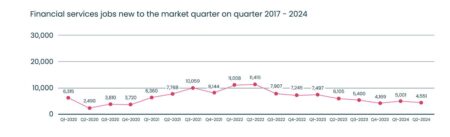

The UK jobs market has witnessed its most significant surge in job seekers since 2020, signaling renewed confidence amid economic recovery. Analysts attribute this rise to easing pandemic restrictions and increased hiring across various sectors.

Browsing: UK economy

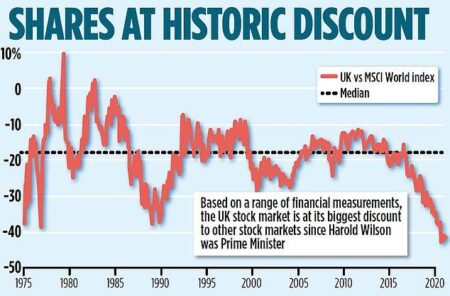

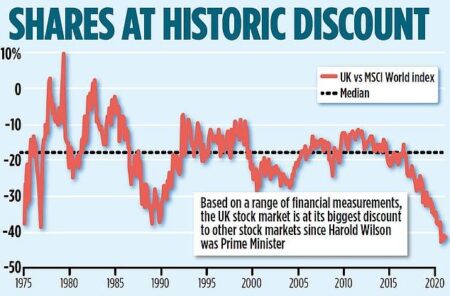

U.K. shares closed higher as investor sentiment rallied, with the Investing.com United Kingdom 100 index rising 3.30%. Strong performance in key sectors bolstered the market, reflecting positive economic outlook amid ongoing recovery efforts.

A new Universal theme park is set to open in the UK, with officials projecting an economic boost of billions of pounds. The anticipated attraction aims to create thousands of jobs and attract millions of visitors, revitalizing the local economy.

U.K. stocks closed in the red on Thursday, with the Investing.com United Kingdom 100 index dropping 4.99%. Investors reacted to mixed economic signals and ongoing geopolitical tensions, prompting a cautious trading environment across major sectors.

The UK’s FTSE 100 experienced its largest daily decline since the onset of the pandemic, driven by renewed concerns over Trump’s tariffs. Market analysts warn that the tariffs could disrupt global trade and economic recovery efforts.

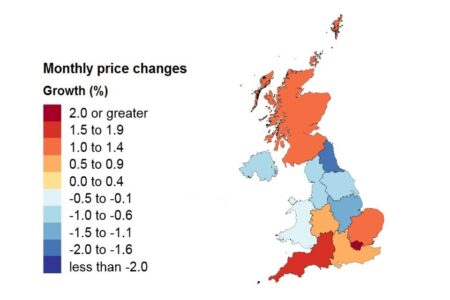

UK house prices have surged the most in two years, according to the Office for National Statistics (ONS). The increase reflects growing demand amid limited housing supply, signaling a potential recovery in the property market.

UK shares climbed, buoyed by rising commodity prices and a resurgence in the construction sector. Analysts noted that robust demand in these areas signaled economic resilience, fostering investor confidence amid global uncertainties.

UK stocks closed higher, signaling a positive end to the trading day. The Investing.com United Kingdom 100 index rose by 0.28%, reflecting investor optimism amid an evolving economic landscape. Key sectors showed robust performance, driving market gains.

UK stocks remained largely unchanged amid ongoing concerns over tariffs, prompting a cautious approach from investors. As trade tensions escalate, market participants are closely monitoring developments that could impact economic stability.

The unemployment rate in the UK has seen significant fluctuations between 2000 and 2025. According to Statista, the period highlights economic cycles influenced by events such as the 2008 financial crisis and the COVID-19 pandemic, shaping workforce dynamics.

The UK’s frozen fish market is projected to expand significantly, with volumes anticipated to reach 538,000 tons by 2035, according to IndexBox, Inc. This growth reflects rising consumer demand for convenient, sustainable seafood options.

The UK government’s recent estimates indicate that proposed welfare cuts could push an additional 250,000 individuals into poverty. Critics are raising concerns about the potential impact on vulnerable populations across the nation.

EY UK is dedicated to “Building a Better Working World” by delivering innovative solutions and insights that drive growth and sustainability. The firm’s commitment to collaboration empowers businesses to tackle challenges and seize opportunities in today’s dynamic landscape.

UK wage growth remains stable at 5.9%, according to the latest Financial Times report. This consistent growth could signal resilience in the labor market, despite ongoing economic challenges and inflationary pressures affecting consumers.

In a move to address fiscal pressures, the British finance minister is expected to implement further cuts to public spending in the upcoming Spring Statement. This follows ongoing economic challenges, as reported by the Financial Times.

The UK economy showed signs of stagnation in January, highlighting the growing challenges for Shadow Chancellor Rachel Reeves. This downturn raises critical questions about the government’s economic strategy and its impact on future growth.

UK Finance Minister has emphasized the necessity of “give and take” in ongoing negotiations to prevent the imposition of tariffs by the US. This statement reflects concerns over potential trade barriers that could impact UK businesses amid turbulent economic conditions.

The United Kingdom remains a focal point for economic and social statistics, showcasing diverse data on GDP, employment, and public health. Statista serves as a critical resource, providing up-to-date insights that drive informed decision-making across sectors.

UK services inflation has unexpectedly declined, offering a positive signal for the Bank of England as it navigates economic challenges. This shift may ease pressure on policymakers, potentially influencing future interest rate decisions.

UK stocks fell for the third consecutive day as mixed earnings reports fueled investor uncertainty. Concerns over economic stability and varying corporate performances led to cautious trading, impacting major indices and investor sentiment.