The Bank of Canada has chosen to keep its interest rates steady as it carefully evaluates the effects of recent tariffs on the economy. This decision highlights the central bank’s commitment to striking a balance while addressing new economic hurdles.

Browsing: interest rates

Analysts at Desjardins predict a modest decline in the Bank of Canada’s interest rate. This careful strategy highlights the persistent economic hurdles we face, all while striving to uphold stability within our financial system.

The Bank of Canada has decided to maintain its key interest rate at 2.75%, citing concerns that escalating trade tensions could lead to a potential recession. The decision reflects ongoing economic uncertainty amid global trade disputes.

A recent Reuters poll indicates that Canada’s growing recession risk could prompt the Bank of Canada to implement at least two additional interest rate cuts this year. Economic concerns are mounting as policymakers seek to stabilize the slowing economy.

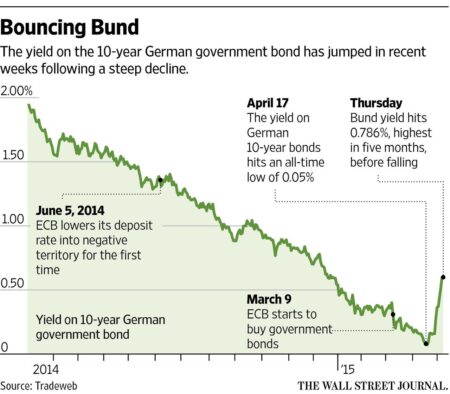

In a flight to safety amid global economic uncertainty, investors are increasingly turning to German government bonds. With their reputation for stability, these bonds offer a refuge from market volatility, reflecting growing concerns over inflation and geopolitical tensions.

Recent inflation data from France and Spain, coupled with insights from the ECB survey, strengthen the argument for potential rate cuts. Analysts suggest that easing monetary policy could address persistent economic challenges in the Eurozone.

Japan’s inflation rate has slowed more than anticipated, yet remains elevated, prompting speculation about the Bank of Japan’s potential interest rate hikes. Analysts suggest that persistent price pressures may force the central bank to act sooner than expected.

Brazil’s central bank has raised interest rates to their highest level since 2016, signaling a cautious approach towards future hikes. With inflation concerns in mind, officials indicate that smaller increases may be on the horizon to balance economic growth and stability.

Asia-Pacific markets opened mixed following the decision of both China and the U.S. to maintain steady interest rates. Investors are closely monitoring economic indicators and global trends as they navigate uncertainties in the financial landscape.

Japan’s bond yields are rising as investors closely watch for the Bank of Japan’s (BoJ) next policy decision. The shift reflects growing expectations of tighter monetary policy amidst global inflation pressures, signaling potential changes in Japan’s economic landscape.

The OECD warns that the Bank of Canada may have to raise interest rates by up to 1.25% in the event of a full-blown tariff war. This increase aims to combat inflationary pressures stemming from heightened trade tensions, impacting economic stability.

As the Federal Reserve prepares to announce its latest policy decision, analysts predict significant implications for the Indian rupee and bond markets. Investors will closely monitor Fed commentary for cues on interest rates and economic outlook, impacting currency stability.

Brazil’s economy is projected to grow by 3.4% in 2024, driven by robust domestic demand. However, recent indicators of year-end weakness suggest that further interest rate hikes may be limited, prompting analysts to reassess monetary policy outlooks.

Japan’s 10-year government bond yield has reached its highest level since 2008, driven by investor speculation regarding potential interest rate hikes by the Bank of Japan. This shift marks a significant change in the country’s longstanding monetary policy stance.

UK services inflation has unexpectedly declined, offering a positive signal for the Bank of England as it navigates economic challenges. This shift may ease pressure on policymakers, potentially influencing future interest rate decisions.

Australia’s central bank has lowered interest rates as part of its strategy to stimulate the economy, signaling a cautious approach towards additional easing. Officials highlighted ongoing economic uncertainties while urging vigilance in monitoring inflation trends.

Japan’s Finance Minister, Shunichi Kato, cautioned that rising bond yields could put pressure on the country’s fiscal health. He emphasized the need for careful monitoring as increased borrowing costs may impact government finance and economic recovery efforts.