Stocks plunged in a dramatic mid-day reversal, erasing a 4% gain as investor sentiment soured. Concerns over rising interest rates and slowing economic growth weighed heavily on market momentum, prompting widespread sell-offs across multiple sectors.

Browsing: investing

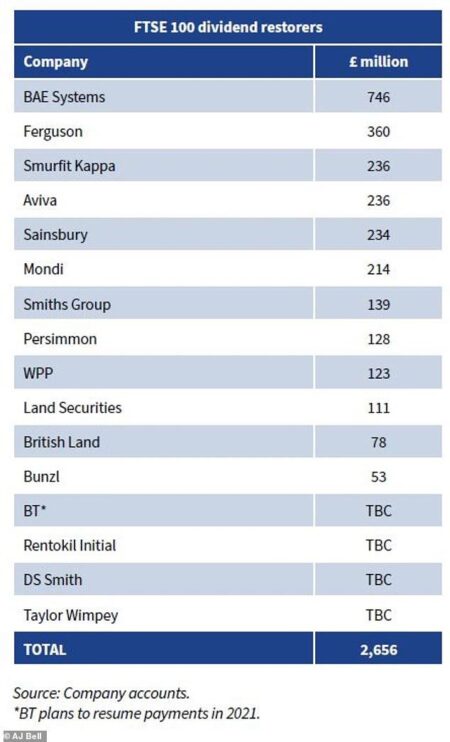

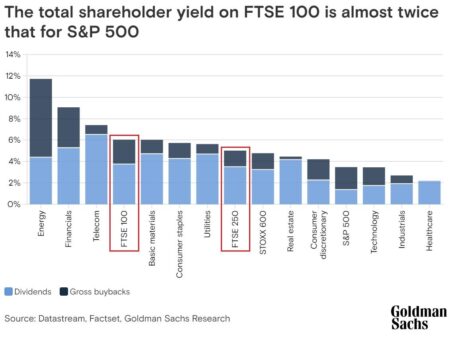

As March 2025 approaches, investors are eyeing top UK dividend stocks for reliable income. Companies such as BP, Unilever, and GlaxoSmithKline stand out, offering attractive yields and stability amid market fluctuations. Consider these options for a robust portfolio.

UK stocks closed higher, signaling a positive end to the trading day. The Investing.com United Kingdom 100 index rose by 0.28%, reflecting investor optimism amid an evolving economic landscape. Key sectors showed robust performance, driving market gains.

Japan’s stock market is poised to open in the red, following mixed signals from global markets and concerns over economic data. Analysts anticipate a cautious trading session as investors weigh potential implications for domestic growth.

French stocks closed lower on Tuesday, with the CAC 40 index declining by 0.96%. Investor sentiment was dampened by global economic concerns, leading to a broad sell-off across major sectors, highlighting ongoing market volatility.

U.K. stocks closed lower on Thursday, with the Investing.com United Kingdom 100 index declining by 0.93%. Market sentiment was dampened amid concerns over economic growth and inflation, reflecting a cautious outlook among investors.

U.K. stocks closed higher as the trading session wrapped up, with the Investing.com United Kingdom 100 index advancing by 0.02%. Investors remained cautious, reflecting broader economic concerns while seeking growth opportunities in key sectors.

Eurasia Mining, a UK-based resource company, is gaining attention for its growth potential amid rising commodity prices. Alongside this, two other penny stocks show promise, reflecting investor optimism in the UK’s emerging market landscape.

Spain’s stock market ended higher as the IBEX 35 index rose by 0.31% at the close of trading. Positive investor sentiment and gains in key sectors contributed to the day‚Äôs increase, reflecting a resilient financial outlook amidst ongoing economic developments.