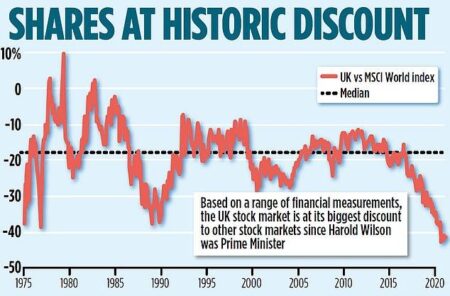

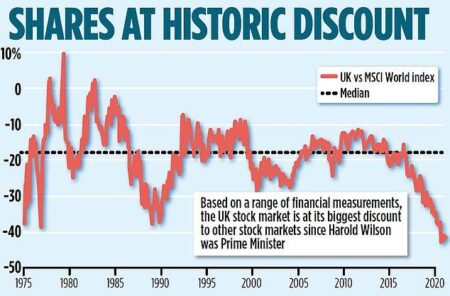

According to a recent analysis by Yahoo Finance, three UK stocks are reportedly trading significantly below their estimated fair value, with potential upside of up to 49.6%. Investors may want to explore these undervalued opportunities for future growth.

Browsing: market analysis

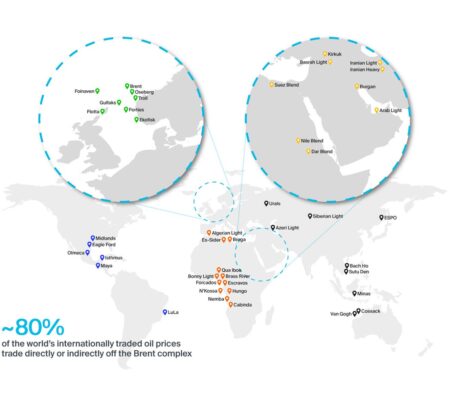

The U.S. Energy Information Administration (EIA) has revised its Brent oil price forecast for 2025 and 2026, signaling a more cautious outlook amid fluctuating global demand and production challenges. This adjustment reflects ongoing volatility in the energy market.

A recent Reuters poll indicates that Canada’s growing recession risk could prompt the Bank of Canada to implement at least two additional interest rate cuts this year. Economic concerns are mounting as policymakers seek to stabilize the slowing economy.

Prices for the PlayStation 5 have surged in Europe and Australia, raising concerns that U.S. gamers could face similar increases. Industry analysts suggest rising production costs and economic factors may lead to price adjustments in the coming months.

In a surprising analysis, strategists suggest that Japan, rather than China, may have strong incentives to reduce its U.S. Treasury holdings. This shift could be driven by Japan’s need to stabilize its currency amidst ongoing economic challenges.

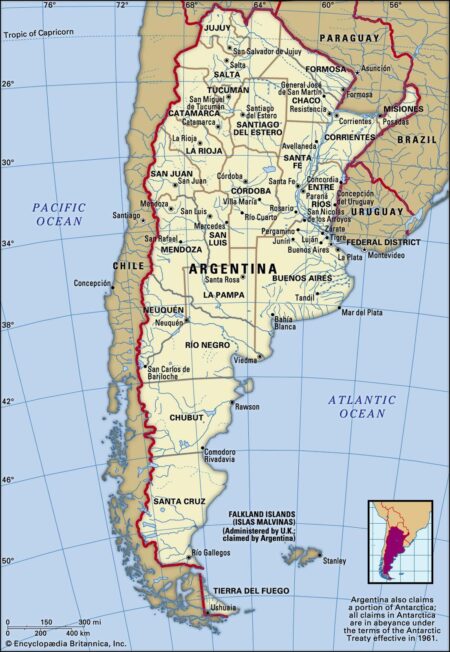

In “Opinion | Argentina Needs the Dollar More Than Ever,” the Wall Street Journal explores the nation‚Äôs escalating economic crisis, highlighting the urgent need for dollarization. As inflation spirals, many Argentines seek stability through the U.S. currency.

Australian miners are poised to benefit from China’s new restrictions on rare earth exports. As Beijing tightens its grip on this strategic resource, Australian firms are expected to fill the supply gap, bolstering their market position and boosting revenues.

Hyatt is strategically positioning itself to leverage India’s burgeoning population as a catalyst for growth. With increasing domestic travel and business opportunities, the hotel chain aims to expand its footprint, tapping into the vibrant hospitality market.

Canada and U.S. markets closed higher Friday, concluding a volatile week marked by fluctuating tariff discussions. Investors responded positively to easing trade tensions, reflecting cautious optimism amid ongoing economic uncertainties.

Canada-made automobiles are set to experience significant price increases in the U.S. market, attributed to recently imposed tariffs. Analysts warn that these higher costs could impact sales and competitiveness, raising concerns for Canadian manufacturers.

U.K. shares closed higher as investor sentiment rallied, with the Investing.com United Kingdom 100 index rising 3.30%. Strong performance in key sectors bolstered the market, reflecting positive economic outlook amid ongoing recovery efforts.

In a recent escalation of trade tensions, Trump’s proposed tariffs on Chinese goods are set to significantly impact ‘Main Street’ U.S. businesses that rely on Amazon. Experts warn that increased costs could crush small retailers struggling to compete.

Argentina has launched an official inquiry into the LIBRA memecoin scandal, raising concerns over potential fraud and investor protection. Authorities aim to clarify the cryptocurrency’s impact on the local economy and safeguard citizens’ interests.

Stocks plunged in a dramatic mid-day reversal, erasing a 4% gain as investor sentiment soured. Concerns over rising interest rates and slowing economic growth weighed heavily on market momentum, prompting widespread sell-offs across multiple sectors.

U.K. stocks fell sharply at the close of trading today, with the Investing.com United Kingdom 100 index down 4.56%. Investors reacted to ongoing economic uncertainties, leading to widespread declines across key sectors.

A recent central bank survey reveals that more Canadian firms anticipate a potential recession within the next year. Concerns over economic stability are rising, with business leaders increasingly wary of inflation and interest rate impacts on growth.

In a stark warning about the economic landscape, finance leaders Jamie Dimon, Larry Fink, and Bill Ackman have expressed concerns over the impact of President Trump’s tariffs. They caution that these trade policies could hinder growth and destabilize markets.

German officials are raising concerns about the validity of the $109 billion in U.S. gold reserves, demanding verification of bullion bars held at the New York Federal Reserve. This request could have significant implications for international gold holdings.

Title: Navigating the Landscape of Grocery market Share in Great Britain (2017-2025) As the grocery sector in Great Britain continues…

Despite the recent decline in the Australian dollar and stock market, experts warn that the United States stands to lose the most from Trump’s escalating tariff war. Analysts emphasize that unintended consequences may hit American consumers and producers hardest.