Analysts at Desjardins predict a modest decline in the Bank of Canada’s interest rate. This careful strategy highlights the persistent economic hurdles we face, all while striving to uphold stability within our financial system.

Browsing: economic outlook

The Bank of Canada has decided to maintain its key interest rate at 2.75%, citing concerns that escalating trade tensions could lead to a potential recession. The decision reflects ongoing economic uncertainty amid global trade disputes.

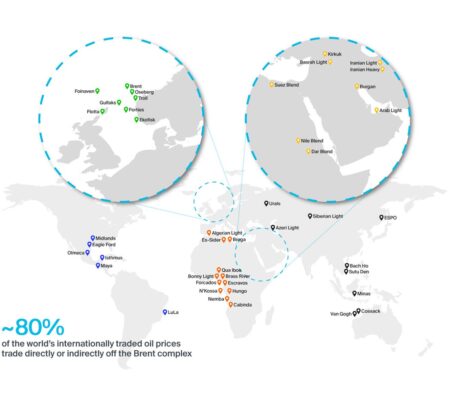

The U.S. Energy Information Administration (EIA) has revised its Brent oil price forecast for 2025 and 2026, signaling a more cautious outlook amid fluctuating global demand and production challenges. This adjustment reflects ongoing volatility in the energy market.

A recent Reuters poll indicates that Canada’s growing recession risk could prompt the Bank of Canada to implement at least two additional interest rate cuts this year. Economic concerns are mounting as policymakers seek to stabilize the slowing economy.

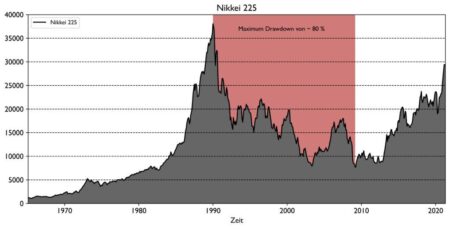

Japan’s Nikkei index fell significantly as escalating trade war concerns and a strengthening yen dampened investor sentiment. Market analysts highlight the negative impact of ongoing U.S.-China tensions on Japanese exports and economic stability.

The UK’s lubricating oil additive market is projected to experience steady growth, reaching 21,000 tons and valued at $121 million by 2035, according to a report by IndexBox. The forecast signals strong demand driven by automotive and industrial sectors.

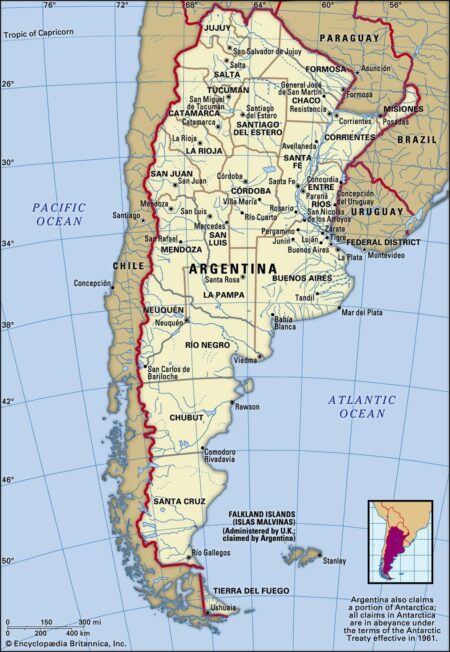

Argentina’s state-controlled oil company YPF may face a decline in earnings as crude prices continue to drop. Analysts warn that the decrease in global oil prices could impact YPF’s profitability, raising concerns about its financial stability in the coming quarters.

In a recent roundtable discussion, Japan’s Sovereign Socially Responsible Allocators (SSAs) expressed concerns over rising geopolitical tensions and fluctuating tariffs. Experts highlighted the need for strategic adaptations to navigate this volatile landscape and safeguard investments.

Brazil’s Petrobras announced plans to resume operations at its Paran√° fertilizer plant in June, aiming to boost domestic production. The move aligns with the company’s strategy to enhance Brazil’s agricultural sector amidst rising global fertilizer demands.

In a recent statement, JPMorgan CEO Jamie Dimon advised former President Trump to consider the resilience of countries like India as the U.S. faces potential recession risks. Dimon emphasized the importance of global economic dynamics amid domestic challenges.

In a stark warning about the economic landscape, finance leaders Jamie Dimon, Larry Fink, and Bill Ackman have expressed concerns over the impact of President Trump’s tariffs. They caution that these trade policies could hinder growth and destabilize markets.

Italy’s service sector growth waned in March, according to the latest PMI data released by Reuters. The index fell, reflecting sluggish demand and rising costs, raising concerns over the resilience of the economy amid ongoing challenges.

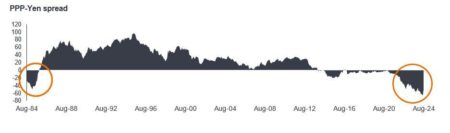

In a recent statement, a Japanese lawmaker highlighted concerns over the yen’s undervaluation, indicating potential measures to counter capital outflows. This move underscores the government’s intent to stabilize the currency and foster economic resilience amid global market fluctuations.

UK stocks remained largely unchanged amid ongoing concerns over tariffs, prompting a cautious approach from investors. As trade tensions escalate, market participants are closely monitoring developments that could impact economic stability.

Bloomberg explores the current state of India’s stock market, raising concerns about a potential bubble. As valuations soar and investor enthusiasm surges, experts weigh in on whether the growth is sustainable or on the brink of a correction.

Former Bank of Canada governor, Stephen Poloz, has cautioned that Canada is at a significant disadvantage in the ongoing trade war, stating, “We’re seriously outgunned.” His remarks highlight the challenges facing Canada’s economy amidst escalating global tensions.

U.K. inflation fell to 2.8% in February, offering a temporary reprieve for consumers and policymakers. However, analysts warn that factors such as rising energy costs and supply chain disruptions could drive prices up again shortly.

Fitch Ratings has warned that Germany’s coveted AAA credit rating may come under pressure if the country fails to stimulate economic growth. Analysts emphasize the need for robust policies to address stagnation and bolster investor confidence.

Argentina’s inflation rate is projected to increase marginally in February, according to a Reuters poll. Analysts anticipate ongoing economic challenges will contribute to persistent price rises, keeping inflationary pressures at the forefront of national concerns.

Argentina’s economy is poised for continued growth as negotiations for a new accord with the IMF progress. This potential agreement aims to stabilize economic conditions, fostering investor confidence and addressing ongoing challenges in the nation‚Äôs financial landscape.