In a recent announcement, former President Donald Trump renewed threats of tariffs on Indian pharmaceutical imports, marking a sudden shift that has negatively impacted Indian pharma stocks. Investors reacted swiftly, reversing the brief respite enjoyed by the sector.

Browsing: business news

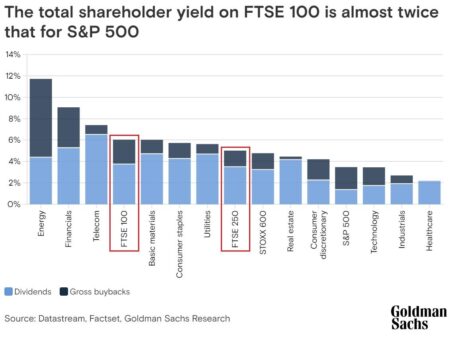

The UK’s FTSE 100 experienced its largest daily decline since the onset of the pandemic, driven by renewed concerns over Trump’s tariffs. Market analysts warn that the tariffs could disrupt global trade and economic recovery efforts.

In the wake of President Trump’s new tariffs, trade dynamics with China and Canada face significant shifts. Analysts predict potential retaliatory measures, which could disrupt supply chains and escalate tensions, impacting economies across multiple sectors.

Italy’s service sector growth waned in March, according to the latest PMI data released by Reuters. The index fell, reflecting sluggish demand and rising costs, raising concerns over the resilience of the economy amid ongoing challenges.

The upcoming 26% US tariffs on Indian goods are poised to impact domestic players significantly, according to top exporters’ bodies. This increase could dampen competitiveness in the global market, affecting trade dynamics between the two nations.

Australia and global markets reacted swiftly to Donald Trump’s US tariff plan, with concerns over potential trade wars igniting tensions. Experts warn that these tariffs could disrupt supply chains and impact economic growth worldwide, prompting calls for diplomatic negotiations.

China’s Luxshare Precision Industry is reportedly considering a potential listing on the Hong Kong Stock Exchange this year, according to sources. This move could enhance its funding capabilities amid the growing demand for electronic components globally.

UK shares climbed, buoyed by rising commodity prices and a resurgence in the construction sector. Analysts noted that robust demand in these areas signaled economic resilience, fostering investor confidence amid global uncertainties.

Toyota’s optimistic outlook during the Trump administration shifted dramatically as escalating tariff threats loomed over the auto industry. The potential financial impact raised concerns, prompting the company to reassess its U.S. production strategies.

UK stocks closed higher, signaling a positive end to the trading day. The Investing.com United Kingdom 100 index rose by 0.28%, reflecting investor optimism amid an evolving economic landscape. Key sectors showed robust performance, driving market gains.

Germany’s labor market shows signs of cooling, with recent data revealing a decrease in job vacancies and rising unemployment rates. Analysts warn that economic uncertainty may further impact employment stability. Observers will be watching closely for trends.

Bar Louie, the popular bar and eatery chain, has announced the closure of over a dozen locations as it seeks Chapter 11 bankruptcy protection. This move comes amid ongoing financial challenges that have impacted many restaurants nationwide.

Coca-Cola announced plans to invest over $1.4 billion in Argentina, aiming to enhance production and distribution capabilities. This strategic move underscores the company’s commitment to the region‚Äôs economic growth and job creation amidst challenging market conditions.

India is reportedly considering a significant reduction in tariffs on over half of its imports from the U.S. This move aims to bolster its export competitiveness amid ongoing trade tensions and is seen as a strategic effort to enhance bilateral economic ties.

Despite the pressures of Trump’s tariffs, India’s job market is experiencing a significant surge. Companies across sectors are ramping up hiring, driven by a resilient economy and the expansion of tech and service industries, showcasing India’s employment robustness.

The UK government is contemplating scrapping its £180 million trade system designed for post-Brexit customs checks. The potential move raises questions about efficiency and trade relations, as businesses face ongoing delays and complexities in the new regime.

Japan’s crude steel production declined for the 12th consecutive month in February, reflecting ongoing challenges in the global market. The downturn underscores concerns about demand in key sectors and highlights the nation’s struggle to stabilize its steel industry.

German manufacturers are ramping up production in anticipation of new tariffs from the Trump administration. This proactive measure is viewed as a ‚Äúpleasant surprise‚ÄĚ in the industry, reflecting resilience amid global trade tensions.

Italy has halted negotiations with SpaceX over a potential Starlink purchase, citing concerns linked to recent controversies involving Elon Musk. This move reflects increasing scrutiny of partnerships with tech firms amidst ongoing geopolitical tensions.

Germany’s Siemens announced plans to cut over 6,000 jobs worldwide, with approximately half of the reductions taking place in its home market. This organizational shift aims to enhance efficiency and respond to evolving market demands amid economic challenges.