China has achieved a remarkable milestone with a record monthly re-export of liquefied natural gas (LNG), all while grappling with sluggish domestic demand. This unexpected surge hints at evolving global market dynamics, as the nation adapts to its shifting energy landscape.

Browsing: energy market

Data from Reuters reveals that Russian oil shipments have dramatically slashed OPEC’s share of India’s crude imports to an all-time low. This significant shift underscores India’s increasing reliance on non-OPEC sources as the global energy landscape continues to evolve and fluctuate

Brazil’s booming offshore oil sector is becoming a crucial supplier for China’s energy needs. As Chinese firms invest heavily in Brazilian oil projects, the two nations strengthen their economic ties, reshaping global energy dynamics amidst rising demand.

A steep decline in oil prices poses a significant challenge for Russia, jeopardizing its extensive funding for the ongoing war in Ukraine. As revenues dip, analysts warn that Moscow may face increased pressure to scale back military operations.

The Kremlin is experiencing heightened concern as the price of Russian Urals crude oil approaches the critical $50 threshold. This significant drop could hamper state revenues, further exacerbating the economic challenges faced amid ongoing sanctions.

Russia’s economy faces a severe crisis as oil prices plummeted by 31%, marking a significant blow to President Vladimir Putin’s financial stability. The sharp decline raises concerns about the nation’s fiscal resilience and potential implications for global markets.

Oil prices remain steady as market participants monitor rising demand from China amid ongoing geopolitical tensions. This delicate balance between supply concerns and economic recovery signals a pivotal moment for energy markets.

Alberta’s Premier emphasized that while Canada could increase oil supplies to the U.S., the country also requires new markets to diversify its economy. This dual focus aims to strengthen energy independence and address fluctuating global demand.

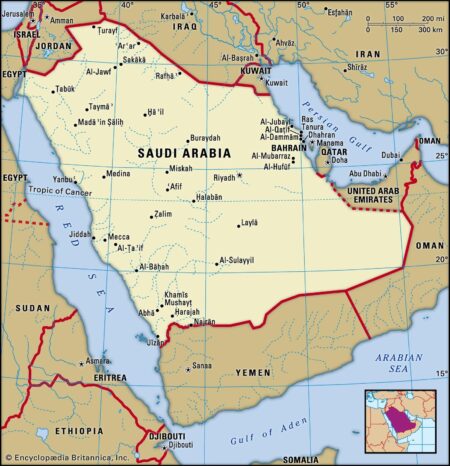

Saudi Arabia, Russia, Iraq, the UAE, Kuwait, Kazakhstan, Algeria, and Oman have reaffirmed their commitment to maintaining oil market stability. This collective pledge aims to support a healthier outlook for global oil prices amid ongoing economic challenges.