long-term effects include:

- Cautious Consumer Spending: With higher prices on imported ‚Ā£goods, consumers may ‚ÄĆreduce ‚ĀĘtheir purchases, impacting overall economic growth.

- Modification of supply Chains: U.S.businesses are‚Äć now re-evaluating their ‚ĀĘsourcing strategies, leading to potential relocations of manufacturing hubs.

- Inflationary‚ÄĆ Pressure: As businesses adjust to tariffs,‚ĀĘ the cost of living may rise, further affecting purchasing power.

Simultaneously occurring,‚Äč trade relations with ‚ÄĆChina have become increasingly strained, sparking retaliatory measures that threaten longstanding partnerships.‚Äč The escalated trade conflict has repercussions beyond tariffs, influencing bilateral‚Äć investments and collaborative ventures. ‚ÄĆkey repercussions include:

| Effect | Details |

|---|---|

| Decrease in‚Ā£ Exports | U.S. ‚Äčagriculture and manufacturing‚Äč sectors ‚Äčreport declines in ‚ÄĆexports‚Äć to China. |

| Shift in Market Dynamics | U.S. companies‚Ā£ are exploring ‚ÄĆnew markets in Southeast Asia and Europe as alternatives. |

| Innovation and Competitiveness | Increased‚Äč pressure could drive U.S. firms to innovate and boost domestic production. |

Analyzing the Consequences of‚ĀĘ Additional China Levies on American‚Ā§ Consumers

the recent implementation of additional levies‚Ā§ on Chinese imports‚Äč is‚ĀĘ poised to reshape‚Ā§ the landscape of ‚ÄćAmerican consumerism. With tariffs applied to‚Ā£ a wide range of goods, the direct ‚ĀĘimpact on shoppers is becoming‚Äć increasingly apparent. Consumer‚Äč products such as electronics,clothing,and ‚Ā§household items,which ‚Ā§previously offered competitive pricing,are expected to see price‚Ā£ hikes as manufacturers and retailers pass along increased costs.This ‚ÄĆshift could lead to a rise ‚ÄĆin overall‚Äć living ‚Ā§expenses for ‚Ā£American families, potentially straining household budgets already stretched by inflationary pressures.

In examining ‚Ā§the broader economic‚Äć effects, ‚Ā£it becomes‚ĀĘ critical to assess the potential implications for consumer behavior and shopping habits. Many consumers may shift towards budget-pleasant options‚ÄĆ or seek alternatives to‚ĀĘ affected products, ‚Ā£which could stimulate the growth of ‚Äćlocal and domestic markets. The repercussions could‚Äč also have ‚Äčlonger-lasting effects‚Äć on brand loyalty and‚Ā§ consumer ‚Ā§preferences. ‚Ā§As part ‚ÄĆof this‚Äč dynamic, ‚ĀĘkey considerations include:

- Shift in spending patterns: Consumers may prioritize essential goods over luxury items.

- Increased manufacturer‚Äč innovation: Companies may accelerate the‚ĀĘ development of ‚Ā§domestically-sourced products.

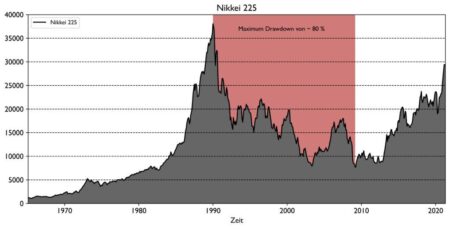

- Potential for ‚Ā§stock market fluctuations: ‚ĀĘRetail ‚Äčstocks ‚Äćmay be affected as consumer spending‚Ā§ alters in ‚Äčresponse to price‚Ā§ changes.

Strategic ‚ÄĆRecommendations‚Ā£ for Businesses navigating the New ‚Ā£Tariff ‚ÄčLandscape

In light of the evolving tariff landscape, businesses must adopt proactive strategies to mitigate risks ‚Ā£and capitalize on emerging‚Äć opportunities. One approach is to diversify supply‚ĀĘ chains beyond customary partners, especially if ‚Ā§reliant ‚ÄĆon regions‚ÄĆ heavily impacted by tariffs. this could involve exploring ‚Ā£alternative‚ÄĆ sourcing options in countries with favorable‚ĀĘ trade agreements or lower‚Ā£ tariff ‚ĀĘimplications. Additionally, companies should consider‚Ā£ leveraging technology‚Ā§ to ‚Äćenhance operational‚Äč efficiency, which can ‚ĀĘoffset increased costs through automation and optimization of logistics.

Moreover,firms are encouraged to engage in rigorous financial forecasting to gauge the potential‚ĀĘ impacts of tariff changes‚ÄĆ on‚ÄĆ their pricing strategies and profit margins. This includes conducting scenario‚ÄĆ analyses to better understand how shifts in tariffs could affect consumer behavior and‚Äć market dynamics.‚ĀĘ Collaboration ‚Äčwith trade experts and legal‚Ā§ advisors can also provide‚Äć invaluable insights into compliance and strategic positioning. Ultimately, a well-rounded‚ÄĆ strategic plan that incorporates‚Äć flexibility and agility could position businesses‚Ā§ favorably amidst ‚Ā£the uncertainties‚Ā£ of the new tariff regime.

the Conclusion

As the new round ‚Äčof reciprocal tariffs‚Äč and additional levies on Chinese goods comes into effect, businesses and consumers alike brace for the potential economic ‚ĀĘripple effects. While the Trump administration aims to address trade imbalances ‚ĀĘand protect domestic industries,‚Ā§ concerns linger ‚Ā£over the impact on inflation and‚ĀĘ global supply chains.As both nations navigate these heightened tensions, the long-term implications ‚Ā§for international trade‚Ā£ relations and economic‚Äć stability‚Äć remain to be‚Äč seen. With ongoing negotiations and a continuing ‚Äćdialog‚ĀĘ necessary for resolution, stakeholders will be closely ‚ÄĆmonitoring developments in the‚Äć coming months. As the landscape‚ÄĆ evolves, the‚Ā§ interplay between tariffs and trade ‚Äčpolicy will undoubtedly shape the broader ‚Äćeconomic‚ÄĆ narrative moving forward.