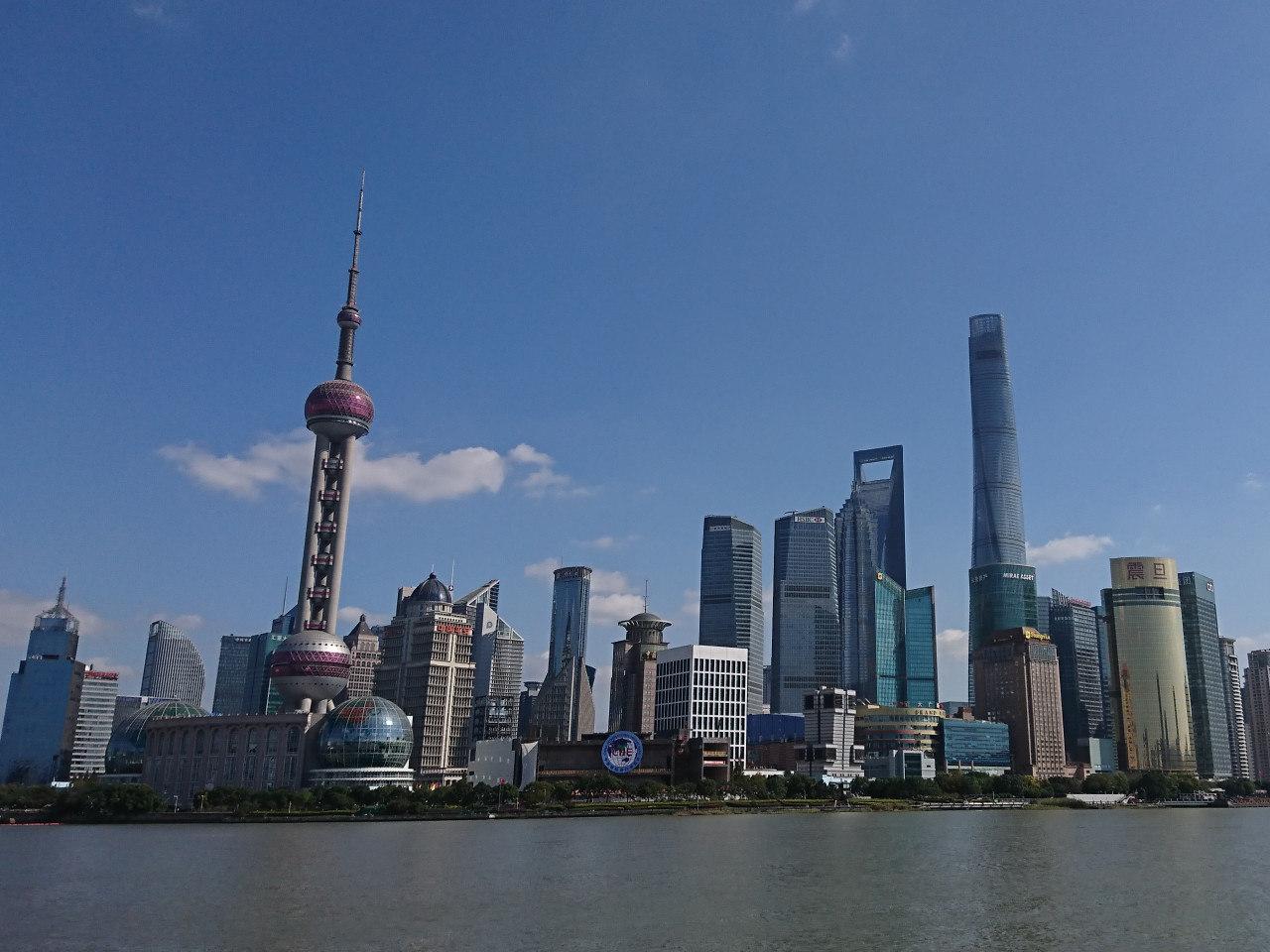

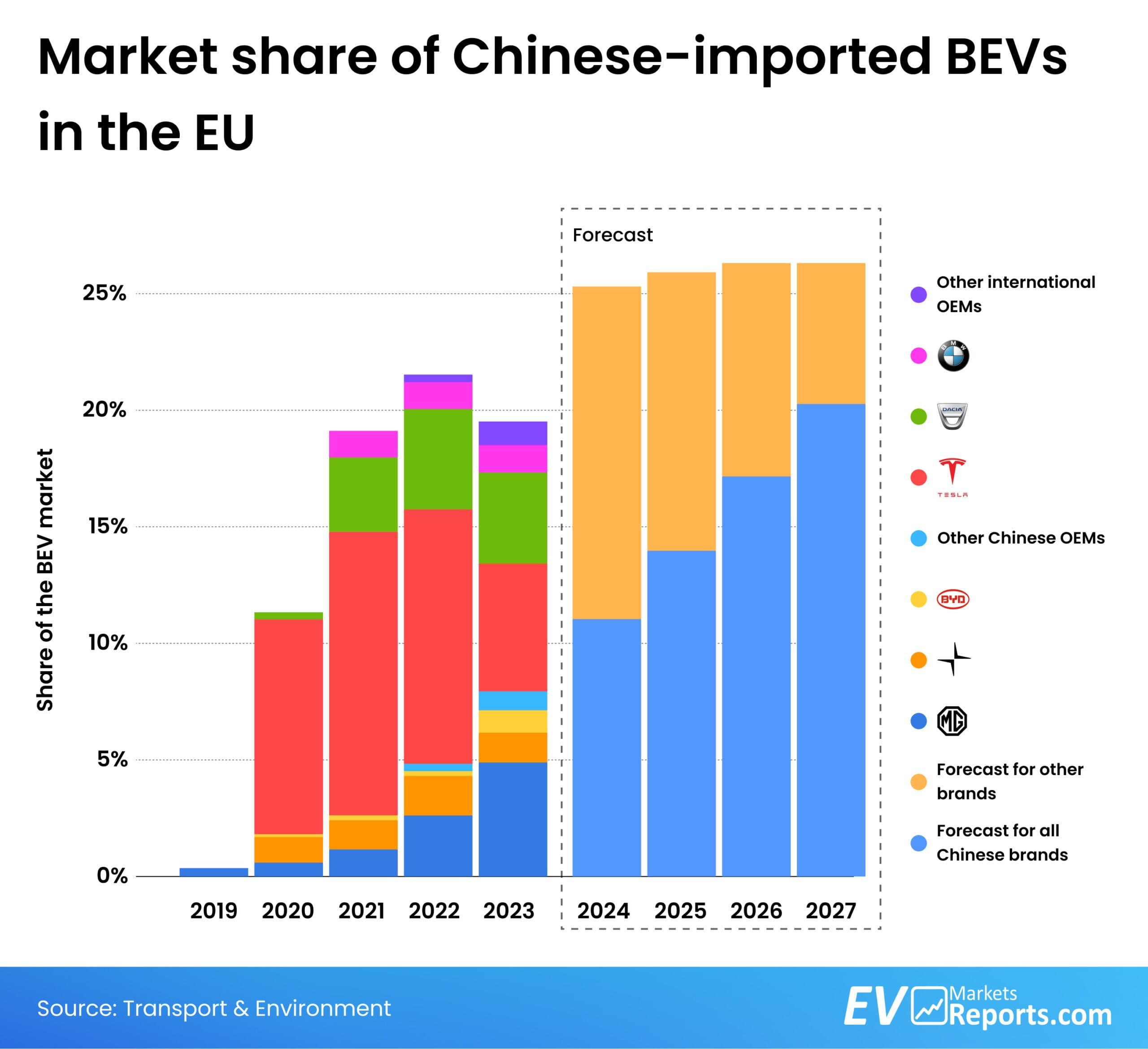

In a bid too navigate the increasingly complex landscape of global geopolitics,China has unveiled a comprehensive action plan aimed at stimulating foreign investment within its borders. As tensions rise between major world powers and economic uncertainty looms, this strategic initiative reflects China’s commitment to attracting international capital while simultaneously bolstering its economic resilience. With trade disputes, regulatory challenges, and concerns over supply chain security dominating the headlines, foreign investors are reassessing their positions in the world’s second-largest economy. This article delves into the key components of China’s latest action plan, the motivations behind it, and its potential implications for both domestic growth and foreign relations in an era marked by uncertainty.

Chinas Strategic Shift Toward Foreign Investment in a Volatile Global Landscape

In a notable pivot, China is actively seeking to attract foreign investment, counteracting negative sentiments fueled by rising geopolitical tensions. The Chinese goverment has initiated a series of reforms designed to create a more favorable environment for foreign businesses. Key strategies include:

- Streamlined regulatory processes to reduce bureaucratic hurdles for foreign investors.

- Incentives for high-tech sectors, notably in artificial intelligence, green energy, and healthcare.

- Improved legal protections for intellectual property rights to reassure potential partners.

This proactive approach is especially crucial as many global markets face instability. China’s action plan reflects an understanding of the shifting economic landscape and attempts to position itself as an attractive destination for capital. A recent comparison highlights the substantial investments in crucial industries:

| Sector | Investment Allocation (Billion USD) |

|---|---|

| Technology | 30 |

| Renewable Energy | 20 |

| Healthcare | 15 |

By focusing on these sectors, China is not only aiming to enhance its economic resilience but is also signaling to the world that it remains open for business, despite external challenges. This strategic shift could redefine the landscape of foreign direct investment, making China a potentially lucrative bastion amidst global uncertainties.

Key Components of Chinas Action Plan and Their Implications for Investors

The new action plan unveiled by China emphasizes a multi-faceted approach to attracting foreign investment, particularly in industries deemed strategically crucial. Key components of this initiative include:

- Enhanced Market Access: The plan aims to eliminate barriers for foreign companies in sectors such as technology, healthcare, and renewable energy.

- Tax Incentives and Subsidies: Financial incentives will be offered to foreign firms to encourage long-term commitments, fostering a more favorable investment climate.

- Strengthened Intellectual Property Protections: New measures are set to bolster protections for foreign patents and trademarks, addressing a long-standing concern among international investors.

These strategies not only signal China’s commitment to economic liberalization but also carry significant implications for investors. As the landscape shifts, companies looking to tap into the vast Chinese market will need to reassess their risk profiles and investment strategies. Furthermore, the action plan’s emphasis on strategic sectors may lead to a competitive environment, compelling firms to innovate and adapt quickly to remain viable. Understanding these dynamics will be crucial for stakeholders aiming to navigate the complexities of investing in China during a time of heightened geopolitical tensions.

Navigating Geopolitical Tensions: Opportunities and Challenges for Foreign Businesses

China’s recent action plan signifies a strategic pivot aimed at enhancing foreign investment during a period characterized by escalating geopolitical tensions. By implementing measures designed to foster a more conducive business environment,the government hopes to attract international firms which may otherwise hesitate due to rising uncertainties. Key elements of this action plan include:

- Incentives for investment: Offering tax benefits and subsidies to foreign companies.

- streamlined regulatory processes: Simplifying approval procedures for foreign business operations.

- Protection of intellectual property: Enforcing stronger IP laws to build trust and protect foreign innovations.

However, navigating this landscape presents distinct challenges for foreign businesses. The inherent unpredictability of geopolitical shifts can create a climate of hesitation, compelling companies to tread carefully as they weigh their options. Additionally, operational risks in supply chain management and local partnerships require meticulous attention. Consider the following factors:

| Prospect | challenge |

|---|---|

| Access to a vast consumer market | Market fluctuations due to trade policies |

| Government incentives for foreign investments | Local competition and market entry barriers |

| Strategic partnerships with local firms | Reliability of local partners amidst political changes |

Recommendations for Engaging with Chinas Evolving Market environment

To effectively navigate the shifting landscape of China’s market, foreign investors should adopt a proactive and adaptable approach.It is crucial to stay informed about governmental policies that directly affect investment opportunities. Engaging in regular dialogues with local stakeholders, such as business partners and regulatory bodies, can yield valuable insights. Companies should also consider establishing a local presence, which not only helps in understanding the market dynamics but also fosters trust and credibility among Chinese consumers and business entities.

Moreover, businesses should prioritize diversification of their investment portfolios to mitigate risks associated with geopolitical tensions. Consider focusing on sectors highlighted by the Chinese government, such as green technology, healthcare, and high-tech manufacturing, which are likely to receive favorable support and incentives. Additionally, leveraging data analytics to understand consumer behavior can enhance strategic decision-making. Below is a simple overview of key areas where investment potential lies:

| Investment Sector | Opportunities |

|---|---|

| Green Technology | Government incentives and growing demand for enduring solutions |

| Healthcare | Need for advanced medical equipment and services |

| High-tech Manufacturing | Support for innovation and technological advancement |

Wrapping Up

China’s newly unveiled action plan signals a strategic pivot aimed at reinvigorating foreign investment in a landscape marked by increasing geopolitical tensions. By implementing policies designed to ease restrictions,enhance transparency,and protect investor rights,Beijing is clearly seeking to placate international concerns and reassure global investors of its commitment to a stable business environment. As nations around the world navigate an increasingly fragmented economic landscape,China’s proactive approach may not only bolster its own growth but also serve as a critical touchpoint for international cooperation. Observers will be closely monitoring how these initiatives unfold and whether they can effectively bridge the existing divides,paving the way for a more integrated global economy amidst uncertainty.