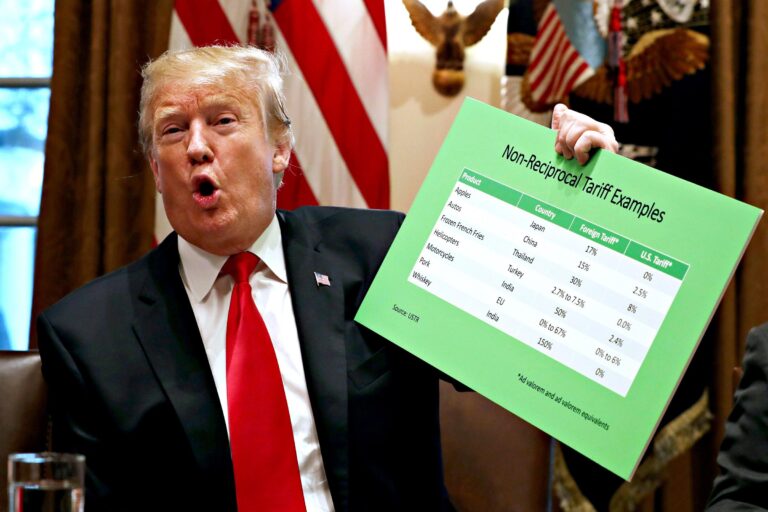

In a important escalation of trade tensions, former president Donald Trump announced that tariffs on Canadian adn Mexican goods are set to begin on march 4, alongside a planned increase in tariffs on Chinese imports. This growth has reignited discussions about the implications for North American trade relations and broader economic repercussions. As Trump positions himself once again in the political spotlight,his statements raise critical questions about the future of cross-border commerce and international trade dynamics.With stakeholders from various sectors closely monitoring the situation, the proclamation is poised to have far-reaching effects on industries reliant on these key markets. This article delves into the specifics of trump’s tariff proposal, its potential impacts on the economy, and the reactions it has provoked from government officials and business leaders alike.

Impact of Tariff Changes on North American Trade Relations

The recent announcement regarding tariffs on Canada and Mexico beginning March 4 poses significant implications for trade relations in North America. With tariffs on various goods,both countries might reassess their trade strategies,impacting industries ranging from automotive to agriculture. The uncertainty introduced by these changes could led to several potential outcomes:

- Increased Prices: Canadian and Mexican products may see a rise in prices,wich could affect American consumers.

- Tighter supply Chains: Companies reliant on cross-border trade may face disruptions, leading to adjustments in supply chain logistics.

- Negotiation Dynamics: The tariffs may prompt renegotiations in existing trade agreements to mitigate the impact.

Moreover, the increase on Chinese goods adds another layer of complexity. The interplay of these tariffs could not only strain U.S. relations with its North American neighbors but also lead to retaliatory measures from China. An analysis of possible reactions from trading partners reveals possibly escalated tensions:

| Country | Potential Response |

|---|---|

| Canada | Counter-tariffs on U.S. exports |

| Mexico | Increased tariffs on American goods |

| China | Further retaliatory tariffs |

Economic Ramifications of Increased Tariffs on China

The extension of tariffs on Chinese goods is poised to have significant repercussions for both the U.S. and global economies.As the U.S. seeks to protect its manufacturing sectors,the impact on consumer prices and international trade dynamics becomes more pronounced. Increased tariffs may lead to a rise in the cost of goods imported from China, affecting various industries, including electronics, textiles, and automotive parts. Consequently, businesses may face higher operational costs, potentially resulting in:

- Increased Consumer Prices: With higher tariffs passed on to consumers, everyday products may become more expensive, leading to reduced purchasing power.

- Supply Chain Disruptions: Companies reliant on Chinese imports could experience delays and increased complexity in their supply chains.

- Retaliatory Actions: Anticipated responses from China might lead to a trade war, further complicating the U.S.’s economic landscape.

The broader economic landscape may reflect not only immediate price changes but also long-term shifts in trade relationships. Small and medium-sized enterprises (SMEs), often more vulnerable to tariff impacts, might struggle to absorb costs or find alternatives to Chinese suppliers. This could lead to job losses in certain sectors while creating opportunities in others, as domestic manufacturing burgeons in response to reduced foreign dependence. Here’s a snapshot of potential effects on key sectors:

| Sector | Impact of Increased Tariffs |

|---|---|

| Electronics | Higher consumer costs; potential shifts to choice suppliers. |

| Textiles | Increased prices; possibility of moving production closer to home. |

| Automotive | Supply chain challenges; potential for increased domestic investments. |

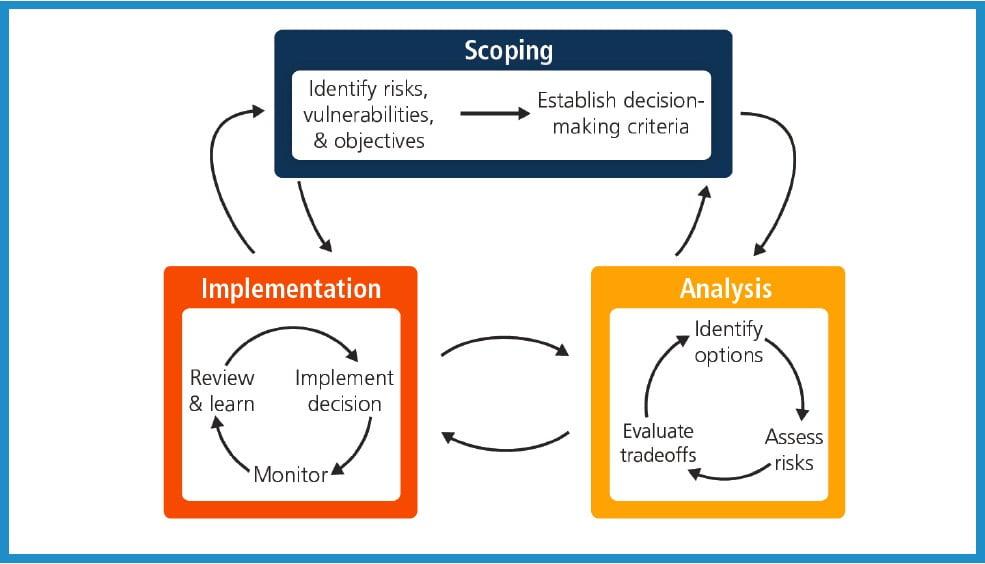

Strategies for Businesses to Adapt to New trade Policies

In light of the recent announcement regarding tariffs on Canadian, mexican, and Chinese goods, businesses must adopt proactive strategies to mitigate potential disruptions and capitalize on emerging opportunities. One approach is to diversify supply chains by finding alternative suppliers and manufacturers that are less affected by these tariffs. This could involve exploring local suppliers or those in countries not subject to the new duties. Additionally, companies should conduct a thorough analysis of their current product pricing structures to understand how increased costs from tariffs may impact their profit margins, adjusting pricing strategies accordingly while still remaining competitive.

Moreover, investing in technology and automation can enhance operational efficiency, helping businesses absorb some of the added costs associated with tariffs. offering training programs for employees to develop new skills related to efficient production processes or supply chain management can also prove beneficial. Companies should stay engaged with trade associations and government representatives to gather insights into upcoming regulatory changes and advocate for their interests. Networking with industry peers to share experiences and strategies can foster resilience and innovation in adapting to this shifting trade landscape.

Political Reactions and Implications for Future Trade Agreements

The announcement of tariffs on Canada and Mexico, along with increased measures against China, has initiated a wave of reactions across the political spectrum. Democratic leaders have voiced strong opposition, arguing that these tariffs could exacerbate economic tensions and hinder collaborative efforts in North America. They warn that retaliatory measures could lead to a trade war, negatively impacting American consumers and businesses. Conversely, Republican lawmakers have expressed support, viewing the tariffs as a necessary tool to protect U.S.industries from perceived unfair trading practices.This divide underscores the broader political implications for upcoming elections, where trade policy may become a pivotal issue for candidates.

The potential disruptions in trade agreements raise critical questions about the future of economic relations in the region. Several key points are emerging in discussions among policymakers and trade experts:

- Stability of Trade relationships: Analysts are concerned about the long-term impacts of this tariff strategy on NAFTA negotiations and the USMCA.

- Impact on American Consumers: Increased tariffs could lead to higher prices on everyday goods, sparking a backlash from voters.

- Global Trade Dynamics: The actions against China specifically may prompt other nations to reconsider their trade alignments, leading to shifts in global economic partnerships.

| Stakeholder | Reaction | Implication |

|---|---|---|

| Democrats | Oppose tariffs | Potential pushback in upcoming elections |

| Republicans | Support tariffs | Strengthening of party unity on trade |

| Business Leaders | Concern about economic impact | Calls for alternatives to tariff measures |

The Way Forward

President Trump’s announcement regarding the imposition of tariffs on imports from Canada and Mexico, set to take effect on March 4, alongside increased tariffs on Chinese goods, marks a significant escalation in the ongoing trade tensions among these key North American partners and China. The implications of these tariffs could reverberate across various sectors, potentially impacting consumers, businesses, and diplomatic relations. As stakeholders across the board assess the potential repercussions of these trade policies, it will be crucial to monitor how these decisions evolve and affect both domestic and international markets. The coming weeks will be pivotal in shaping the narrative of U.S.trade relations and the broader economic landscape. For continuous updates and analysis, stay tuned to The New York Times.