The Bank of Canada has chosen to keep its interest rates steady as it carefully evaluates the effects of recent tariffs on the economy. This decision highlights the central bank’s commitment to striking a balance while addressing new economic hurdles.

Browsing: economic analysis

The Bank of Canada has decided to maintain its key interest rate at 2.75%, citing concerns that escalating trade tensions could lead to a potential recession. The decision reflects ongoing economic uncertainty amid global trade disputes.

Brazil could emerge as a significant beneficiary of the U.S. tariffs on imports, economists suggest. As American companies seek alternative suppliers, Brazilian exports in agriculture and manufacturing may see a substantial boost.

Japan’s real wages fell for the second consecutive month in February, signaling growing financial pressures on households as inflation continues to outpace earnings. This trend raises concerns over consumer spending and overall economic stability.

Spain is experiencing an economic boom, driven by a resurgence in tourism, robust exports, and increased foreign investment. As the country capitalizes on its diverse sectors, experts predict sustained growth, boosting employment and national confidence.

Germany’s labor market shows signs of cooling, with recent data revealing a decrease in job vacancies and rising unemployment rates. Analysts warn that economic uncertainty may further impact employment stability. Observers will be watching closely for trends.

The UK’s frozen fish market is projected to expand significantly, with volumes anticipated to reach 538,000 tons by 2035, according to IndexBox, Inc. This growth reflects rising consumer demand for convenient, sustainable seafood options.

Japan has issued a warning regarding the potential “significant impact” of impending U.S. tariffs on its economy. Officials express concerns over disrupted trade relations, which could affect sectors ranging from manufacturing to agriculture, emphasizing the need for dialogue.

In his latest piece, Terence Corcoran examines the absence of a comprehensive book detailing Mark Carney’s vision for Canada’s economic future. He critiques the lack of transparency and analysis surrounding Carney’s ambitious plans and their implications for the nation‚Äôs financial landscape.

U.S. farmers and ocean carriers warn of the nation’s unpreparedness in facing an economic war against China’s dominance in containership production. With China’s shipping capacity growing, concerns mount over the competitive strain on American industries.

Javier Milei‚Äôs economic policies in Argentina have garnered attention as a potential “inflation miracle,” but analysis indicates that outdated items in the inflation index may skew perceptions of economic recovery. As critics examine the data, the true impact remains uncertain.

UK wage growth remains stable at 5.9%, according to the latest Financial Times report. This consistent growth could signal resilience in the labor market, despite ongoing economic challenges and inflationary pressures affecting consumers.

In Bloomberg’s analysis, the decline in beer consumption in China serves as a barometer for broader economic challenges. As households tighten budgets, the shift in drinking habits reflects consumer confidence and signals potential lasting impacts on the economy.

Brazil’s central bank has raised interest rates to their highest level since 2016, signaling a cautious approach towards future hikes. With inflation concerns in mind, officials indicate that smaller increases may be on the horizon to balance economic growth and stability.

Moody’s has upgraded Argentina’s credit rating for the first time in five years, reflecting improved economic conditions and government reforms. Analysts view the move as a positive signal for investors, potentially fostering greater financial stability in the country.

In 2024, France’s beauty market is showing signs of sluggish growth, predominantly fueled by pharmacy sales. Premium beauty brands are navigating this challenging landscape, focusing on innovative formulations to attract health-conscious consumers amid shifting shopping behaviors.

The UK economy showed signs of stagnation in January, highlighting the growing challenges for Shadow Chancellor Rachel Reeves. This downturn raises critical questions about the government’s economic strategy and its impact on future growth.

The Bundesbank has acknowledged that increased German spending is justified in the current economic climate, yet it cautions that such measures alone will not resolve deeper structural issues. Experts urge a balanced approach to ensure sustainable growth.

Former RBI Deputy Governor has suggested that Trump’s tariffs on India could offer unexpected opportunities for local industries to strengthen and innovate. The measures, while challenging in the short term, may ultimately lead to greater self-reliance.

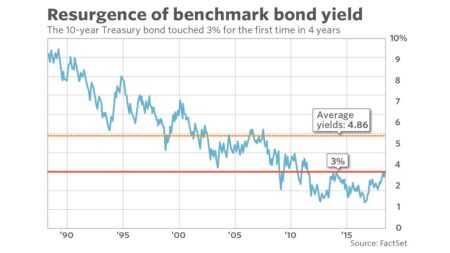

Germany’s recent spending plans have sparked concerns in global markets, leading to a decline in the 10-year Treasury note and the dollar. Analysts fear increased fiscal stimulus in Europe could draw investment away from U.S. assets, heightening volatility.