USA Rare Earth stock soared dramatically after news broke that the Trump administration is set to stockpile essential metals. This development has sparked a wave of optimism among investors, who are eager about the prospects of heightened demand in light of persistent global supply chain challenges.

Browsing: commodities

Exciting news from Pacific Bay Minerals! The company has officially announced the resumption of trading for its highly anticipated Brazil Gold Property, following a significant update. Investors are on the edge of their seats, eagerly awaiting more details as Pacific Bay advances its exploration and development initiatives in this promising region.

Vale has announced a dip in iron ore production for the first quarter, primarily attributed to the heavy rains sweeping across Brazil that have hampered mining activities. This weather-related disruption poses significant challenges for the company as it strives to sustain its production levels. With these adverse conditions in play, concerns are mounting regarding future supply stability.

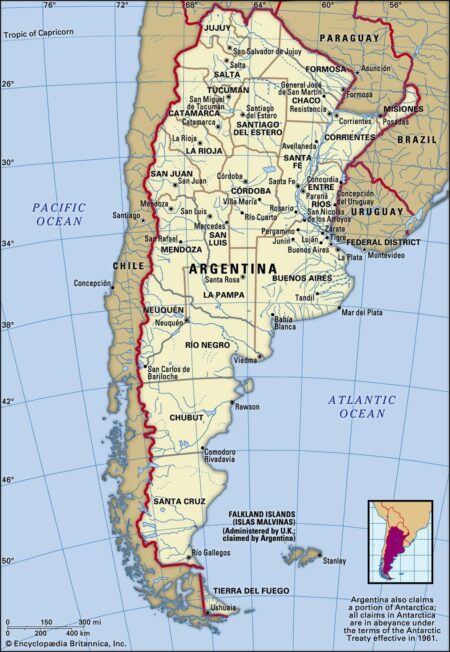

Argentina is poised for a record wheat harvest this season, bolstered by favorable weather and an increase in plantings. Experts suggest that extending cuts to export taxes could further enhance production and stimulate the economy, benefiting farmers nationwide.

Brazil’s booming offshore oil sector is becoming a crucial supplier for China’s energy needs. As Chinese firms invest heavily in Brazilian oil projects, the two nations strengthen their economic ties, reshaping global energy dynamics amidst rising demand.

Argentina’s state-controlled oil company YPF may face a decline in earnings as crude prices continue to drop. Analysts warn that the decrease in global oil prices could impact YPF’s profitability, raising concerns about its financial stability in the coming quarters.

Brazil’s Petrobras announced plans to resume operations at its Paraná fertilizer plant in June, aiming to boost domestic production. The move aligns with the company’s strategy to enhance Brazil’s agricultural sector amidst rising global fertilizer demands.

Brazil could emerge as a significant beneficiary of the U.S. tariffs on imports, economists suggest. As American companies seek alternative suppliers, Brazilian exports in agriculture and manufacturing may see a substantial boost.

Russia’s economy faces a severe crisis as oil prices plummeted by 31%, marking a significant blow to President Vladimir Putin’s financial stability. The sharp decline raises concerns about the nation’s fiscal resilience and potential implications for global markets.

UK shares climbed, buoyed by rising commodity prices and a resurgence in the construction sector. Analysts noted that robust demand in these areas signaled economic resilience, fostering investor confidence amid global uncertainties.

In a bold economic move, former President Donald Trump proposed a 25% tariff on countries that purchase oil and gas from Venezuela. The policy aims to pressure the Maduro regime while altering global energy dynamics amid ongoing sanctions.

Japan’s crude steel production declined for the 12th consecutive month in February, reflecting ongoing challenges in the global market. The downturn underscores concerns about demand in key sectors and highlights the nation’s struggle to stabilize its steel industry.

As global markets brace for shifts, tracking China’s economy and its commodity needs has become increasingly challenging. Analysts cite complexities in data accuracy and evolving consumption patterns that obscure insights vital for forecasting.

In a significant shift, China has halted its purchases of U.S. liquefied natural gas (LNG), impacting the global energy market. This move reflects rising tensions between the two nations, as China’s energy strategies evolve amidst ongoing geopolitical friction.

Oil prices remain steady as market participants monitor rising demand from China amid ongoing geopolitical tensions. This delicate balance between supply concerns and economic recovery signals a pivotal moment for energy markets.

Singapore Exchange (SGX) has announced a partnership with Brazil’s B3 to launch real futures in 2025. This collaboration aims to enhance trading opportunities and liquidity in the foreign exchange derivatives market, facilitating greater access for global investors.

Brazil’s coffee stockpiles are rapidly depleting, driving prices to unprecedented levels. With supply tensions rising amid climate challenges, the country’s pivotal role in the global coffee market is increasingly under pressure, impacting consumers worldwide.

Loma Negra (NYSE: LOMA) faces significant challenges in Argentina’s struggling cement market, marked by overcapacity and economic volatility. As demand dwindles, analysts predict further strain on profitability, raising concerns for investors and stakeholders.

Coffee prices are under pressure following forecasts of rain in Brazil, a key producer. Increased moisture could boost crop yields, leading to potential oversupply concerns. Traders are closely monitoring weather patterns that may impact global prices.

As the US trade war intensifies, China is set to increase food imports from Latin America and Europe. This strategic shift aims to diversify its supply sources and strengthen economic ties, signaling a significant change in global trade dynamics.