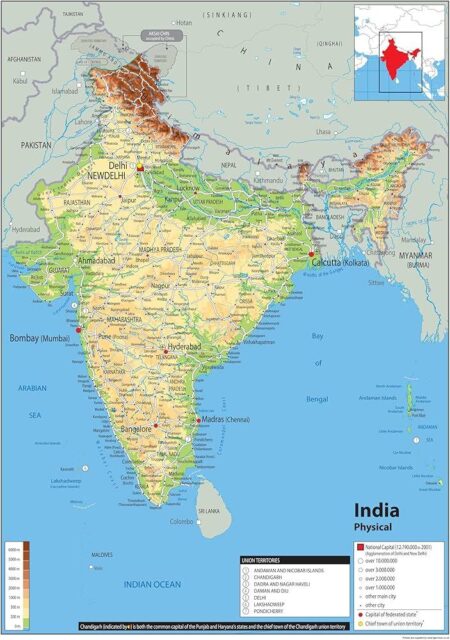

In a surprising turn of events, India’s inflation rate plummeted to an impressive 3.34% in March, far surpassing analysts’ predictions. This notable drop could potentially reshape economic policies as decision-makers evaluate its effects on consumer spending and overall growth.

Browsing: economic indicators

Inflation in Canada eased to 2.3% in March, largely due to a decline in gas prices, according to recent data. This marks a slight improvement, offering some relief to consumers as the cost of living remains a key concern nationwide.

India’s foreign exchange reserves have surged to $676.3 billion, according to the central bank governor, reflecting a robust external position. This increase highlights the country’s resilience amid global economic uncertainties, bolstering confidence in the Indian economy.

A recent Reuters poll indicates that Canada’s growing recession risk could prompt the Bank of Canada to implement at least two additional interest rate cuts this year. Economic concerns are mounting as policymakers seek to stabilize the slowing economy.

India’s industrial output fell to a six-month low in February, raising concerns over economic momentum. Contraction in manufacturing and electricity sectors has contributed to the decline, signaling potential challenges ahead for growth prospects.

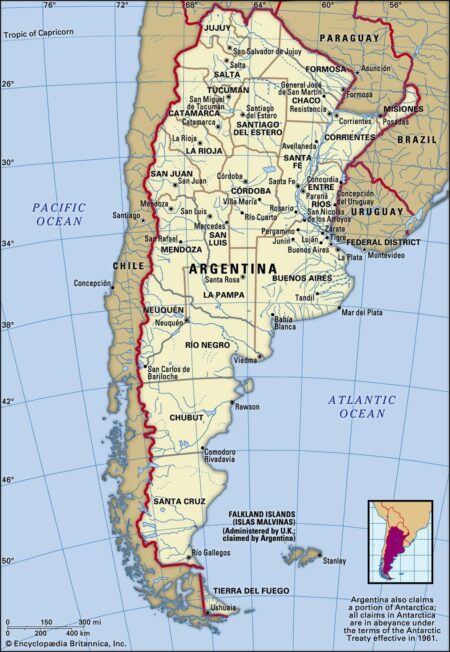

Argentina’s state-controlled oil company YPF may face a decline in earnings as crude prices continue to drop. Analysts warn that the decrease in global oil prices could impact YPF’s profitability, raising concerns about its financial stability in the coming quarters.

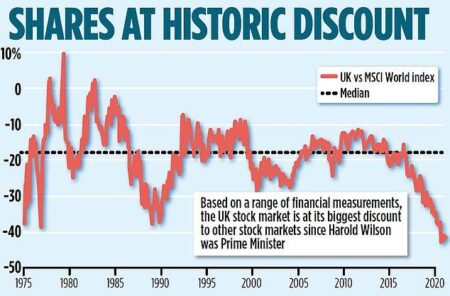

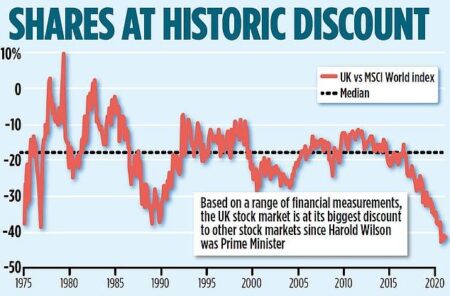

U.K. shares closed higher as investor sentiment rallied, with the Investing.com United Kingdom 100 index rising 3.30%. Strong performance in key sectors bolstered the market, reflecting positive economic outlook amid ongoing recovery efforts.

U.K. stocks fell sharply at the close of trading today, with the Investing.com United Kingdom 100 index down 4.56%. Investors reacted to ongoing economic uncertainties, leading to widespread declines across key sectors.

A recent central bank survey reveals that more Canadian firms anticipate a potential recession within the next year. Concerns over economic stability are rising, with business leaders increasingly wary of inflation and interest rate impacts on growth.

U.K. stocks closed in the red on Thursday, with the Investing.com United Kingdom 100 index dropping 4.99%. Investors reacted to mixed economic signals and ongoing geopolitical tensions, prompting a cautious trading environment across major sectors.

U.K. stocks finished lower as trading closed, with the Investing.com United Kingdom 100 index declining by 0.34%. Economic uncertainties continue to weigh on investor sentiment, reflecting a cautious outlook in the markets.

Spain’s private sector growth has shown signs of moderation, according to a recent TradingView report. Economic uncertainties and rising costs are impacting businesses, leading to a slowdown in expansion efforts across various industries.

Italy’s service sector growth waned in March, according to the latest PMI data released by Reuters. The index fell, reflecting sluggish demand and rising costs, raising concerns over the resilience of the economy amid ongoing challenges.

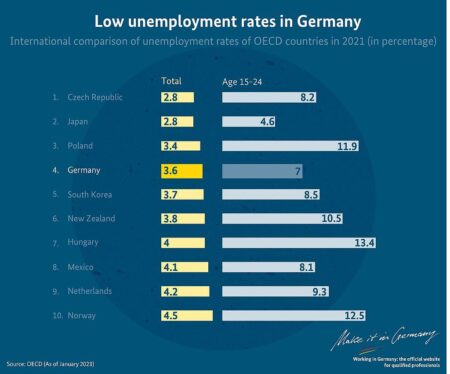

Germany’s unemployment rate rose to 6.3% in March, marking a notable increase as economic challenges persist. Analysts point to factors such as shifts in the labor market and ongoing economic pressures as contributing elements to this uptick.

The unemployment rate in the UK has seen significant fluctuations between 2000 and 2025. According to Statista, the period highlights economic cycles influenced by events such as the 2008 financial crisis and the COVID-19 pandemic, shaping workforce dynamics.

U.K. inflation fell to 2.8% in February, offering a temporary reprieve for consumers and policymakers. However, analysts warn that factors such as rising energy costs and supply chain disruptions could drive prices up again shortly.

Japan’s crude steel production declined for the 12th consecutive month in February, reflecting ongoing challenges in the global market. The downturn underscores concerns about demand in key sectors and highlights the nation’s struggle to stabilize its steel industry.

China’s GDP forecast has been upgraded as the economy shows robust growth from a strong start to the year and increased capital investments. Despite ongoing trade tensions and tariffs, confidence in China’s economic resilience continues to strengthen.

Javier Milei’s economic policies in Argentina have garnered attention as a potential “inflation miracle,” but analysis indicates that outdated items in the inflation index may skew perceptions of economic recovery. As critics examine the data, the true impact remains uncertain.

Argentina’s inflation rate is projected to increase marginally in February, according to a Reuters poll. Analysts anticipate ongoing economic challenges will contribute to persistent price rises, keeping inflationary pressures at the forefront of national concerns.