Exciting news for commodity traders! They are gearing up to submit their bids for Italy’s vital gas storage facility, the Interconnector Pipeline (IP), by May. This strategic initiative is a key part of Italy’s mission to bolster energy security in response to the surging demand for resources.

Browsing: economic trends

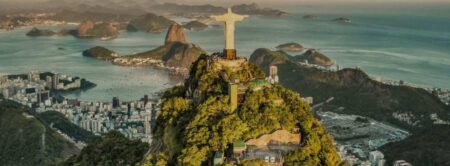

Exciting news from Brazil’s Meliuz! The company is gearing up to unveil a groundbreaking initiative designed to supercharge its Bitcoin buying strategy. This bold move aims to draw in a wave of cryptocurrency enthusiasts, harnessing Meliuz’s popular cashback platform to encourage crypto transactions in the booming digital economy.

Germany is grappling with a consumer spending crisis as households shift their focus from splurging to saving. With inflation and energy costs on the rise, many are feeling the pinch and choosing to hold onto their cash. In response, the government is stepping in with initiatives aimed at reigniting economic activity. However, analysts caution that this prolonged period of caution could stifle recovery efforts.

In a small town teetering on the edge of economic revitalization, residents have embraced cryptocurrency with fervor. Local businesses now accept digital currency, attracting tech enthusiasts and reigniting community spirit, but questions about sustainability loom large.

As job opportunities in Britain expand, more Americans are considering relocation for work. Factors such as favorable employment conditions and a robust job market are driving this trend, raising concerns over potential brain drain from the U.S. workforce.

A recent Reuters poll indicates that Canada’s growing recession risk could prompt the Bank of Canada to implement at least two additional interest rate cuts this year. Economic concerns are mounting as policymakers seek to stabilize the slowing economy.

Value investors are increasingly turning their attention to Japan, Korea, and Brazil, drawn by attractive valuations and growth potential. With economic reforms and favorable market conditions, these countries present promising opportunities for savvy investors.

Hyatt is strategically positioning itself to leverage India’s burgeoning population as a catalyst for growth. With increasing domestic travel and business opportunities, the hotel chain aims to expand its footprint, tapping into the vibrant hospitality market.

Stocks plunged in a dramatic mid-day reversal, erasing a 4% gain as investor sentiment soured. Concerns over rising interest rates and slowing economic growth weighed heavily on market momentum, prompting widespread sell-offs across multiple sectors.

“Views From The Ground: Why Brazil And Why BRAZ? 2025” on Seeking Alpha explores Brazil’s economic landscape and the potential of the BRAZ ETF. Analysts emphasize Brazil’s growth opportunities amid global market shifts, making it a focal point for investors.

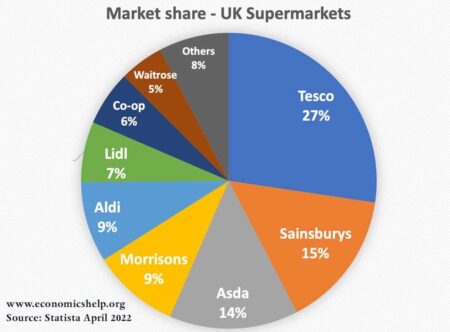

Title: Navigating the Landscape of Grocery market Share in Great Britain (2017-2025) As the grocery sector in Great Britain continues…

Italy’s service sector growth waned in March, according to the latest PMI data released by Reuters. The index fell, reflecting sluggish demand and rising costs, raising concerns over the resilience of the economy amid ongoing challenges.

China’s Luxshare Precision Industry is reportedly considering a potential listing on the Hong Kong Stock Exchange this year, according to sources. This move could enhance its funding capabilities amid the growing demand for electronic components globally.

As demand for air travel between Canada and the US continues to dwindle, airlines are adjusting strategies to navigate the shifting landscape. OAG’s latest aviation market analysis reveals how carriers are refining routes and fares to remain competitive.

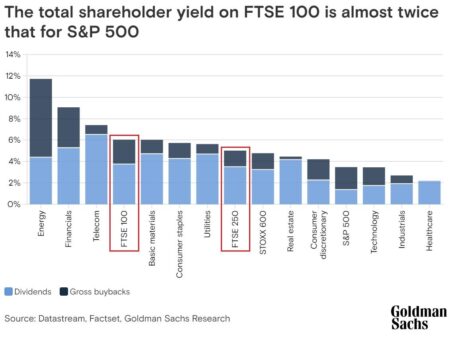

UK shares climbed, buoyed by rising commodity prices and a resurgence in the construction sector. Analysts noted that robust demand in these areas signaled economic resilience, fostering investor confidence amid global uncertainties.

Spain is experiencing an economic boom, driven by a resurgence in tourism, robust exports, and increased foreign investment. As the country capitalizes on its diverse sectors, experts predict sustained growth, boosting employment and national confidence.

UK stocks closed higher, signaling a positive end to the trading day. The Investing.com United Kingdom 100 index rose by 0.28%, reflecting investor optimism amid an evolving economic landscape. Key sectors showed robust performance, driving market gains.

Germany’s labor market shows signs of cooling, with recent data revealing a decrease in job vacancies and rising unemployment rates. Analysts warn that economic uncertainty may further impact employment stability. Observers will be watching closely for trends.

Carnival Corporation (CCL: NYSE) is expanding its fleet in Australia to meet robust local demand for cruising. The addition of new ships aims to bolster the company’s presence in the region, responding to the resurgence of travel and tourism post-pandemic.

Japan’s stock market is poised to open in the red, following mixed signals from global markets and concerns over economic data. Analysts anticipate a cautious trading session as investors weigh potential implications for domestic growth.