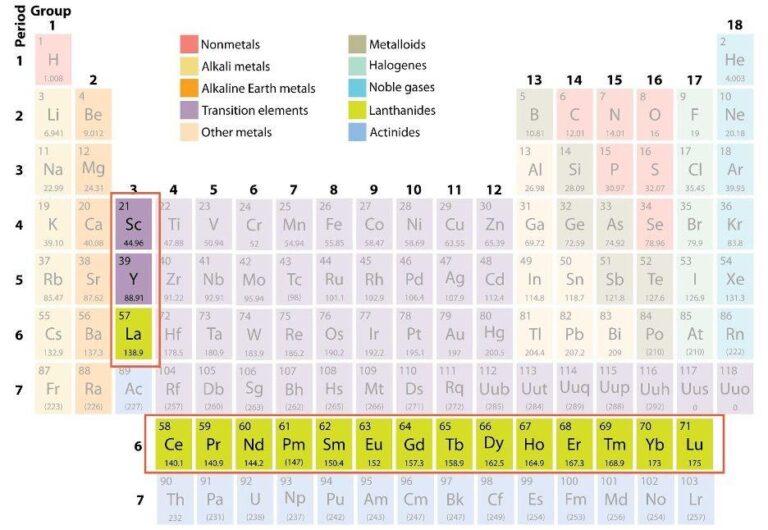

The Rising Significance of Rare Earth Elements in Modern Mining

In the fiercely competitive realm of global mining, rare earth elements (REEs) have emerged as essential components that drive contemporary technology, from smartphones to electric vehicles. Leading this thriving sector is Gina Rinehart, recognized as Australia’s wealthiest individual and a powerful presence in the mining industry. with an extraordinary investment portfolio valued at approximately $800 million, Rinehart’s ventures into rare earths are attracting considerable attention for their financial prospects and potential influence on future technological advancements. As the demand for sustainable energy solutions escalates, her strategic involvement in the rare earth market could reshape the relationship between wealth and innovation within Australia. This article explores how Rinehart’s initiatives illustrate the convergence of resource management,economic strength,and technological progress while highlighting the pivotal role of rare earths in today’s evolving global economy.

Gina Rinehart’s Vision in the Rare Earth Sector

Australia’s leading businesswoman has made waves with her enterprising entry into the rare earth sector, building a remarkable portfolio worth $800 million. This calculated investment aligns seamlessly with a worldwide transition towards renewable energy sources and cutting-edge technologies where REEs are indispensable. These materials are vital for manufacturing everything from electric vehicle batteries to advanced electronic devices; consequently, their demand has surged significantly—positioning her investments for substantial growth. experts suggest that given recent fluctuations in global supply chains driven by geopolitical tensions, her foresight not only enhances her personal wealth but also holds sway over market dynamics.

Rinehart’s investment strategy encompasses various companies involved in exploring and extracting rare earth materials while prioritizing sustainable practices and ethical sourcing methods. Key aspects of her approach include:

- Diversification: Spreading investments across multiple firms to reduce risk while maximizing potential returns.

- Sustainability Commitment: Focusing on eco-friendly practices to attract increasingly environmentally conscious consumers and investors.

- Market Insight: Keeping abreast of geopolitical developments that may affect supply chains and pricing structures.

Recent analyses indicate that Rinehart’s investments have already started yielding positive results as global demand continues to rise. With nations committing to decreasing fossil fuel dependency, the market for rare earth elements is set for explosive expansion—making her strategic positioning particularly astute.

The Global impact of Rare earth Market Dynamics

The landscape surrounding rare earth elements has undergone important changes recently, directly affecting international supply chains and economic strategies worldwide.As countries increasingly depend on advanced technologies, there has been a notable surge in demand for REEs across various sectors including electronics and renewable energy production. The interconnected nature of these supply chains means any variations in availability or pricing can trigger widespread repercussions globally. Several key factors contributing to this scenario include:

- Tensions Between Nations: Political instability within major production areas can disrupt supplies significantly.

- Tighter Environmental Regulations: Stricter policies may impact mining operations’ efficiency or output levels.

- Evolving Technologies: The growing need for REEs due to new technological innovations can alter existing demand patterns dramatically.

The substantial portfolio amassed by australia’s richest woman reflects increasing investor confidence within this sector—a concentration of wealth that underscores not just individual success but also highlights how strategically crucial REEs have become within our global economy. A comparative overview reveals Australia’s robust position against other nations regarding its annual production capabilities:

| Nation | Total Annual Production (metric tons) | % Share Globally |

|---|---|---|

| China | 140000 | 60% |

This data clearly illustrates Australia’s emerging significance within the realm of rare earths—establishing itself as an essential player amid fluctuating international markets. As demands continue escalating globally,countries must adeptly navigate vulnerabilities present within their supply chains if they wish to achieve sustained economic growth alongside environmental sustainability efforts moving forward.

Strategies for Investors Entering the Expanding Rare Earth Sector

Aiming at capitalizing on opportunities presented by this burgeoning industry requires investors adopt several strategic measures tailored specifically toward navigating its complexities effectively.

A deep understanding of market dynamics is paramount; engage actively with industry reports , attend pertinent conferences ,and seek partnerships with firms boasting robust supply chain infrastructures . Furthermore , evaluating geopolitical influences remains critical since many resources tied up involve specific nations which could sway overall availability . Given China ‘ s dominant status , it becomes imperative investors monitor shifts occurring around export regulations along with trade negotiations likely impacting prices internationally .

Additionally, diversifying one ‘ s portfolio will help mitigate risks associated directly linked back towards investing solely into rarer commodities themselves . Allocating funds across different segments such as extraction processes , recycling initiatives or innovative tech applications ensures protection against unpredictable fluctuations seen throughout these markets.

For instance companies focusing heavily upon sustainable extraction methodologies alongside cutting-edge recycling techniques stand poised well ahead aligning themselves closely towards future regulatory trends emerging rapidly today! Below follows swift reference table showcasing key players operating actively along respective focus areas worth considering :

Final Thoughts on Rare Earth Investments

The $800 million investment portfolio held by Australia’s leading businesswoman exemplifies not only how intertwined wealth intersects strategically through resource management but also emphasizes rising importance surrounding these minerals crucially shaping modern technology landscapes globally! As society pivots further toward greener alternatives coupled alongside sustainable energy solutions—the value attributed towards such essential resources continues climbing steadily upwards influencing both personal fortunes & entire economies alike! Observing rich stakeholders like Gina Rinehart positioning themselves firmly amidst this dynamic habitat suggests promising prospects lie ahead concerning Australia’s role influencing broader discussions revolving around critical resource supplies extending far beyond national borders too! Moving forward it becomes vital we remain vigilant observing developments unfolding impacting both marketplace conditions & geopolitics surrounding these invaluable assets!