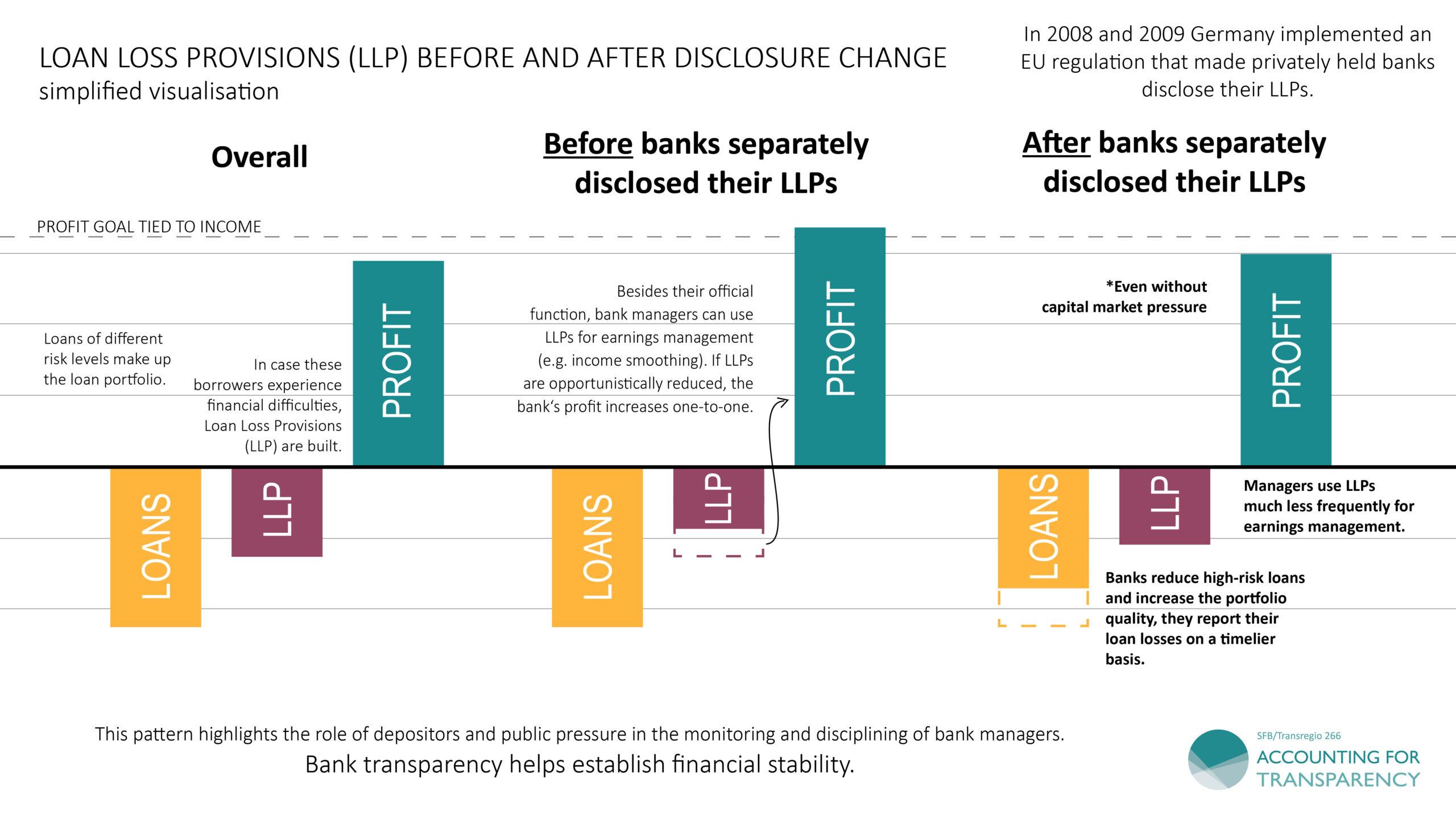

In a concerning turn of events, the German Central Bank has reported significant financial losses, raising alarms about the stability of Europe’s largest economy. This growth accentuates the growing economic uncertainties that have enveloped Germany in recent months, as external pressures and internal challenges converge.Analysts are now questioning the resilience of the German economy, which has long been admired for its robust manufacturing sector and export-driven growth. With inflationary pressures and shifting geopolitical dynamics at play, the implications of the central bank’s losses extend far beyond its own balance sheet, potentially signaling a broader economic downturn that could impact not only Germany but the entire eurozone. In this article, we delve into the factors contributing to these losses and explore what they mean for the future of Germany’s economic landscape.

Impact of German Central Bank Loss on National Economy

The recent loss reported by the German Central Bank could have profound implications for the national economy, suggesting a troubling horizon ahead. With a significant decrease in profits—primarily due to rising interest rates and geopolitical uncertainties—the bank’s financial stability is under scrutiny. This situation raises concerns about the possible ripple effects across various sectors, including investment, consumer spending, and foreign trade. Key concerns include:

- Reduced lending capacity, impacting businesses and homeowners

- increased borrowing costs affecting enterprise expansion

- Investor confidence potentially diminishing amidst greater economic instability

The potential fallout is not just confined to the financial sector; it may also extend to employment and economic growth. As businesses face tighter financial conditions, the likelihood of job cuts and hiring freezes increases, potentially leading to higher unemployment rates. Additionally, the overall GDP growth could stagnate, inhibiting Germany’s position as Europe’s economic powerhouse. Below is a summary of the anticipated economic indicators considering the central bank’s losses:

| Indicator | Current Status | Projected Impact |

|---|---|---|

| GDP Growth Rate | 1.5% | Possibly down to 1.0% |

| Unemployment Rate | 3.6% | Potential rise to 4.2% |

| Consumer Confidence Index | 95 | Forecasted decline to 90 |

Analysis of Contributing Factors Behind financial Decline

The recent losses reported by the German Central Bank are symptomatic of a deeper malaise affecting the nation’s economic landscape. Several interrelated factors contribute to this financial decline, reflecting both domestic and global challenges that have emerged in recent years. Key contributors include:

- Persistent Inflation: A sustained rise in prices has eroded purchasing power, dissuading consumer spending and investment.

- Supply Chain Disruptions: Ongoing global supply chain challenges have hindered production capacities, leading to shortages in critical sectors.

- Geopolitical Tensions: Regional instability has introduced uncertainties, affecting trade relationships and foreign investment inflows.

Furthermore, the structural issues within the economy exacerbate these problems. The transition to greener technologies and energy independence requires substantial investment and adjustment, placing strain on industries reliant on customary energy sources. To illustrate the evolving financial landscape, the following table outlines crucial economic indicators:

| Indicator | Current Value | Change (%) |

|---|---|---|

| Inflation Rate | 7.5% | +2.5 |

| Unemployment Rate | 5.2% | +0.3 |

| GDP Growth Rate | -1.0% | -0.5 |

Recommendations for Policy Adjustments and Economic Recovery

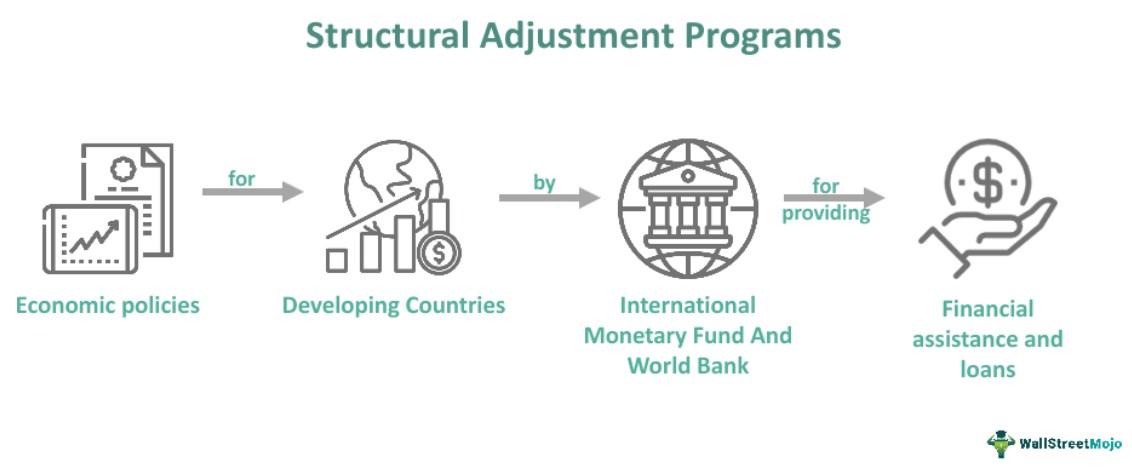

the recent losses reported by the German Central Bank highlight the urgent need for extensive policy adjustments to stabilize the nation’s economy. Considering these financial setbacks,it is essential for policymakers to prioritize measures that promote economic resilience and restore investor confidence. Key recommendations include:

- Enhancing Fiscal Stimulus: Increased public investment in infrastructure and technology can spur growth, creating jobs and strengthening domestic consumption.

- Facilitating Financial Support: Offering targeted financial assistance to struggling sectors, particularly small and medium-sized enterprises (SMEs), can help mitigate losses and sustain employment.

- Regulatory Reforms: Streamlining bureaucracy and reducing regulatory burdens can foster a more conducive surroundings for business growth and innovation.

- Collaborative Research Initiatives: Promoting partnerships between academic institutions and industries will encourage innovation and drive competitive advantage in global markets.

A coordinated approach is crucial to navigate the economic turmoil effectively. It is indeed also vital to reassess monetary policies to ensure they align with current economic realities. The following measures can be incorporated to support recovery:

| Policy Measure | Expected Outcome |

|---|---|

| Adjusting Interest Rates | encouraging borrowing and investment |

| Quantitative Easing | Increasing liquidity in markets |

| Exchange Rate Management | stabilizing the Euro |

| Debt Relief Programs | Alleviating fiscal pressure on households |

Outlook for germanys Financial Stability Amid Ongoing Challenges

Germany’s financial landscape is currently characterized by a complex interplay of factors that are undermining its long-standing economic stability. The recent disclosure of significant losses by the German central bank has raised alarms among economists and policymakers alike. As the country grapples with rising inflation, fluctuating interest rates, and external shocks such as the ongoing energy crisis and geopolitical tensions, the pressure mounts on financial institutions to maintain resilience. analysts are particularly concerned about the potential ripple effects that these losses could have on public confidence and consumer spending.

To fully comprehend the implications of these challenges on Germany’s financial stability, several key areas warrant attention:

- Inflationary Pressures: Sustained inflation has eroded purchasing power, affecting household consumption.

- Interest Rate Adjustments: As central banks worldwide adjust rates, Germany may face increased borrowing costs.

- Investment Challenges: uncertainty could deter foreign investments, crucial for a robust economic recovery.

- government Response: Timely and effective fiscal measures are essential to mitigate potential crises.

| factor | Impact Level | Potential Solutions |

|---|---|---|

| Inflation | High | Targeted fiscal support |

| Interest Rates | Medium | Monetary policy adjustments |

| Foreign Investment | Medium | Boost investor confidence |

| Government Fiscal Measures | High | Increased infrastructure spending |

Concluding Remarks

the mounting losses reported by the German Central Bank serve as a harbinger of the economic challenges facing Germany in the near future. As the nation grapples with rising inflation, energy crises, and a shifting global landscape, the financial health of its central institution underscores a broader narrative of economic fragility. Policymakers will need to navigate these turbulent waters with precision, balancing fiscal obligation against the urgent need for recovery. As the world’s fourth-largest economy confronts these multifaceted issues, the stakes are high—not only for Germany but for the entire European economic landscape. Continued monitoring of both domestic and international trends will be crucial as the implications of these losses unfold in the coming months.