The Bank of Canada has chosen to keep its interest rates steady as it carefully evaluates the effects of recent tariffs on the economy. This decision highlights the central bank’s commitment to striking a balance while addressing new economic hurdles.

Browsing: financial markets

Exciting news from Pacific Bay Minerals! The company has officially announced the resumption of trading for its highly anticipated Brazil Gold Property, following a significant update. Investors are on the edge of their seats, eagerly awaiting more details as Pacific Bay advances its exploration and development initiatives in this promising region.

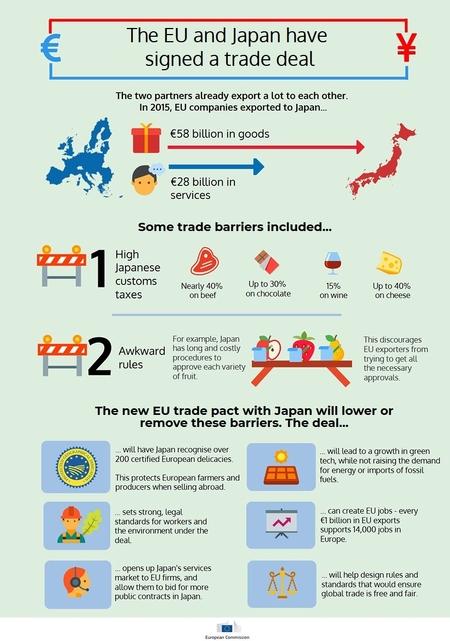

Bessent has identified Japan, the U.K., Australia, and South Korea as key priorities for future trade agreements, aiming to strengthen economic ties and enhance market access. This strategic focus signals a commitment to expanding international trade relations.

Japan has no intention of leveraging U.S. Treasurys amid ongoing tariff discussions, reaffirming its commitment to stable financial markets. Officials emphasize the importance of cooperative trade relations while navigating complex economic challenges.

Argentina’s recent overhaul of its foreign exchange regime has sparked widespread speculation about the future of the peso. As the government aims to stabilize the currency amid soaring inflation, analysts are closely watching how these changes influence economic recovery.

Canada and U.S. markets closed higher Friday, concluding a volatile week marked by fluctuating tariff discussions. Investors responded positively to easing trade tensions, reflecting cautious optimism amid ongoing economic uncertainties.

In a recent roundtable discussion, Japan’s Sovereign Socially Responsible Allocators (SSAs) expressed concerns over rising geopolitical tensions and fluctuating tariffs. Experts highlighted the need for strategic adaptations to navigate this volatile landscape and safeguard investments.

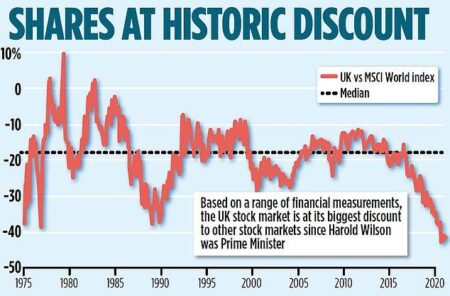

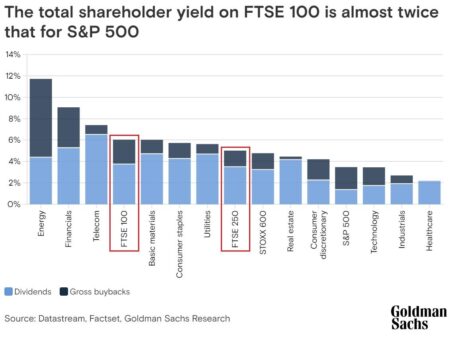

U.K. shares closed higher as investor sentiment rallied, with the Investing.com United Kingdom 100 index rising 3.30%. Strong performance in key sectors bolstered the market, reflecting positive economic outlook amid ongoing recovery efforts.

In recent discussions, Canada, the current G7 chair, engaged with Japan and the European Union to address concerns over market stability. The talks focused on collaborative strategies to bolster economic resilience amid global uncertainties, signaling a unified approach.

U.K. stocks fell sharply at the close of trading today, with the Investing.com United Kingdom 100 index down 4.56%. Investors reacted to ongoing economic uncertainties, leading to widespread declines across key sectors.

In a recent statement, JPMorgan CEO Jamie Dimon advised former President Trump to consider the resilience of countries like India as the U.S. faces potential recession risks. Dimon emphasized the importance of global economic dynamics amid domestic challenges.

In a stark warning about the economic landscape, finance leaders Jamie Dimon, Larry Fink, and Bill Ackman have expressed concerns over the impact of President Trump’s tariffs. They caution that these trade policies could hinder growth and destabilize markets.

Despite the recent decline in the Australian dollar and stock market, experts warn that the United States stands to lose the most from Trump’s escalating tariff war. Analysts emphasize that unintended consequences may hit American consumers and producers hardest.

The yuan has emerged as a critical strategic barometer for China in the wake of tariff escalations. Analysts suggest that its fluctuations reflect broader economic resilience and shifting trade dynamics, influencing both domestic markets and global perceptions.

Trade tensions escalate as China’s retaliation to U.S. tariffs intensifies, prompting fears of a global economic slowdown. Markets react negatively, reflecting uncertainty and revealing the potential for prolonged trade disruption between the two powers.

In response to plummeting stock markets and escalating trade tensions, former President Donald Trump asserted that his tariff policies ‚ÄúWILL NEVER CHANGE.‚ÄĚ This statement comes amid increased scrutiny from China, which is adjusting its strategies in light of U.S. tariffs.

UK stocks closed higher, signaling a positive end to the trading day. The Investing.com United Kingdom 100 index rose by 0.28%, reflecting investor optimism amid an evolving economic landscape. Key sectors showed robust performance, driving market gains.

UK stocks remained largely unchanged amid ongoing concerns over tariffs, prompting a cautious approach from investors. As trade tensions escalate, market participants are closely monitoring developments that could impact economic stability.

Recent inflation data from France and Spain, coupled with insights from the ECB survey, strengthen the argument for potential rate cuts. Analysts suggest that easing monetary policy could address persistent economic challenges in the Eurozone.

Bloomberg explores the current state of India’s stock market, raising concerns about a potential bubble. As valuations soar and investor enthusiasm surges, experts weigh in on whether the growth is sustainable or on the brink of a correction.