Ford Argentina reported a remarkable 99 percent increase in sales for March 2025, signaling a robust recovery in the automotive market. This surge reflects growing consumer demand and revitalized production efforts, positioning Ford for a strong year ahead.

Browsing: market trends

Dimethylcyclosiloxane prices have declined in Germany and the U.S. due to soft demand and abundant supply, according to ChemAnalyst. The market’s shift reflects changing industrial needs amid a broader economic slowdown.

The Farnborough International Space Show 2025 is set to showcase groundbreaking advancements in aerospace and space technology. Attendees can expect major announcements, innovative patents, and discussions on the UK’s pivotal role in the future of space exploration.

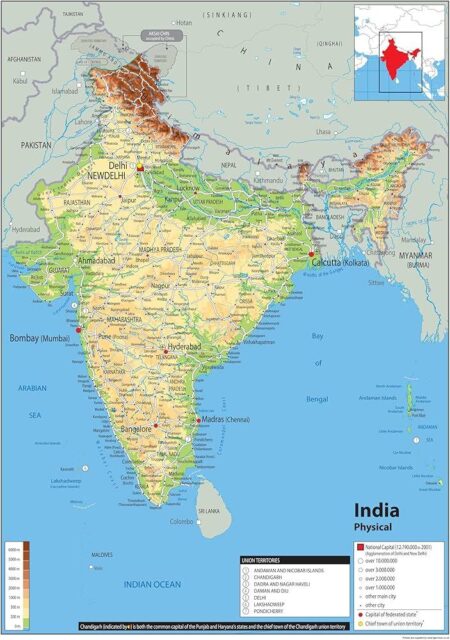

India’s industrial output fell to a six-month low in February, raising concerns over economic momentum. Contraction in manufacturing and electricity sectors has contributed to the decline, signaling potential challenges ahead for growth prospects.

Australia’s median home value has surged by approximately $230,000 over the past five years, highlighting a significant shift in the housing market. This rise raises concerns over affordability and accessibility for potential buyers amidst ongoing economic challenges.

Canada and U.S. markets closed higher Friday, concluding a volatile week marked by fluctuating tariff discussions. Investors responded positively to easing trade tensions, reflecting cautious optimism amid ongoing economic uncertainties.

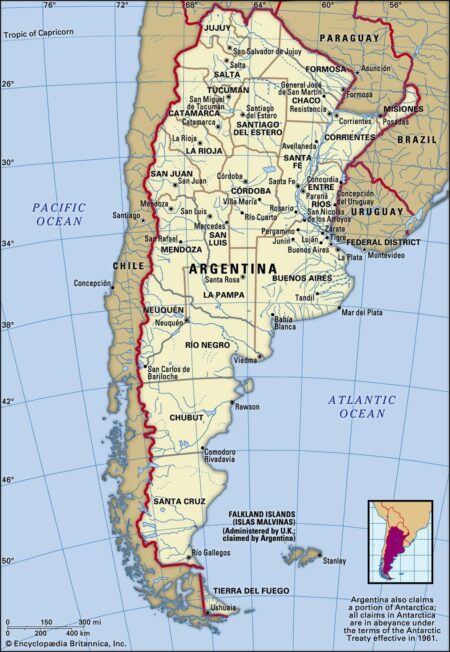

Argentina’s state-controlled oil company YPF may face a decline in earnings as crude prices continue to drop. Analysts warn that the decrease in global oil prices could impact YPF’s profitability, raising concerns about its financial stability in the coming quarters.

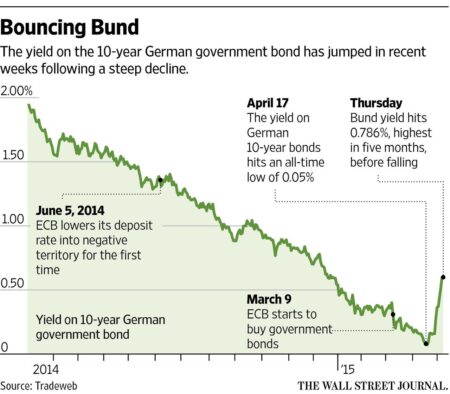

In a flight to safety amid global economic uncertainty, investors are increasingly turning to German government bonds. With their reputation for stability, these bonds offer a refuge from market volatility, reflecting growing concerns over inflation and geopolitical tensions.

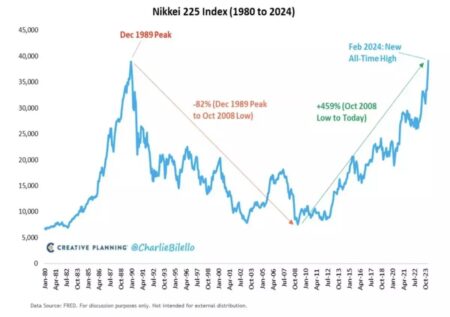

In a recent roundtable discussion, Japan’s Sovereign Socially Responsible Allocators (SSAs) expressed concerns over rising geopolitical tensions and fluctuating tariffs. Experts highlighted the need for strategic adaptations to navigate this volatile landscape and safeguard investments.

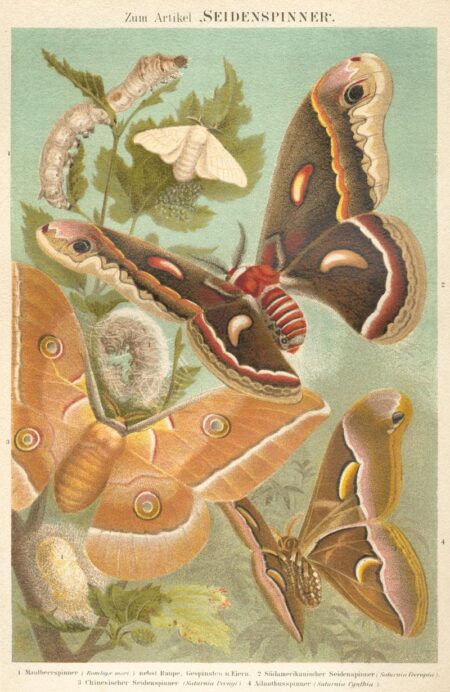

The United Kingdom’s trademark office is paving the way for bio-produced silk innovations, sparking a new era in sustainable textile production. This move underlines a commitment to eco-friendly practices while also fostering advancements in biomanufacturing technologies.

Japan’s Nikkei surged 6% as investors rallied on hopes of a market recovery. Positive economic signals and easing global concerns fueled buying interest, propelling the index to a strong close, reflecting renewed confidence in the Japanese economy.

In a market where insider ownership can signal confidence, three UK growth companies stand out. These firms, highlighted by Yahoo Finance, showcase substantial insider stakes, suggesting robust faith in their future prospects as they pursue ambitious growth strategies.

Canada holds billions in U.S. real estate, but recent threats from former President Trump regarding border policies and trade could jeopardize these investments. Experts warn that uncertainty may deter future Canadian buyers, impacting the market significantly.

Starbucks is slowing its expansion plans in India as rising inflation and economic concerns lead consumers to cut discretionary spending. The decision reflects shifting market dynamics, prompting the coffee giant to reevaluate growth strategies in a challenging environment.

The yuan has emerged as a critical strategic barometer for China in the wake of tariff escalations. Analysts suggest that its fluctuations reflect broader economic resilience and shifting trade dynamics, influencing both domestic markets and global perceptions.

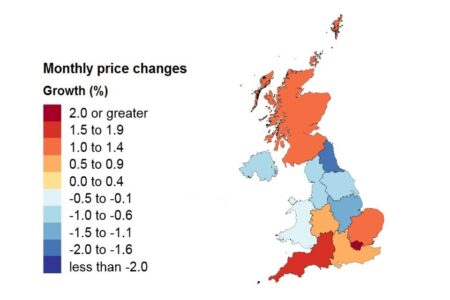

U.K. stocks finished lower as trading closed, with the Investing.com United Kingdom 100 index declining by 0.34%. Economic uncertainties continue to weigh on investor sentiment, reflecting a cautious outlook in the markets.

In a recent announcement, former President Donald Trump renewed threats of tariffs on Indian pharmaceutical imports, marking a sudden shift that has negatively impacted Indian pharma stocks. Investors reacted swiftly, reversing the brief respite enjoyed by the sector.

Former President Trump’s proposed 24% tariff on Japanese imports could significantly affect camera and lens prices in the U.S. Market analysts warn that this policy may lead to increased costs for consumers, disrupting the photography industry supply chain.

After years of navigating sanctions and market challenges, Huawei has reported a rebound in revenue, returning to its peak performance. The company’s strategic shifts and innovation initiatives have bolstered its standing in the competitive telecom landscape.

UK house prices have surged the most in two years, according to the Office for National Statistics (ONS). The increase reflects growing demand amid limited housing supply, signaling a potential recovery in the property market.