Analysts at Desjardins predict a modest decline in the Bank of Canada’s interest rate. This careful strategy highlights the persistent economic hurdles we face, all while striving to uphold stability within our financial system.

Browsing: monetary policy

The Bank of Canada has decided to maintain its key interest rate at 2.75%, citing concerns that escalating trade tensions could lead to a potential recession. The decision reflects ongoing economic uncertainty amid global trade disputes.

In a surprising turn of events, India’s inflation rate plummeted to an impressive 3.34% in March, far surpassing analysts’ predictions. This notable drop could potentially reshape economic policies as decision-makers evaluate its effects on consumer spending and overall growth.

Inflation in Canada eased to 2.3% in March, largely due to a decline in gas prices, according to recent data. This marks a slight improvement, offering some relief to consumers as the cost of living remains a key concern nationwide.

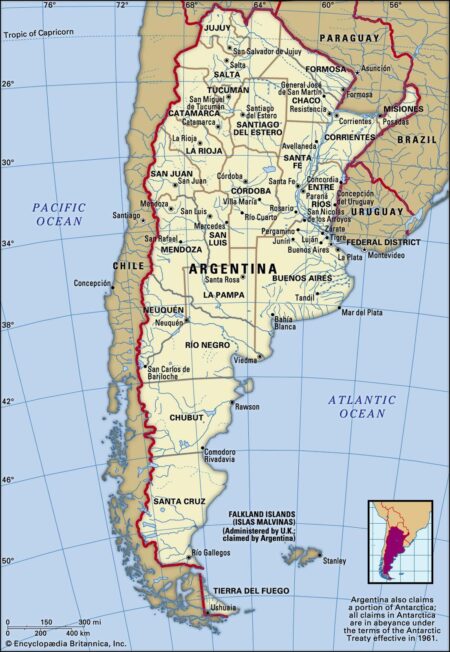

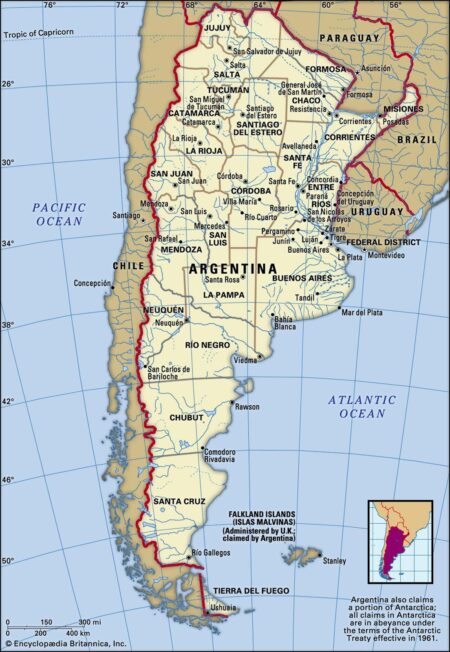

Argentina’s recent IMF deal marks a critical financial maneuver aimed at stabilizing its economy. Negotiations involved stringent fiscal reforms and commitments to reduce inflation, showcasing the government’s resolve to navigate ongoing economic challenges.

India’s foreign exchange reserves have surged to $676.3 billion, according to the central bank governor, reflecting a robust external position. This increase highlights the country’s resilience amid global economic uncertainties, bolstering confidence in the Indian economy.

A recent Reuters poll indicates that Canada’s growing recession risk could prompt the Bank of Canada to implement at least two additional interest rate cuts this year. Economic concerns are mounting as policymakers seek to stabilize the slowing economy.

Argentina’s recent overhaul of its foreign exchange regime has sparked widespread speculation about the future of the peso. As the government aims to stabilize the currency amid soaring inflation, analysts are closely watching how these changes influence economic recovery.

In “Opinion | Argentina Needs the Dollar More Than Ever,” the Wall Street Journal explores the nation’s escalating economic crisis, highlighting the urgent need for dollarization. As inflation spirals, many Argentines seek stability through the U.S. currency.

In a significant economic shift, President Javier Milei has announced the end of Argentina’s strict currency controls, known as the “cepo,” following the IMF board’s approval of a US$20-billion bailout. This move aims to restore market confidence amid ongoing financial turmoil.

Central bank deputies from China, Japan, and South Korea convened to discuss the implications of U.S. tariffs on their economies. The meeting, reported by Reuters, highlights growing concerns over trade tensions and their potential impact on regional stability.

Argentina announced plans to lift its stringent currency controls, a move supported by the International Monetary Fund (IMF) as the country seeks to stabilize its economy. This decision signals a potential shift in economic policy aimed at attracting foreign investment.

Argentina has secured a $20 billion deal with the International Monetary Fund (IMF) to support President Javier Milei’s ambitious economic reforms. The agreement aims to stabilize the nation’s economy amid ongoing inflation and fiscal challenges.

The yuan has emerged as a critical strategic barometer for China in the wake of tariff escalations. Analysts suggest that its fluctuations reflect broader economic resilience and shifting trade dynamics, influencing both domestic markets and global perceptions.

Argentina has formally requested the first tranche of over 40% of its $20 billion loan program from the International Monetary Fund (IMF). This financial assistance aims to stabilize the country’s economy amid ongoing fiscal challenges and inflation concerns.

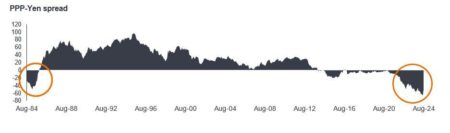

In a recent statement, a Japanese lawmaker highlighted concerns over the yen’s undervaluation, indicating potential measures to counter capital outflows. This move underscores the government’s intent to stabilize the currency and foster economic resilience amid global market fluctuations.

Recent inflation data from France and Spain, coupled with insights from the ECB survey, strengthen the argument for potential rate cuts. Analysts suggest that easing monetary policy could address persistent economic challenges in the Eurozone.

In a recent statement, Deutsche Bank Chairman revealed that Germany received approximately $1 trillion in financial support without cost. This significant figure highlights the country’s economic strategies and the ongoing impact of fiscal policies in Europe.

Former Bank of Canada governor, Stephen Poloz, has cautioned that Canada is at a significant disadvantage in the ongoing trade war, stating, “We’re seriously outgunned.” His remarks highlight the challenges facing Canada’s economy amidst escalating global tensions.

U.K. inflation fell to 2.8% in February, offering a temporary reprieve for consumers and policymakers. However, analysts warn that factors such as rising energy costs and supply chain disruptions could drive prices up again shortly.