India’s Trade Landscape: A New Era of Exports and Imports

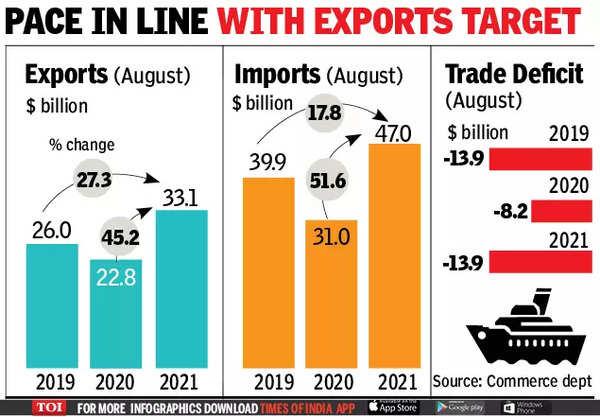

In a noteworthy shift in India’s trade landscape, recent statistics indicate that during the fiscal year 2024-25, exports to the United States and imports from China have reached record highs. This dual trend highlights the intricate and evolving nature of India’s global trade relationships.The U.S. has solidified its position as a primary market for Indian products, while china continues to be an essential source of imports. As global economic conditions evolve, experts are closely monitoring how these trends will shape India’s economic framework and its international partnerships. The latest data not only showcases the tenacity of Indian exporters in a competitive environment but also raises concerns regarding increasing dependence on Chinese goods amid ongoing geopolitical tensions.

Trade Surplus with the U.S.: Economic Strategy Implications

The significant trade surplus India is experiencing with the United States represents a pivotal change in its economic interactions, particularly as exports reach new heights. In 2024-25, India recorded unprecedented export figures to America across various sectors including technology, textiles, and pharmaceuticals. This upward trajectory reflects India’s strategic focus on enhancing trade relations with one of its largest partners—an approach that not only boosts export revenues but also provides a buffer against potential disruptions in global supply chains. Increased engagement with American markets positions India favorably for businesses seeking to diversify their sourcing strategies amidst geopolitical uncertainties.

On the flip side, while imports from China have similarly surged to historic levels—underscoring interdependence between these two Asian powerhouses—this situation prompts critical discussions about economic resilience and self-sufficiency. Policymakers face the challenge of balancing benefits derived from affordable Chinese products against nurturing domestic industries to reduce import reliance. Investments in key sectors such as innovation and infrastructure will be vital for effectively capitalizing on this burgeoning trade surplus.

Examining India’s Growing Dependence on Chinese Imports

The notable increase in imports from China has sparked conversations around potential vulnerabilities within India’s economy due to strategic dependence on foreign goods. In 2024-25 alone, import volumes soared dramatically; essential items like electronics, machinery, and raw materials predominantly came from Chinese suppliers. This growing dependency raises significant questions about India’s manufacturing capabilities and what long-term effects may arise from such an imbalanced trading relationship.

Experts caution that while these imports may satisfy immediate economic demands, they could hinder local industry growth over time and exacerbate existing trade deficits.

To address this rising dependency effectively, industry specialists advocate for policy reforms alongside increased investment into domestic manufacturing sectors aimed at reducing reliance on external sources.Strategies worth considering include:

- Pursuing local production incentives through subsidies.

- Cultivating stronger trading partnerships globally to diversify supply chains.

- Nurturing innovation within critical industries through technological advancements.

Navigating this complex landscape necessitates fostering self-reliance while enhancing internal capabilities—a crucial endeavor as India maneuvers through current geopolitical challenges without compromising national interests.

| Import Category | Total Value (in billions) – FY 2024-25 | |

|---|---|---|

| Electronics | $35 billion | |

| $28 billion | ||

| Raw Materials | $22 billion | |

| $15 billion |

| Sectors | total Export Value (USD Billion) | Total Import Value (USD Billion) / tr /> / head /> |

|---|---|---|

| Electronics | 20 | 40 |

| Pharmaceuticals | 15 | 10 |

| Textiles | 12 | 5 |