Wall Street kicked off the day on a positive note, with the S&P 500 and Nasdaq climbing higher as exciting US-Japan tariff discussions began. However, a 1.5% drop in UnitedHealth cast a shadow over the Dow, highlighting the persistent challenges facing the healthcare sector.

Browsing: trading

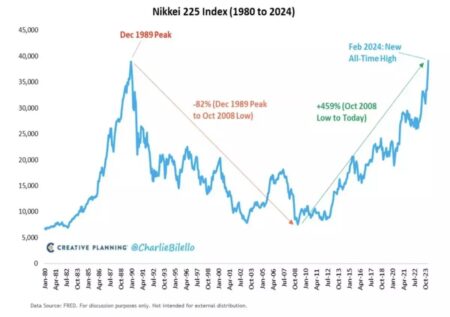

Japan’s Nikkei surged 6% as investors rallied on hopes of a market recovery. Positive economic signals and easing global concerns fueled buying interest, propelling the index to a strong close, reflecting renewed confidence in the Japanese economy.

U.K. shares closed higher as investor sentiment rallied, with the Investing.com United Kingdom 100 index rising 3.30%. Strong performance in key sectors bolstered the market, reflecting positive economic outlook amid ongoing recovery efforts.

U.K. stocks finished lower as trading closed, with the Investing.com United Kingdom 100 index declining by 0.34%. Economic uncertainties continue to weigh on investor sentiment, reflecting a cautious outlook in the markets.

UK shares climbed, buoyed by rising commodity prices and a resurgence in the construction sector. Analysts noted that robust demand in these areas signaled economic resilience, fostering investor confidence amid global uncertainties.

Bloomberg explores the current state of India’s stock market, raising concerns about a potential bubble. As valuations soar and investor enthusiasm surges, experts weigh in on whether the growth is sustainable or on the brink of a correction.

Japan’s stock market is poised to open in the red, following mixed signals from global markets and concerns over economic data. Analysts anticipate a cautious trading session as investors weigh potential implications for domestic growth.

In today’s ForexLive Asia-Pacific FX news wrap, Bank of Japan Governor Kazuo Ueda addressed key monetary policy issues, underscoring the central bank’s commitment to maintaining its accommodative stance. His remarks influenced market sentiment, impacting the yen’s fluctuations.

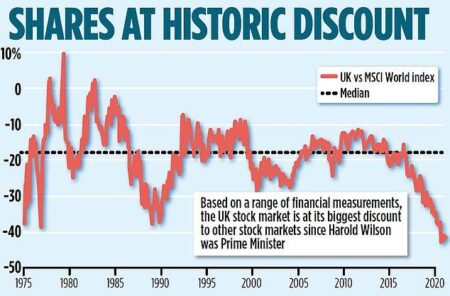

In March 2025, numerous UK stocks are trading below their estimated valuations, signaling potential investment opportunities. Analysts attribute this trend to market volatility and economic uncertainty, highlighting sectors poised for recovery amid evolving conditions.

Air France-KLM’s CEO announced plans to increase the airline group’s stake in Scandinavian Airlines (SAS), signaling a strategic move to strengthen its foothold in the Nordic market. This initiative underscores Air France-KLM’s commitment to regional growth and consolidation.

U.K. stocks closed lower today, with the Investing.com United Kingdom 100 index declining by 1.25%. The downturn reflects broader market concerns amid economic uncertainty, prompting investors to reassess their strategies as volatility persists.

Spain’s second largest bank has reportedly received approval to offer trading services for Bitcoin and Ether. This move marks a significant step in the country’s growing acceptance of cryptocurrencies, potentially expanding access for investors and enhancing the digital asset market.

U.K. stocks closed higher on Thursday, with the Investing.com United Kingdom 100 index rising by 0.52%. Investor sentiment boosted by positive corporate earnings and economic indicators contributed to the market’s upward momentum.

BBVA has announced it will provide Bitcoin and Ether trading and custody services in Spain, expanding its digital asset offerings. This move positions the bank as a key player in the cryptocurrency market, catering to growing consumer interest in digital currencies.

U.K. stocks closed higher as the trading session wrapped up, with the Investing.com United Kingdom 100 index advancing by 0.02%. Investors remained cautious, reflecting broader economic concerns while seeking growth opportunities in key sectors.

India’s Nifty Index has recorded its longest monthly losing streak since 1996, signaling a concerning trend for investors. Meanwhile, midcap stocks have confirmed a bear market, reflecting broader economic challenges as market volatility continues to rise.

Argentina has announced the easing of regulations on the vital Paraná River, a key artery for grain transport. This move is expected to enhance shipping efficiency, boost exports, and support the agricultural sector amid growing global demand.