Trade tensions escalate as China’s retaliation to U.S. tariffs intensifies, prompting fears of a global economic slowdown. Markets react negatively, reflecting uncertainty and revealing the potential for prolonged trade disruption between the two powers.

Browsing: investment

Canada’s Minister is advocating for a doubling of LNG Canada’s capacity to meet growing demand and strengthen energy exports. The proposal includes an upgrade to western pipelines, highlighting the government’s focus on expanding the nation’s LNG potential.

In a recent announcement, former President Donald Trump renewed threats of tariffs on Indian pharmaceutical imports, marking a sudden shift that has negatively impacted Indian pharma stocks. Investors reacted swiftly, reversing the brief respite enjoyed by the sector.

Brazil’s Petrobras is exploring new avenues in the energy sector, considering participation in an upcoming power auction focused on battery storage. This move could enhance the company’s portfolio and support Brazil’s growing renewable energy ambitions.

The UK’s FTSE 100 experienced its largest daily decline since the onset of the pandemic, driven by renewed concerns over Trump’s tariffs. Market analysts warn that the tariffs could disrupt global trade and economic recovery efforts.

Spain’s private sector growth has shown signs of moderation, according to a recent TradingView report. Economic uncertainties and rising costs are impacting businesses, leading to a slowdown in expansion efforts across various industries.

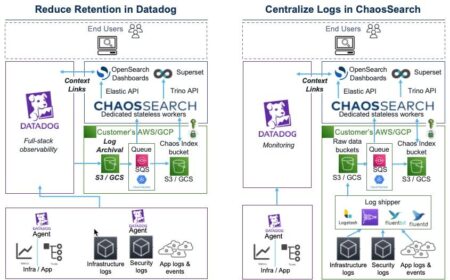

Datadog has announced plans to establish a new data center in Australia, aiming to enhance its cloud monitoring and analytics services for local clients. This move underscores the company’s commitment to expanding its footprint in the Asia-Pacific region.

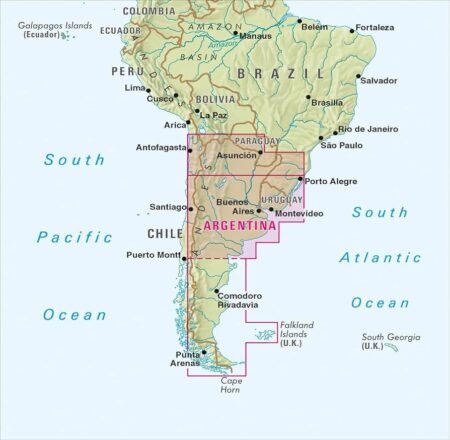

The future of a floating casino in Buenos Aires remains uncertain as regulatory challenges and community opposition mount. Stakeholders are grappling with the project’s implications for local tourism and gaming revenues, raising questions about its viability.

White Energy has successfully acquired a majority stake in the Specimen Hill Project located in Australia, enhancing its position in the mining sector. This strategic investment is expected to bolster the company’s growth and operational capabilities in resource extraction.

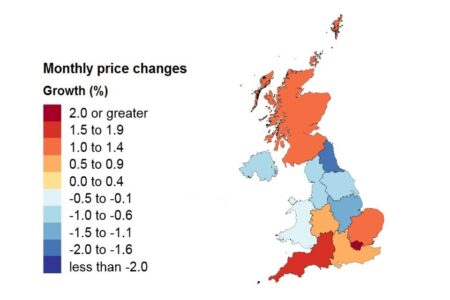

UK house prices have surged the most in two years, according to the Office for National Statistics (ONS). The increase reflects growing demand amid limited housing supply, signaling a potential recovery in the property market.

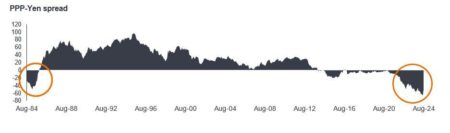

In a recent statement, a Japanese lawmaker highlighted concerns over the yen’s undervaluation, indicating potential measures to counter capital outflows. This move underscores the government’s intent to stabilize the currency and foster economic resilience amid global market fluctuations.

ProPublica reveals that Elon Musk’s SpaceX has been quietly facilitating investment from Chinese entities, raising concerns about national security and technology transfer. This opaque financial maneuvering underscores the complex interplay between innovation and geopolitical risk.

UK shares climbed, buoyed by rising commodity prices and a resurgence in the construction sector. Analysts noted that robust demand in these areas signaled economic resilience, fostering investor confidence amid global uncertainties.

Spain is experiencing an economic boom, driven by a resurgence in tourism, robust exports, and increased foreign investment. As the country capitalizes on its diverse sectors, experts predict sustained growth, boosting employment and national confidence.

The EU and India are on the brink of finalizing a pivotal free trade agreement aimed at boosting economic ties and enhancing trade in goods and services. This partnership could reshape global trade dynamics, fostering growth and innovation in both regions.

Beazer Homes USA (BZH) is generating buzz as analysts predict potential growth amid a recovering housing market. With recent financial reports signaling stability and strategic land acquisitions, investors are keenly watching for signs of an upswing.

Templus has successfully acquired and relaunched a state-of-the-art data center in Seville, Spain, enhancing its operational capabilities. This strategic move aims to strengthen Templus’s presence in the European market and support growing data demands.

Australia is ramping up its regulatory framework for cryptocurrencies, as exchanges expand amid rising interest. This move aims to enhance consumer protection and financial stability, testing the industry’s adaptability to stricter oversight.

Chiesi has invested €430 million in a new facility in Italy, aiming to bolster its production capabilities. Meanwhile, Bharat Biotech has inaugurated its first cell and gene therapy (CGT) site in India, marking a significant advancement in the region’s biopharmaceutical landscape.

Coca-Cola announced plans to invest over $1.4 billion in Argentina, aiming to enhance production and distribution capabilities. This strategic move underscores the company’s commitment to the region’s economic growth and job creation amidst challenging market conditions.