India’s foreign exchange reserves have surged to $676.3 billion, according to the central bank governor, reflecting a robust external position. This increase highlights the country’s resilience amid global economic uncertainties, bolstering confidence in the Indian economy.

Browsing: currency

Japan has no intention of leveraging U.S. Treasurys amid ongoing tariff discussions, reaffirming its commitment to stable financial markets. Officials emphasize the importance of cooperative trade relations while navigating complex economic challenges.

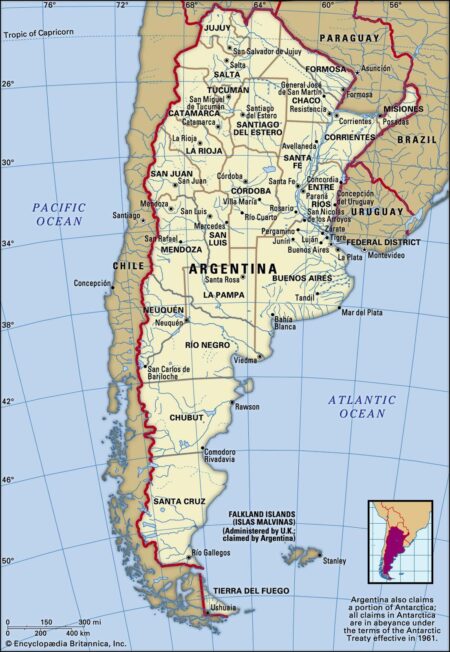

Argentina’s recent overhaul of its foreign exchange regime has sparked widespread speculation about the future of the peso. As the government aims to stabilize the currency amid soaring inflation, analysts are closely watching how these changes influence economic recovery.

In “Opinion | Argentina Needs the Dollar More Than Ever,” the Wall Street Journal explores the nation’s escalating economic crisis, highlighting the urgent need for dollarization. As inflation spirals, many Argentines seek stability through the U.S. currency.

A recent map reveals the extent of gold reserves stored by various countries in the United States, highlighting Germany’s consideration of repatriating its gold. As global economic concerns rise, this move sparks debate on the security and accessibility of national assets.

Germany is contemplating the withdrawal of its 1,200-ton gold reserves stored in the U.S., a move seen as a response to rising tensions during Donald Trump’s presidency. This potential action highlights ongoing concerns over international trust and economic security.

The yuan has emerged as a critical strategic barometer for China in the wake of tariff escalations. Analysts suggest that its fluctuations reflect broader economic resilience and shifting trade dynamics, influencing both domestic markets and global perceptions.

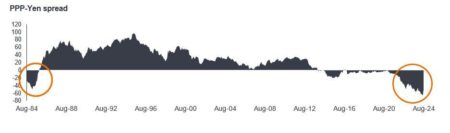

In a recent statement, a Japanese lawmaker highlighted concerns over the yen’s undervaluation, indicating potential measures to counter capital outflows. This move underscores the government’s intent to stabilize the currency and foster economic resilience amid global market fluctuations.

As the Federal Reserve prepares to announce its latest policy decision, analysts predict significant implications for the Indian rupee and bond markets. Investors will closely monitor Fed commentary for cues on interest rates and economic outlook, impacting currency stability.

Former Bank of Japan Governor Haruhiko Kuroda urged the government to address global perceptions that Japan is manipulating the yen. He emphasized that enhancing communication about monetary policy is crucial to dispel misunderstandings and maintain credibility.