Subscribe to Updates

Get the latest creative news from FooBar about art, design and business.

Browsing: financial news

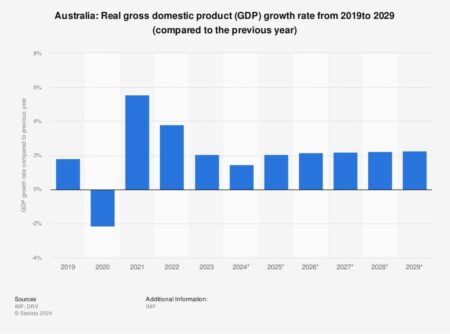

Australia’s GDP growth accelerated by 0.6% quarter-on-quarter in Q4, driven by robust consumer spending and investment. This positive economic trend reflects resilience amid global uncertainties, boosting confidence in the nation’s recovery.

Air France’s CEO has announced the airline’s readiness to submit a bid for Portugal’s TAP Air Portugal. This potential acquisition reflects Air France’s strategic growth plans amid the evolving European aviation landscape. Further developments are anticipated.

Eurasia Mining, a UK-based resource company, is gaining attention for its growth potential amid rising commodity prices. Alongside this, two other penny stocks show promise, reflecting investor optimism in the UK’s emerging market landscape.

The Canadian dollar and Mexican peso hit one-month lows as U.S. tariffs on imports exerted downward pressure on both currencies. Analysts warn that ongoing trade tensions could further destabilize the exchange rates in the near term.

India’s Nifty Index has recorded its longest monthly losing streak since 1996, signaling a concerning trend for investors. Meanwhile, midcap stocks have confirmed a bear market, reflecting broader economic challenges as market volatility continues to rise.

Germany’s Friedrich Merz in ‘difficult’ talks over plans to boost defence spending – Financial Times

Germany’s Friedrich Merz is engaged in challenging negotiations aimed at increasing the nation’s defense budget. As international security concerns rise, the discussions reflect the balancing act between fiscal restraint and military readiness.

Argentina’s crypto scandal has cast a shadow over Presidential candidate Javier Milei, featuring an unusual blend of characters from the crypto world. As investigations unfold, the implications for Milei’s campaign and the broader economic landscape remain uncertain.

Italy’s financial markets regulator, CONSOB, has announced the blocking of an additional batch of illegal investment websites, bringing the total to 1,236. This clampdown aims to protect investors from fraudulent schemes proliferating online.

Telefónica has divested its Argentine subsidiary for $1.25 billion, marking a significant shift in its South American strategy. This move highlights the ongoing challenges in the telecommunications market as companies realign their portfolios.

Canada and the EU are intensifying efforts to diversify trade relationships amid increasing U.S. threats to economic stability. Both regions aim to strengthen partnerships and reduce reliance on any single market, fostering resilience in global trade dynamics.

Australia’s flagship airline, Qantas, has declared its first dividend in over five years following a significant rise in profits. The decision marks a positive shift for the airline as it continues to recover from the impacts of the pandemic.

Argentina’s President Javier Milei has come under scrutiny in Spain amid a scandal involving the $LIBRA cryptocurrency. Reports suggest potential financial irregularities linked to Milei’s administration, sparking intensified investigations into his dealings.

Japan’s Nikkei index fell to a four-month low, driven by concerns over the U.S. economic outlook and a strengthening yen. Investors are wary of potential impacts on export competitiveness, prompting a cautious approach in the market.

Warren Buffett highlighted his confidence in U.S. stock holdings during a recent investment overview while also expressing optimism about his ventures in Japan. The billionaire’s insights reflect a strategic approach amid global economic fluctuations.

In a concerning indication of economic strain, the German Central Bank reported significant losses, highlighting challenges ahead for Europe’s largest economy. Analysts warn this trend may reflect deeper issues, raising alarms about Germany’s financial stability.

Australia’s Consumer Price Index (CPI) inflation held steady at 2.5% year-on-year in January, slightly below the expected 2.6%. This stability suggests a controlled inflation environment, providing insight into the nation’s economic health moving forward.

Indian shares fell amid rising concerns over US economic growth and a significant foreign sell-off. Investors reacted to shifting global market dynamics, prompting broader declines across key sectors, heightening caution among traders.

Chinese tech stocks experienced significant volatility as market sentiment shifts amid renewed trade tensions. Comments from former President Trump on decoupling heighten investor anxiety, amplifying fears over the future of U.S.-China relations and technology collaboration.

Argentina’s presidential candidate Javier Milei is under investigation for potential fraud linked to the launch of a cryptocurrency that plummeted shortly after debuting. Critics question the legitimacy of Milei’s support for the coin amid growing concerns over transparency.

Berkshire Hathaway plans to gradually increase its investments in Japanese trading houses, signaling confidence in the country’s economic resilience. This strategic move aims to diversify Berkshire’s portfolio and leverage growth opportunities in Asia.