The Bank of Canada has chosen to keep its interest rates steady as it carefully evaluates the effects of recent tariffs on the economy. This decision highlights the central bank’s commitment to striking a balance while addressing new economic hurdles.

Browsing: inflation

Germany is grappling with a consumer spending crisis as households shift their focus from splurging to saving. With inflation and energy costs on the rise, many are feeling the pinch and choosing to hold onto their cash. In response, the government is stepping in with initiatives aimed at reigniting economic activity. However, analysts caution that this prolonged period of caution could stifle recovery efforts.

Analysts at Desjardins predict a modest decline in the Bank of Canada’s interest rate. This careful strategy highlights the persistent economic hurdles we face, all while striving to uphold stability within our financial system.

The Bank of Canada has decided to maintain its key interest rate at 2.75%, citing concerns that escalating trade tensions could lead to a potential recession. The decision reflects ongoing economic uncertainty amid global trade disputes.

In a surprising turn of events, India’s inflation rate plummeted to an impressive 3.34% in March, far surpassing analysts’ predictions. This notable drop could potentially reshape economic policies as decision-makers evaluate its effects on consumer spending and overall growth.

Inflation in Canada eased to 2.3% in March, largely due to a decline in gas prices, according to recent data. This marks a slight improvement, offering some relief to consumers as the cost of living remains a key concern nationwide.

A recent Reuters poll indicates that Canada’s growing recession risk could prompt the Bank of Canada to implement at least two additional interest rate cuts this year. Economic concerns are mounting as policymakers seek to stabilize the slowing economy.

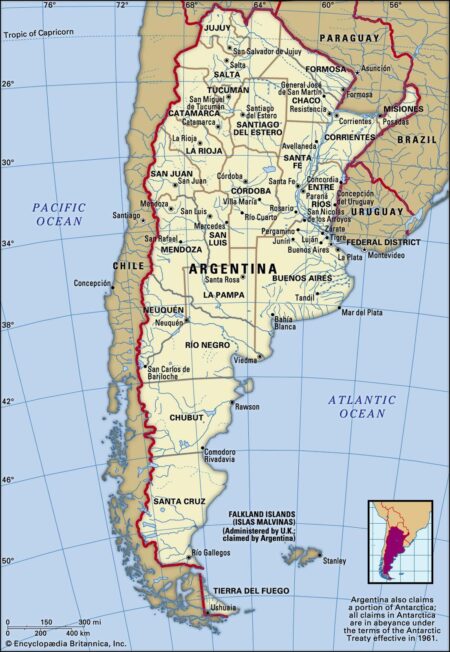

Argentina’s recent overhaul of its foreign exchange regime has sparked widespread speculation about the future of the peso. As the government aims to stabilize the currency amid soaring inflation, analysts are closely watching how these changes influence economic recovery.

In “Opinion | Argentina Needs the Dollar More Than Ever,” the Wall Street Journal explores the nation‚Äôs escalating economic crisis, highlighting the urgent need for dollarization. As inflation spirals, many Argentines seek stability through the U.S. currency.

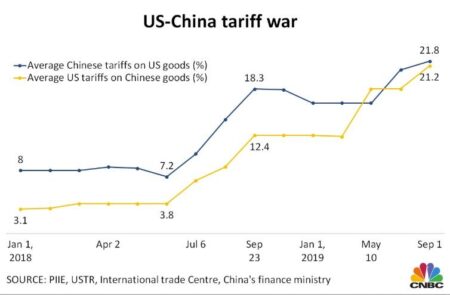

As the U.S.-China tariff war intensifies, Canadian consumers may face rising online shopping prices. Experts warn that increased tariffs on Chinese goods could lead to higher costs for retailers, which might be passed on to Canadian shoppers.

Japan’s government is contemplating cash handouts to help citizens cope with escalating living costs and the impact of U.S. tariffs. The proposed measures aim to alleviate financial pressure on households amid growing economic uncertainties.

Argentina announced plans to lift its strict currency controls, bolstered by support from the International Monetary Fund (IMF). The move aims to stabilize the economy and restore investor confidence amid ongoing financial challenges.

Tens of thousands across Spain took to the streets in a massive protest against the escalating housing crisis. Demonstrators demanded affordable housing solutions, highlighting the urgent need for government action to address soaring rents and homelessness.

In a bold move, former President Donald Trump has threatened to impose an additional 50% tariff on Chinese imports, potentially driving total tariffs beyond the 100% mark. This escalation raises concerns about the impact on U.S.-China trade relations and global markets.

Japan’s real wages fell for the second consecutive month in February, signaling growing financial pressures on households as inflation continues to outpace earnings. This trend raises concerns over consumer spending and overall economic stability.

The UK’s FTSE 100 experienced its largest daily decline since the onset of the pandemic, driven by renewed concerns over Trump’s tariffs. Market analysts warn that the tariffs could disrupt global trade and economic recovery efforts.

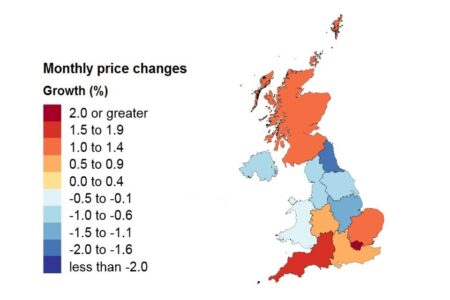

UK house prices have surged the most in two years, according to the Office for National Statistics (ONS). The increase reflects growing demand amid limited housing supply, signaling a potential recovery in the property market.

Recent inflation data from France and Spain, coupled with insights from the ECB survey, strengthen the argument for potential rate cuts. Analysts suggest that easing monetary policy could address persistent economic challenges in the Eurozone.

U.K. inflation fell to 2.8% in February, offering a temporary reprieve for consumers and policymakers. However, analysts warn that factors such as rising energy costs and supply chain disruptions could drive prices up again shortly.

Germany’s recent surge in spending, aimed at bolstering its economy post-pandemic, is raising concerns within the EU. Critics warn that this financial splurge could disrupt budgetary stability across member states, triggering anxiety about fiscal discipline in the bloc.