In a recent move, Trump has paused certain tariffs on imports from Mexico and Canada, impacting various goods. Exemptions primarily include critical materials for manufacturing. Analysts speculate on potential trade negotiations and future tariff adjustments.

Browsing: economic impact

Tesla experienced a significant downturn in German sales, plummeting 76% in February, according to Reuters. This sharp decline raises concerns about the company’s competitiveness in the European electric vehicle market amid increasing local competition.

As US-China trade tensions escalate, African nations find themselves at a crossroads. With both superpowers seeking influence, countries must navigate complex trade dynamics, potentially reshaping their economies and diplomatic relations in the process.

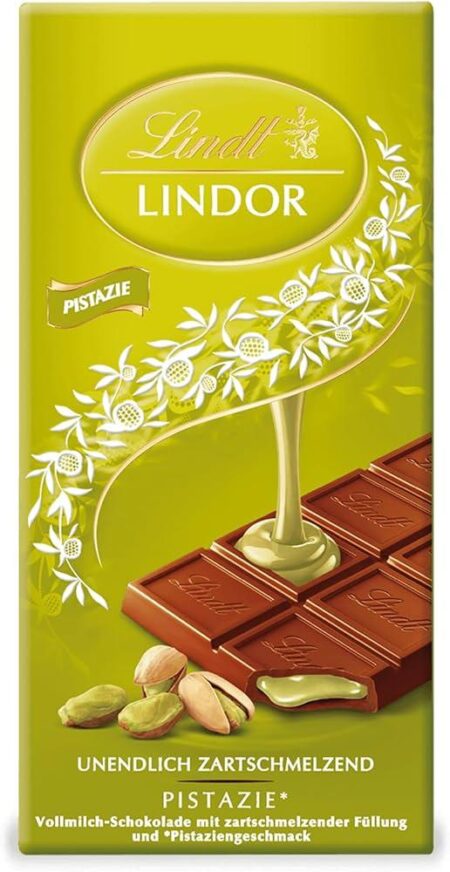

Lindt has announced plans to supply chocolate to Canada from Europe, aiming to avoid tariffs that increased costs for importing goods. This strategic move underscores the company’s efforts to maintain competitive pricing amid international trade challenges.

In a significant shift, key industry leaders express willingness to accept tariff reductions in negotiations with the US. This move is seen as a bid to enhance trade relations and stimulate economic growth, amid ongoing discussions to resolve trade tensions.

As U.S. tariffs on various imports take effect, Mexico, Canada, and China respond with retaliatory measures, targeting American goods. This escalation raises concerns over escalating trade tensions and potential impacts on the global economy.

In a bold economic move, President Trump has imposed tariffs on imports from Canada, China, and Mexico, igniting a trade war that analysts warn could escalate tensions and lead to significant price hikes for consumers across various sectors.

Tesla’s sales in Germany plummeted 76% amid Elon Musk’s controversial political campaigning efforts. The sharp decline raises questions about the impact of Musk’s distractions on the automaker’s performance in key European markets.

China has implemented a ban on imports of Illumina’s gene sequencing machines, shortly after the U.S. reinstated tariffs on certain products. This move highlights escalating tensions between the two nations in the field of biotechnology and trade.

Trump’s tariffs have ignited a wave of anger and retaliation among trading partners, fueling market unease. As nations respond with their own tariffs, analysts warn of potential disruptions in global trade and the economic ramifications that could follow.

Global stock markets took a hit as President Trump announced new tariffs on Canada, Mexico, and China, escalating trade tensions and raising concerns about potential economic repercussions. Investors reacted swiftly, driving down major indices.

Spain has reopened the investigation into the death of Mango tycoon Isak Andic, sparking renewed interest in the circumstances surrounding his passing. Authorities aim to clarify unresolved questions that have lingered since his unexpected demise.

In response to potential tariffs under the Trump administration, Sony and Suntory are proactively building stockpiles in the US. This strategic move aims to mitigate supply chain disruptions and ensure continued access to the American market amidst rising trade tensions.

In light of recent statements by Lutnick, speculation is mounting around a potential tariff deal between Canada and Mexico. Market analysts will keenly monitor financial markets for reactions, particularly in sectors heavily reliant on cross-border trade.

Javier Milei’s recent visit to Washington underscores his commitment to promoting freer trade between the U.S. and Argentina. Such a shift could enhance economic ties, boost exports, and foster investment, potentially benefiting both nations’ economies.

The Associated Press reports that Trump’s tariffs on Mexico, Canada, and China target a range of goods, including agricultural products, electronics, and vehicles. This trade policy aims to bolster domestic industries but risks escalating tensions and consumer prices.

In a significant move, President Trump has announced a 10% increase in tariffs on Chinese imports, escalating trade tensions between the two countries. This strategy aims to protect U.S. industries but may further complicate global supply chains and consumer prices.

The Canadian dollar and Mexican peso hit one-month lows as U.S. tariffs on imports exerted downward pressure on both currencies. Analysts warn that ongoing trade tensions could further destabilize the exchange rates in the near term.

Russia’s recent seizures of assets serve as a stark reminder to Western firms considering a return amidst easing tensions. Analysts warn that reliance on political shifts, like a potential Trump-inspired approach, could lead to significant risks in volatile markets.

Argentina’s crypto scandal has cast a shadow over Presidential candidate Javier Milei, featuring an unusual blend of characters from the crypto world. As investigations unfold, the implications for Milei’s campaign and the broader economic landscape remain uncertain.