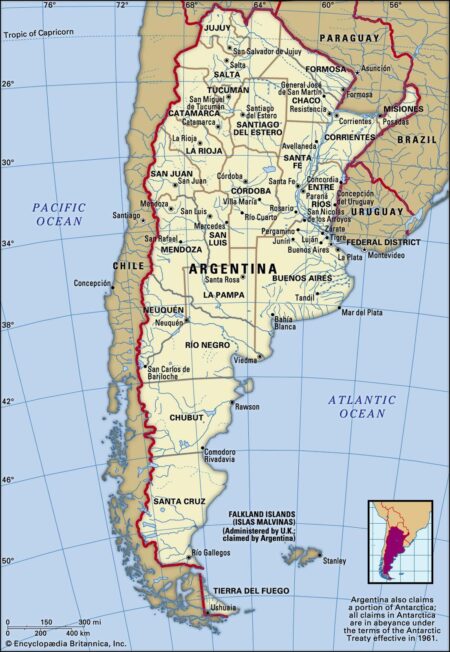

The IMF and World Bank have greenlit exciting new bailout packages for Argentina, designed to bolster its economy in the face of persistent inflation challenges. These vital measures are set to offer essential support as the nation charts a course through financial uncertainty.

Browsing: international finance

US Treasury’s Bessent has voiced strong support for Argentina’s ambitious economic reforms, highlighting their crucial role in stabilizing the nation as worries about China’s expanding influence in the region mount. This initiative not only reflects a commitment to Argentina’s progress but also aligns seamlessly with broader U.S. interests in bolstering economic partnerships across Latin America.

The World Bank is gearing up to unveil a remarkable $12 billion financing package for Argentina, designed to give a much-needed boost to the nation’s faltering economy. This substantial investment arrives at a critical time, as the country grapples with persistent challenges like soaring inflation and currency fluctuations, according to reports from Reuters.

Argentina’s recent overhaul of its foreign exchange regime has sparked widespread speculation about the future of the peso. As the government aims to stabilize the currency amid soaring inflation, analysts are closely watching how these changes influence economic recovery.

In “Opinion | Argentina Needs the Dollar More Than Ever,” the Wall Street Journal explores the nation’s escalating economic crisis, highlighting the urgent need for dollarization. As inflation spirals, many Argentines seek stability through the U.S. currency.

The International Monetary Fund (IMF) has confirmed a preliminary agreement with Argentina for a $20 billion loan aimed at stabilizing the country’s economy. This funding is expected to bolster Argentina’s financial situation amid ongoing challenges.

Argentina announced plans to lift its strict currency controls, bolstered by support from the International Monetary Fund (IMF). The move aims to stabilize the economy and restore investor confidence amid ongoing financial challenges.

Argentina has secured a $20 billion deal with the International Monetary Fund (IMF) to support President Javier Milei’s ambitious economic reforms. The agreement aims to stabilize the nation’s economy amid ongoing inflation and fiscal challenges.

Canada holds billions in U.S. real estate, but recent threats from former President Trump regarding border policies and trade could jeopardize these investments. Experts warn that uncertainty may deter future Canadian buyers, impacting the market significantly.

German officials are raising concerns about the validity of the $109 billion in U.S. gold reserves, demanding verification of bullion bars held at the New York Federal Reserve. This request could have significant implications for international gold holdings.

Singapore Exchange (SGX) has announced a partnership with Brazil’s B3 to launch real futures in 2025. This collaboration aims to enhance trading opportunities and liquidity in the foreign exchange derivatives market, facilitating greater access for global investors.

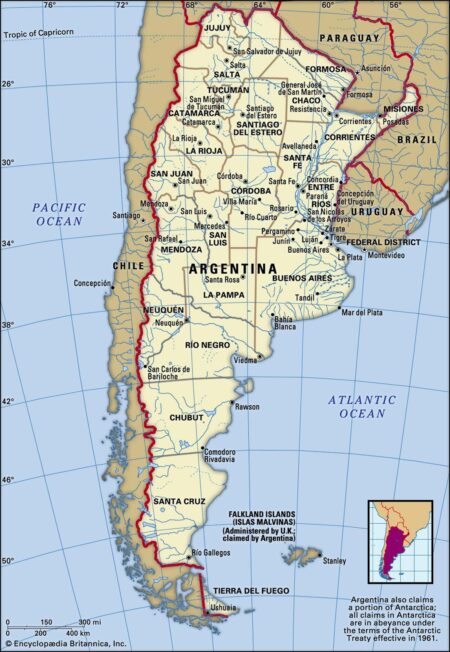

Germany’s recent spending plans have sparked concerns in global markets, leading to a decline in the 10-year Treasury note and the dollar. Analysts fear increased fiscal stimulus in Europe could draw investment away from U.S. assets, heightening volatility.

The UK has signed a multi-billion dollar loan agreement to support Ukraine amid ongoing challenges. This financial aid aims to bolster the nation’s economy and strengthen its resilience, reflecting the UK’s commitment to Ukraine’s recovery and stability.

If the U.S. withdraws from the World Bank, the China-led Asian Infrastructure Investment Bank (AIIB) could fill the void. As nations seek alternative funding sources, AIIB’s collaborative model may reshape global finance and enhance international cooperation.