Germany is on the brink of an exciting economic transformation as a fresh “stimulus wave” sweeps in, designed to spark growth and ignite innovation. Investors are eagerly focusing on pivotal sectors, with certain stocks set to thrive from this surge of government backing

Browsing: investment opportunities

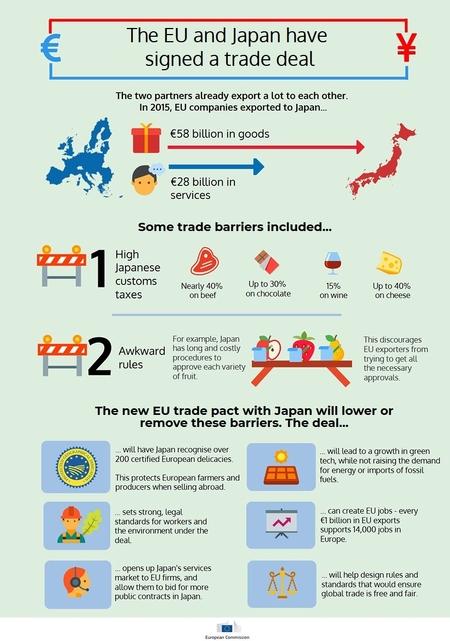

Bessent has identified Japan, the U.K., Australia, and South Korea as key priorities for future trade agreements, aiming to strengthen economic ties and enhance market access. This strategic focus signals a commitment to expanding international trade relations.

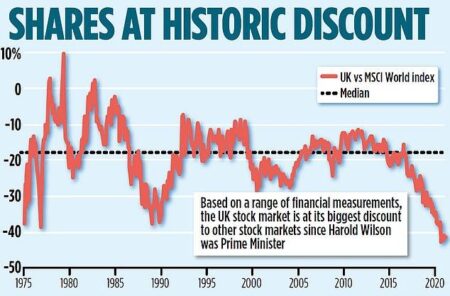

According to a recent analysis by Yahoo Finance, three UK stocks are reportedly trading significantly below their estimated fair value, with potential upside of up to 49.6%. Investors may want to explore these undervalued opportunities for future growth.

Value investors are increasingly turning their attention to Japan, Korea, and Brazil, drawn by attractive valuations and growth potential. With economic reforms and favorable market conditions, these countries present promising opportunities for savvy investors.

In the latest edition of Project Bulletin, key developments emerge from Ontario, Canada, Newport, South Wales, and Lviv, Ukraine. Each region showcases promising initiatives aimed at enhancing economic growth and attracting investment. Stay tuned for detailed insights.

China is poised to increase its imports from India amid looming U.S. tariffs on Chinese goods. This strategic shift could bolster India’s economy and strengthen bilateral trade relations, offering a potential buffer against U.S. trade pressures.

Bakkavor Group emerges as a standout in the UK penny stock landscape, offering potential for savvy investors. In our latest analysis, we explore three promising penny stock opportunities that align with Bakkavor’s growth strategy, highlighting their market potential.

In the ever-evolving landscape of investment, small-cap stocks often offer hidden potential. This article explores three promising UK-based small-cap stocks that could become undiscovered gems, attracting savvy investors seeking growth opportunities.

Japan’s smart building market is projected to exceed a valuation of US$ 31.45 billion by 2033, driven by advancements in IoT technology, sustainability initiatives, and increased demand for energy-efficient solutions, according to Astute Analytica.

As Trump tariffs reshape global trade dynamics, India stands poised to excel in Asia. With a burgeoning domestic market, a strong manufacturing base, and strategic alliances, India is uniquely positioned to leverage these tensions for economic growth and opportunity.

Eurasia Mining, a UK-based resource company, is gaining attention for its growth potential amid rising commodity prices. Alongside this, two other penny stocks show promise, reflecting investor optimism in the UK’s emerging market landscape.

In a bid to enhance economic growth, Governor Whitmer has announced strengthened ties with Spain, focusing on increasing foreign investment and job creation in Michigan. This partnership aims to attract Spanish businesses and foster innovation in key industries.

Canada stands at the forefront of the critical minerals sector, crucial for green technologies and battery production. With vast resources and a commitment to sustainable mining, Canada can bolster its economy while contributing to global climate goals.

As Rocket Lab USA continues to innovate in the space industry, investors are weighing the potential of its stock. With recent developments in satellite launches and ambitious plans for expansion, analysts are evaluating if now is the right time to buy.