Wall Street kicked off the day on a positive note, with the S&P 500 and Nasdaq climbing higher as exciting US-Japan tariff discussions began. However, a 1.5% drop in UnitedHealth cast a shadow over the Dow, highlighting the persistent challenges facing the healthcare sector.

Browsing: stock market

USA Rare Earth stock soared dramatically after news broke that the Trump administration is set to stockpile essential metals. This development has sparked a wave of optimism among investors, who are eager about the prospects of heightened demand in light of persistent global supply chain challenges.

Shares of India’s IndusInd Bank surged as investors reacted positively to news that the impact of a recent accounting lapse was less severe than anticipated. What initially sparked concern has now been largely addressed, calming investor anxieties and restoring confidence in the market.

Germany is on the brink of an exciting economic transformation as a fresh “stimulus wave” sweeps in, designed to spark growth and ignite innovation. Investors are eagerly focusing on pivotal sectors, with certain stocks set to thrive from this surge of government backing

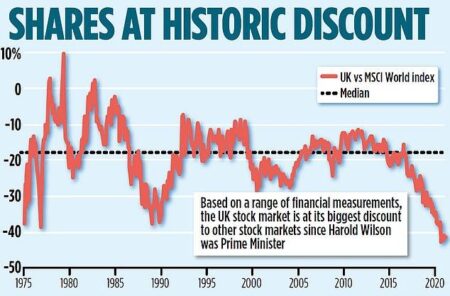

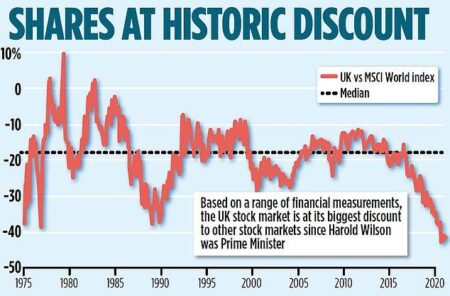

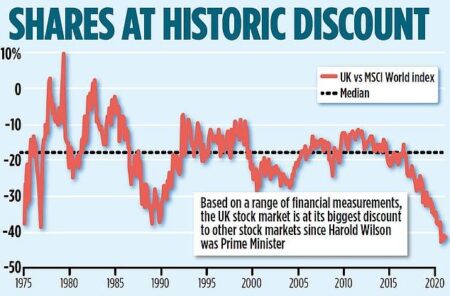

According to a recent analysis by Yahoo Finance, three UK stocks are reportedly trading significantly below their estimated fair value, with potential upside of up to 49.6%. Investors may want to explore these undervalued opportunities for future growth.

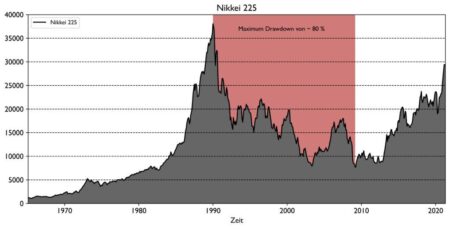

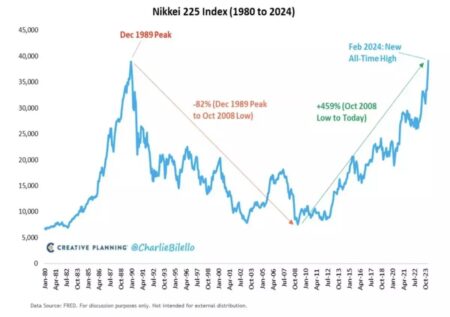

Japan’s Nikkei index fell significantly as escalating trade war concerns and a strengthening yen dampened investor sentiment. Market analysts highlight the negative impact of ongoing U.S.-China tensions on Japanese exports and economic stability.

Value investors are increasingly turning their attention to Japan, Korea, and Brazil, drawn by attractive valuations and growth potential. With economic reforms and favorable market conditions, these countries present promising opportunities for savvy investors.

Canada and U.S. markets closed higher Friday, concluding a volatile week marked by fluctuating tariff discussions. Investors responded positively to easing trade tensions, reflecting cautious optimism amid ongoing economic uncertainties.

Japan’s Nikkei surged 6% as investors rallied on hopes of a market recovery. Positive economic signals and easing global concerns fueled buying interest, propelling the index to a strong close, reflecting renewed confidence in the Japanese economy.

U.K. shares closed higher as investor sentiment rallied, with the Investing.com United Kingdom 100 index rising 3.30%. Strong performance in key sectors bolstered the market, reflecting positive economic outlook amid ongoing recovery efforts.

In a market where insider ownership can signal confidence, three UK growth companies stand out. These firms, highlighted by Yahoo Finance, showcase substantial insider stakes, suggesting robust faith in their future prospects as they pursue ambitious growth strategies.

Japanese stocks are poised for a significant rise following former President Trump’s decision to pause higher tariffs. Investors are optimistic, anticipating a boost in trade relations and economic stability, as markets react positively to this unexpected development.

Stocks plunged in a dramatic mid-day reversal, erasing a 4% gain as investor sentiment soured. Concerns over rising interest rates and slowing economic growth weighed heavily on market momentum, prompting widespread sell-offs across multiple sectors.

U.K. stocks fell sharply at the close of trading today, with the Investing.com United Kingdom 100 index down 4.56%. Investors reacted to ongoing economic uncertainties, leading to widespread declines across key sectors.

“Views From The Ground: Why Brazil And Why BRAZ? 2025” on Seeking Alpha explores Brazil’s economic landscape and the potential of the BRAZ ETF. Analysts emphasize Brazil’s growth opportunities amid global market shifts, making it a focal point for investors.

U.K. stocks closed in the red on Thursday, with the Investing.com United Kingdom 100 index dropping 4.99%. Investors reacted to mixed economic signals and ongoing geopolitical tensions, prompting a cautious trading environment across major sectors.

Trade tensions escalate as China’s retaliation to U.S. tariffs intensifies, prompting fears of a global economic slowdown. Markets react negatively, reflecting uncertainty and revealing the potential for prolonged trade disruption between the two powers.

U.K. stocks finished lower as trading closed, with the Investing.com United Kingdom 100 index declining by 0.34%. Economic uncertainties continue to weigh on investor sentiment, reflecting a cautious outlook in the markets.

In response to plummeting stock markets and escalating trade tensions, former President Donald Trump asserted that his tariff policies ﻗWILL NEVER CHANGE.ﻗ This statement comes amid increased scrutiny from China, which is adjusting its strategies in light of U.S. tariffs.

In a recent announcement, former President Donald Trump renewed threats of tariffs on Indian pharmaceutical imports, marking a sudden shift that has negatively impacted Indian pharma stocks. Investors reacted swiftly, reversing the brief respite enjoyed by the sector.